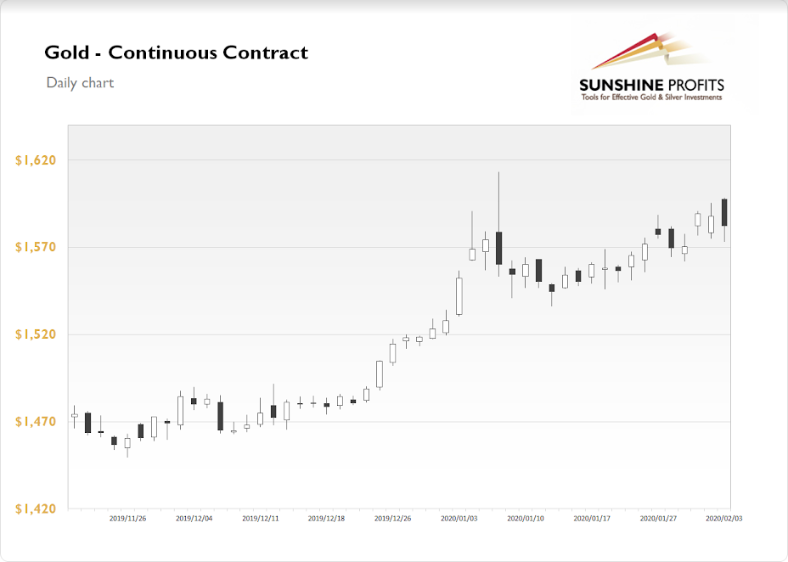

The Gold Futures lost 0.35% on Monday, after extending its short-term uptrend at the beginning of an overnight trading session. The market has reached new local high of $1,598.50. But then it bounced off the $1,600-1,615 resistance level, marked by January 8 medium-term high of $1,613.30 and reached daily low of $1,573.20. The price of gold continues to trade along last week’s local highs.

Gold is currently down 0.5%, trading below yesterday’s low, as investors’ sentiment improves ahead of the U.S. stock market open at 9:30 a.m. What about the other precious metals? Silver lost 1.9% yesterday, as it retraced its recent advance again. The short-term volatility remains relatively high. It is currently up 0.2%. Platinum gained 0.9% on Monday and today it is up another 0.9%. However, the market remains below $1,000 mark following mid-January downward reversal. Palladium gained 0.4% yesterday and today it is gaining 3.1%, as it is retracing some of the recent decline off its new record high.

The financial markets are still looking at China virus crisis developments. However, the sentiment has further improved since Friday’s risk-on assets’ selloff. The markets will await today’s Factory Orders number release at 10:00 a.m., and then at 8:45 p.m. we will get the Chinese Caixin Services PMI release. Investors will surely wait for this week’s Friday’s Nonfarm Payrolls release. Where would the price of gold go following the NFP news? Take a look at our Monday's Market News Report to find some clue.