In a surprising turn of events during the first week of December 2023, Gold futures achieved a record high, reaching $2152 from the day's low at $2038 on December 4, 2023.

This unexpected move followed a month-long uptrend initiated on November 11, 2023, starting from the day's low at $1936.

Notably, this upward trajectory found substantial support at the 50 DMA in the daily chart, drawing attention from gold bulls.

At the end of this month-long journey in Nov. 2023, gold futures finally formed a last bullish daily candle of this uptrend on Dec. 1, before another volatile session on Dec. 4, 2023, as the big bears had turned aggressive till then to trap the bulls.

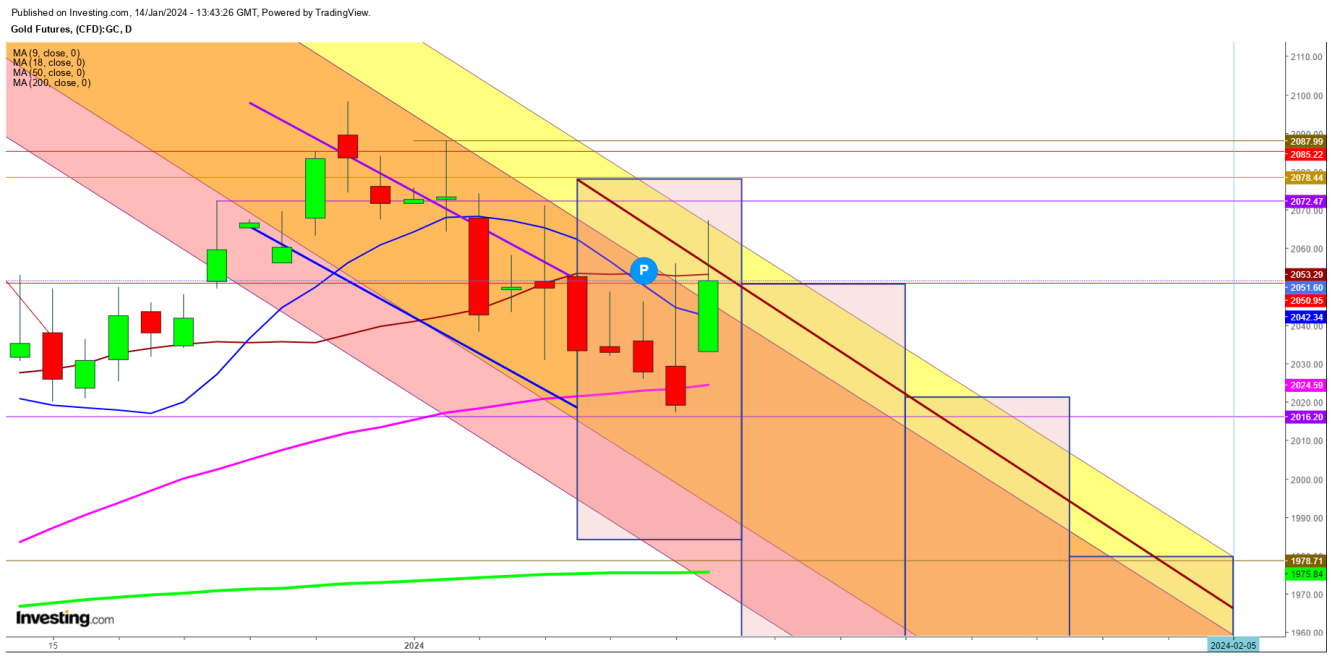

Since Dec. 4, 2023, the gold futures remained on the sliding path up to Dec. 13, 2023, and hit a low at $1978 before the advent of the recent reversal after finding support at 50 DMA.

On December 14, 2023, gold futures delivered a surprising uptick, even in the presence of an 'exhaustive hammer' formation on the daily chart. Post this event, the gold futures attempted to maintain a position above the 9 DMA, traversing a tight range.

Notably, a 'bullish crossover' emerged on December 25, 2023, providing substantial support for the bulls, sustaining their position above the 9 DMA until December 28, 2023.

During this period, gold futures reached a peak at $2098 before retracing and testing the 9 DMA support. Unfortunately, the support couldn't hold, leading to a decline that found the next support at the 18 DMA on January 3, 2024.

Finally, the gold futures continued to sustain below the 18 DMA since Jan. 5, 2024, with futile attempts by the gold bulls amid growing geopolitical tensions.

However, the volatility could extend more during the last week since the announcement of the latest economic data on rising rents and food prices caused overall US inflation to rise unexpectedly, with the annual CPI rising to 3.4%.

These recently announced economic data are evident enough to raise the Fed’s eye to cut rates and may keep the gold futures under selling pressure till the Fed’s next meeting on Jan. 31/Feb.1, 2024, as the growing hopes for more rate cuts are likely to result in sharp declines in the near term amid the absence of notable economic and political news.

Finally, I conclude that the gold futures could maintain a slow sliding spree before gaining more bearish momentum during the next two weeks.

Undoubtedly, the repetition of the surprising move by the gold futures during the first week of Dec. 2023 is likely to be repeated during the last week of Jan. 2024.

However, this repetition of the surprising move by the gold futures would be at the end of a downtrend. To understand this analysis, watch the attached video till it ends.

Undoubtedly, the yellow metal is likely to slide amid decreasing recessionary fear as it is still uncertain to calculate the direction and pace of rate cuts to control inflationary pressure by the Fed.

Watch my attached video, which I uploaded on Jan. 15, 2024.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. Readers can take any long or short trading position at their own risk.