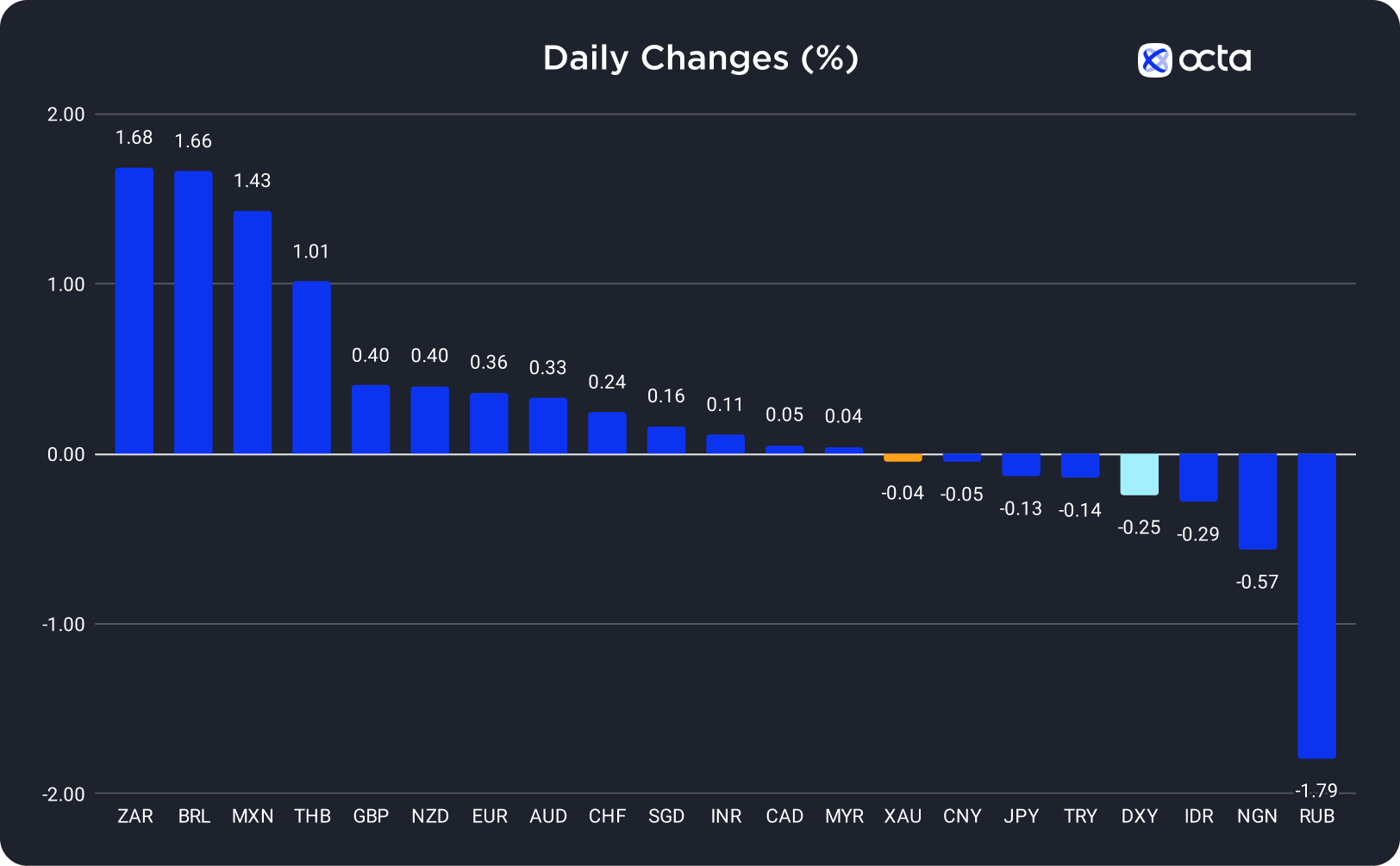

On Tuesday, the South African rand (ZAR) was the best-performing currency among the 20 global currencies we track, while the Russian rouble (RUB) showed the weakest results. The British pound (GBP) was the leader among majors, while the US dollar underperformed.

Gold Continues to Rise After a Temporary Pause

Gold (XAU) declined on Tuesday as the risk sentiment improved and investors refocused on the Federal Reserve's (Fed) monetary policy stance.

"Profit-taking and increased investor's appetite for risk pressured prices, although the conflict between Israel and Hamas limited gold's losses," said Bart Melek, the head of commodity strategy at TD Securities.

Indeed, XAU/USD's 1.6% rise on Monday was the biggest one-day rally in five months and may have prompted some bulls to leave the market. The escalating conflict in the Middle East boosted safe-haven assets' prices. Still, their future trends depend on the upcoming U.S. inflation figures, which are crucial for predicting the outcome of the next Fed policy meeting. Investors assume the U.S. interest rates might have peaked as the Fed officials made some dovish comments lately. According to the CME FedWatch tool, the chance of another rate hike this year is about 30%.

XAU/USD was rising slightly during the Asian and early European trading sessions. Today, two important events are coming: the U.S. Producer Price Index (PPI) report at 12:30 p.m. UTC and the FOMC minutes at 6:00 p.m. UTC. Higher-than-expected PPI figures may bring XAU/USD's price below 1,850. However, the short-term bullish trend in the pair may continue if the figures are lower than expected. The September protocols from the FOMC meeting could give more clues on the U.S. rate-hike path.

"Any comments that are perceived to be slightly dovish, I think the unwind of yields can continue, and that can weigh down on the US dollar more," said Carol Kong, the currency strategist at Commonwealth Bank of Australia.

The Market Expects the BOJ to Intervene as the Japanese Yen Is Falling

The Japanese yen lost 0.13% on Tuesday but didn't reach the critical 150.000 mark as the US dollar remained under bearish pressure.

USD/JPY is near a 33-year high, fuelling the speculation of possible interventions by the Bank of Japan (BOJ), which supports the Japanese yen near 150.000. In addition, the dovish comments from the Federal Reserve (Fed) hinted at a pause in the rate-hiking cycle, putting downward pressure on the US Dollar Index (DXY). Fundamentally, the sentiment is slowly turning in favor of the yen. Moreover, the recent Reuters Tankan poll showed that business activity in the Japanese services sector increased, as upbeat domestic demand helped partly offset the decline in the manufacturing sector.

USD/JPY was rising during the Asian and early European trading sessions. Today, the key report is the U.S. Producer Price Index (PPI) at 12:30 p.m. UTC, but minutes from the FOMC September meeting at 6:00 p.m. UTC might also affect the pair. Also, Japan will release a PPI report at 11:50 p.m. UTC. The data will help determine the rate-hike paths of both countries. The divergence between the U.S. and Japanese monetary policies favors the US dollar, but all the strong data has been priced in. Therefore, if the U.S. PPI figures are lower than expected, USD/JPY may drop sharply.