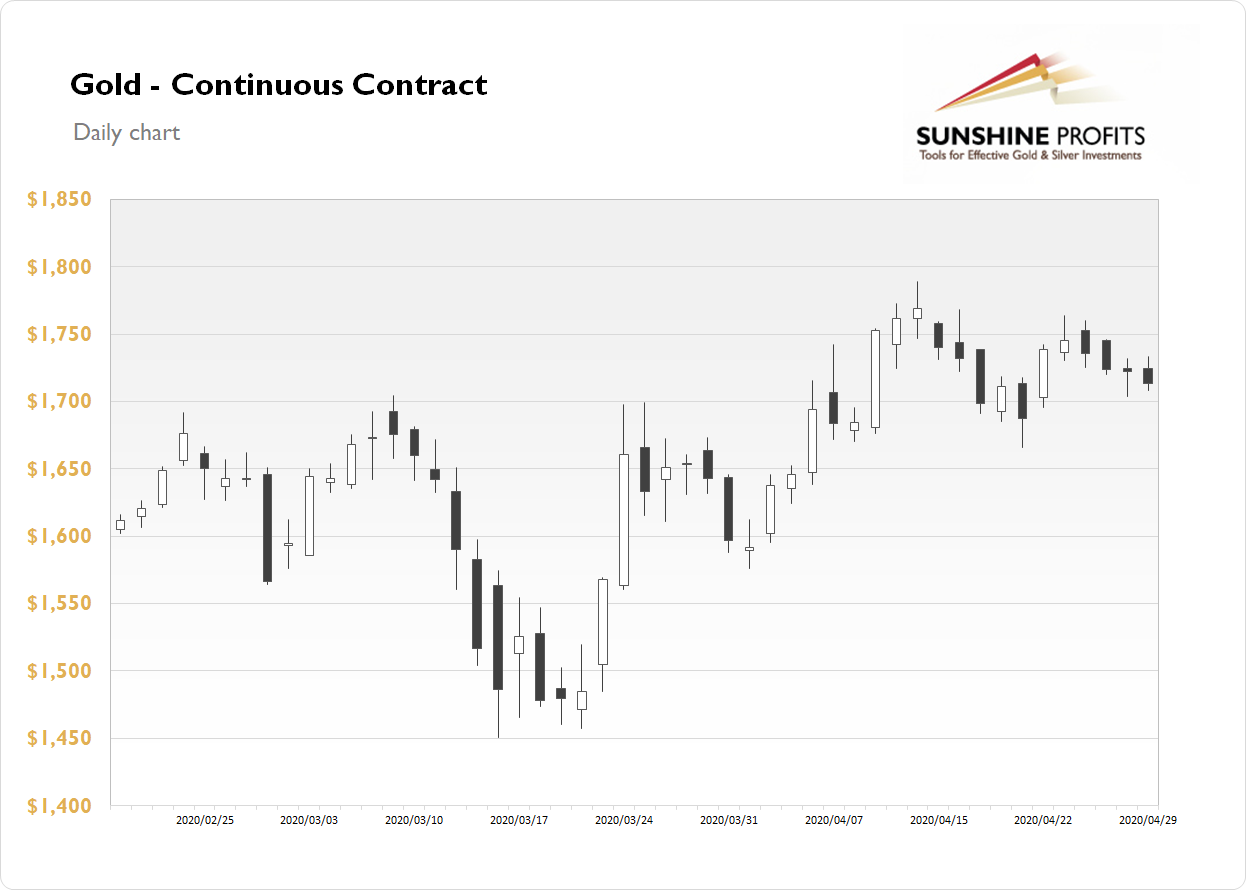

The Gold futures contract lost 0.51% on Wednesday but it's basically remained within Tuesday's trading range. The market continues to trade within a short-term downward correction following last week's advance. The price bounced off the mid-April local high. On April 14 it was the highest since November of 2012 and the daily high was at $1,788.80. Since then we've seen some profit-taking action and a potential downward reversal. But gold began acting as a safe haven asset again last week. This week gold remains relatively weak.

Gold is basically going sideways since early April. It is trading above February-March local highs. So it looks like a consolidation within a medium-term uptrend. But if the price gets below $1,700 level, we could see more selling pressure.

Gold is trading 0.1% higher this morning. What about the other precious metals? Silver lost 0.08% on Wednesday and today it is trading 0.9% higher. Platinum gained 0.5% yesterday and today it is gaining 0.6%. Palladium gained 2.06% on Wednesday and today it is up 2.7%. Precious metals continue to trade within a short-term consolidation.

The recent economic data releases have revealed more coronavirus damage to the economy. Yesterday's Advance GDP number release has been generally in line with expectations (-4.8%) and the FOMC Monetary Policy update hasn't been a real game changer.