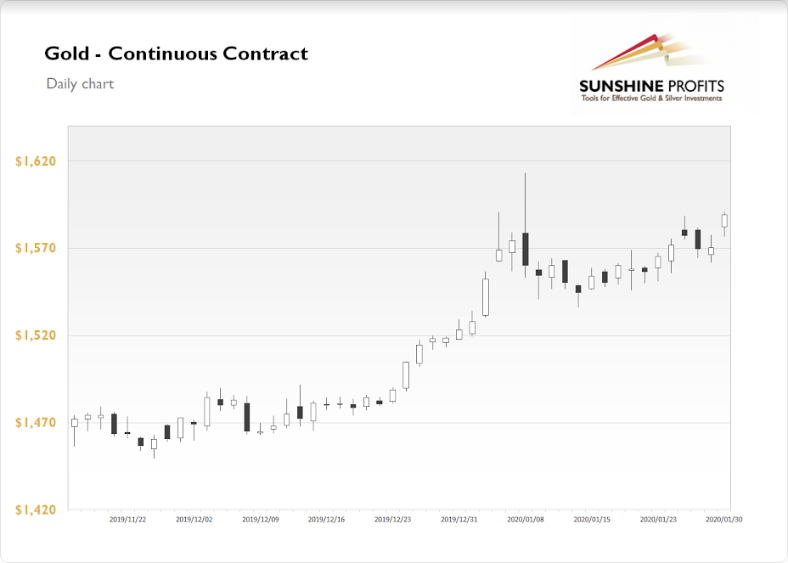

The Gold Futures contract gained 1.20% on Thursday, as it resumed its short-term uptrend following Tuesday’s-Wednesday’s downward correction. The market continued to retrace its sharp move lower from January 8 medium-term high. It reached the new short-term local high of 1590.70 yesterday. The ongoing China virus crisis is still negative for the risk-on assets, so gold continues to outperform. It is a safe-haven asset.

Gold is currently 0.4% higher, as it remains close to the short-term local high. However, it is still below $1,600 mark, and January 8 high of $1,613.30. What about the other precious metals? Silver gained 2.9% on Thursday, as it retraced most of its recent decline. The market got close to $18 mark again. It is currently trading 0.2% higher. Platinum gained 0.5% yesterday and it currently trades 0.8% lower, as it remains below $1,000 price level. Palladium is unchanged, as it fluctuates following the recent retreat from new record high.

The financial markets continue to look at the China virus crisis developments. The stock market sentiment is mixed following yesterday’s Amazon's (NASDAQ:AMZN)’s much better-than-expected quarterly earnings release and today’s pre-session decline. And gold is reacting in a bullish manner. Yesterday’s U.S. Advance GDP number has been as expected (+2.1%), but the markets look forward, as virus crisis is causing some uncertainty at this point. Today, we will get the U.S. Personal Spending and Personal Income number release at 8:30 a.m. Then at 9:45 a.m. we will also get the Chicago PMI.