It is absolutely amazing how the precious metals markets have followed our October 2018 predictions almost like clockwork. Our call for an April 21~24 momentum base below $1300 followed by an extensive rally to levels above $1550 has been playing out almost like we scripted these future price moves.

Now that Gold has reached the $1550 level, we are expecting a rotation to levels that may reach just below the $1450 level before attempting to set up another momentum base/bottom formation. And just like clockwork, Gold has followed our predictions and price is falling as we expected. Just look at our October 2018 chart where we forecasted the price of gold rallies and corrections along the way.

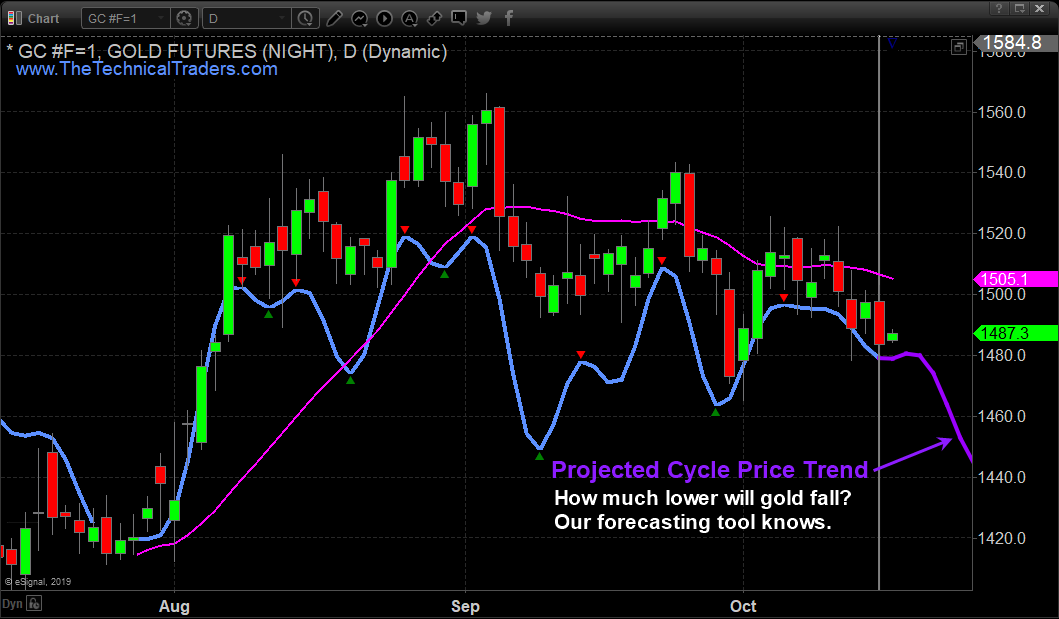

Gold Cycle Forecast – Daily Chart

Take a look at the most active cycles for gold and where our gold forecast is pointing to next. The downside rotation currently in gold is likely not quite over yet and the gold mines will selloff the most. This new momentum base should setup and complete once the gold cycles bottom. The next upside price leg should push gold well above the $1760~1780 level – so get ready for another big rally of 20%+.

Gold Miners Sell Off – Daily Chart

Unfortunately, so many traders are highly emotional and fall in love with positions in shiny metals or gold miner stock positions. Yet we all know if you trade on emotions or fall in love with a position, you are most likely to lose a ton of money. Two weeks ago I got so much flack from traders when I said gold miners were on the verge of a violent drop in price, then the bottom fell out and the dropped huge. Then last Thursday morning when gold, silver, and miners are trading up huge in pre-market and at the opening bell I warned it looked like a big fakeout and price could collapse for yet a second leg down and the same response from those emotional traders who love their positions and won’t sell them when they should as active traders.Have You Outperformed GDXJ This Year?

If you like to trade in the precious metals sector then you most likely love to trade VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ). As you can see above GDXJ is only up 19.55% year to date. Sure, it’s a nice gain, but are you still holding your metals position knowing you just gave back most or all of your profits?

Being a technical analyst my focus is to only enter a position when the charts/analysis point to an immediate price advance or decline. I sit in cash waiting for the next cycle top or bottom to form in an asset class like gold miners, gold, silver, or silver miners, and once the cycle starts I jump on the wave and ride it for the move until it shows signs that its weakening and will break. almost 50% of the year my portfolio is sitting in cash. And my average position only lasts around 12 days.

My point here is that no matter how much you love metals (and I LOVE METALS), you do not need to always be in a position in them. There are times to own, and times to watch with your money safely in cash.

Concluding Thoughts:

The end result is that the fear and greed that is starting to show up in the precious metals markets may become an “unruly beast” if it continues to grow in strength and velocity.

The next bottom in metals should set up when our cycle bottoms – then the next upside leg will begin. This time Gold should target $1800 and Silver should target $21 to $24. This will be an incredible move higher if it plays out as we suspect.