Gold had made impressive moves before active trading in New York. Still, comments from Fed officials, combined with the release of relatively strong industrial production data, pushed the price back almost $30 to $1990, where it remains at the time of writing.

The Fed's Loretta Meister noted yesterday that US interest rates have not yet reached a level where the central bank could stop tightening, given the resilience of inflation. Influential Fed member John Williams noted that inflation is "gradually moving in the right direction" but remains "unacceptably high".

In addition, the bond markets took a positive view of the outcome of the McCarthy-Biden meeting to discuss the debt ceiling, although no agreement was reached.

The market also reacted positively to the Fed's report on industrial production growth of 0.5% in April, of which the manufacturing sector added 1%, which was much higher than expected.

As a result, the market is again pricing in more than a 20% chance of another rate hike in mid-June. These are far from extreme levels, as the probability has been above 30% since the second half of April. Nonetheless, this revision of expectations is creating some pull for the dollar. The dollar index has risen by 2% since last week, putting pressure on precious metals and cryptocurrencies.

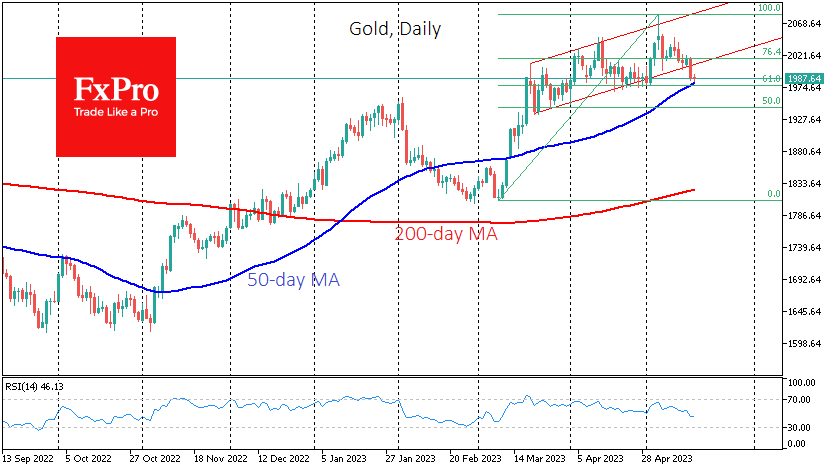

As a result of yesterday's fall, gold has broken out of the bullish range formed at the end of March. Gold is now close to the April lows from which it was supported then.

At the same time, gold is approaching its 50-day moving average, above which it rallied at the end of last year and confirmed in March. At $1970, just below is the 61.8% retracement level of the rally from the March lows to the early May highs.

From this perspective, a sharp pullback below $1980 would be an essential signal of a change in market sentiment, forcing a further drop to $1950 (the February high).

However, the fall below the $1980 scenario does not yet appear mainstream. The recent pullback has cleared the overbought conditions on the daily timeframes and opened the way to the upside.

The next advance could take gold to new highs if gold finds some support. A technical target for the bulls could be the $2250 level, representing 161.8% of the last two-month rally. The 12-month target for the gold bugs seems to be an ambitious $2640.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Cools off After the Rally and Chooses a Path Forward

Published 05/17/2023, 06:46 AM

Updated 03/21/2024, 07:45 AM

Gold Cools off After the Rally and Chooses a Path Forward

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.