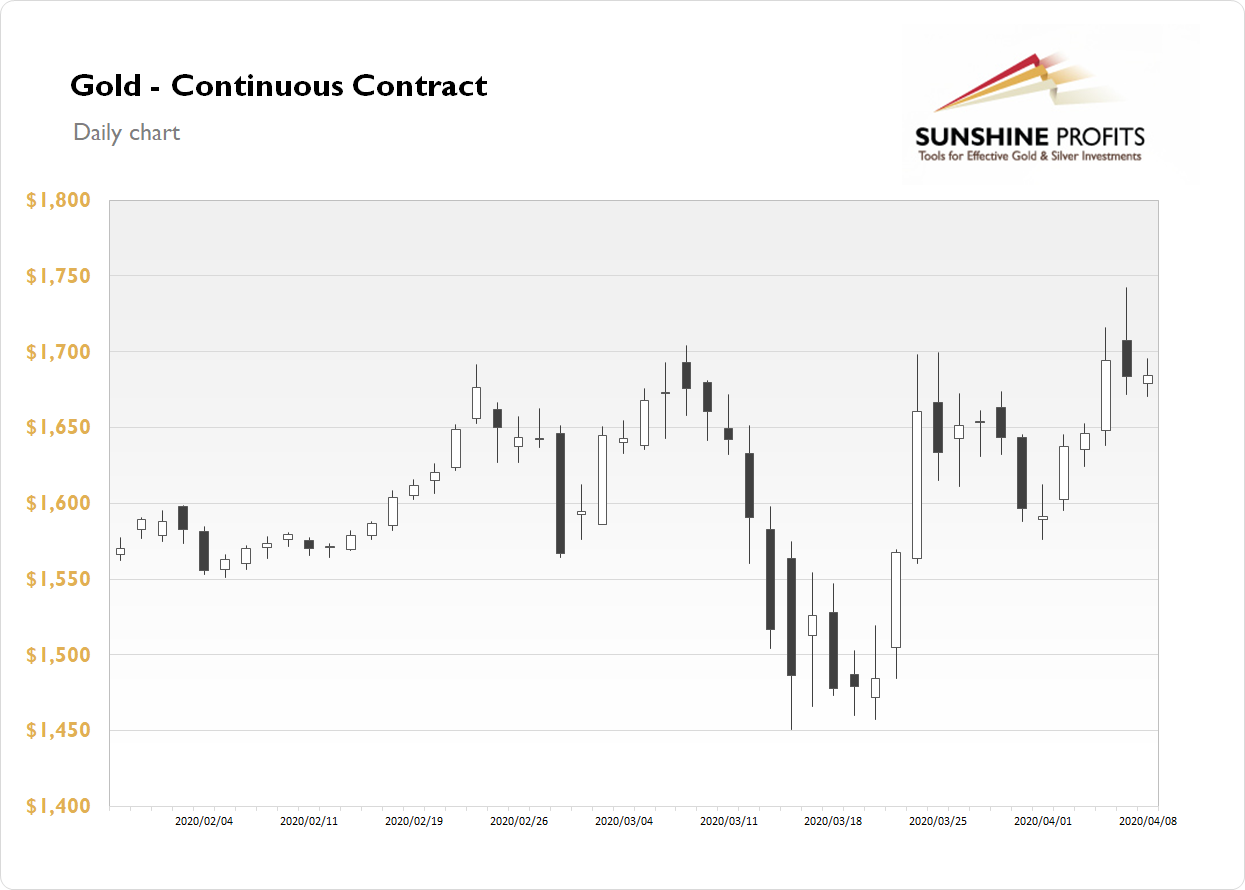

The Gold futures contract fluctuated on Wednesday, as it gained 0.04%. The market is going sideways following its recent rally. The price of gold has reached a new medium-term high of $1,742.60 on Tuesday, the highest since November of 2012 after it broke above $1,700 mark. However, it got back below $1,700 and the yellow metal's price remained close to previous local highs. Mounting pandemic fears are supporting the demand side and gold is still acting as a safe haven asset.

Gold is 0.9% higher this morning, as it continues to fluctuate following Monday's-Tuesday's rallies. What about the other precious metals? Silver lost 1.78% yesterday and today it gains 1.3%. Platinum gained 1.53% yesterday and today it is up 0.6%. Palladium gained 0.04% on Wednesday and today it is 0.3% lower. So, precious metals trade within a short-term consolidation.

Last week's Friday's U.S. Nonfarm Payrolls along with the Unemployment Rate releases have been worse than expected. However, it wasn't that surprising after the recent Unemployment Claims numbers. And we may see more bad economic data releases in the near future, as they will be revealing coronavirus damage to the economy.

Today we'll have the new employment data from the U.S. and Canada at 8:30 a.m. We will also get the Producer Price Index at 8:30 a.m. Then at 10:00 the Preliminary UoM Consumer Sentiment will be released. Also, don't miss the Fed Chair Powell speech at 10:00 a.m.