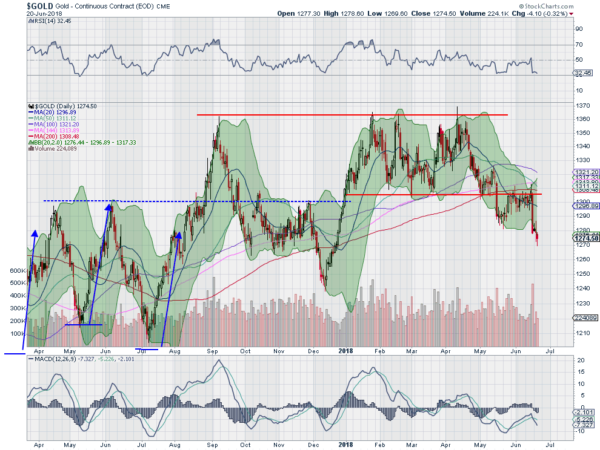

Don’t look now, but Gold is getting crushed. To those that have followed it the price of Gold has been moving lower for more than 2 months. Yes, the price of Gold goes up and down like any other asset. And it had been moving in a range between 1310 and 1365 for 5 months before breaking it to the downside.

Even that breakdown was mild at first, dipping slightly below 1300 then bouncing back to the bottom of the range. But it could never get back in the range. It also could not get back over the 200 day SMA. Then came last Friday when it sold off to new lows. The chart above shows the price action with that sell off on the far right side.

It has continued into the current week and shows no signs of stopping. The Bollinger Bands® are opening to the downside. The RSI is in the bearish zone and falling, maybe barely into oversold territory. The MACD is negative and moving lower. All signs point to more downside with the next support area around the December low at 1240. Looks like Gold will continue to get crushed.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.