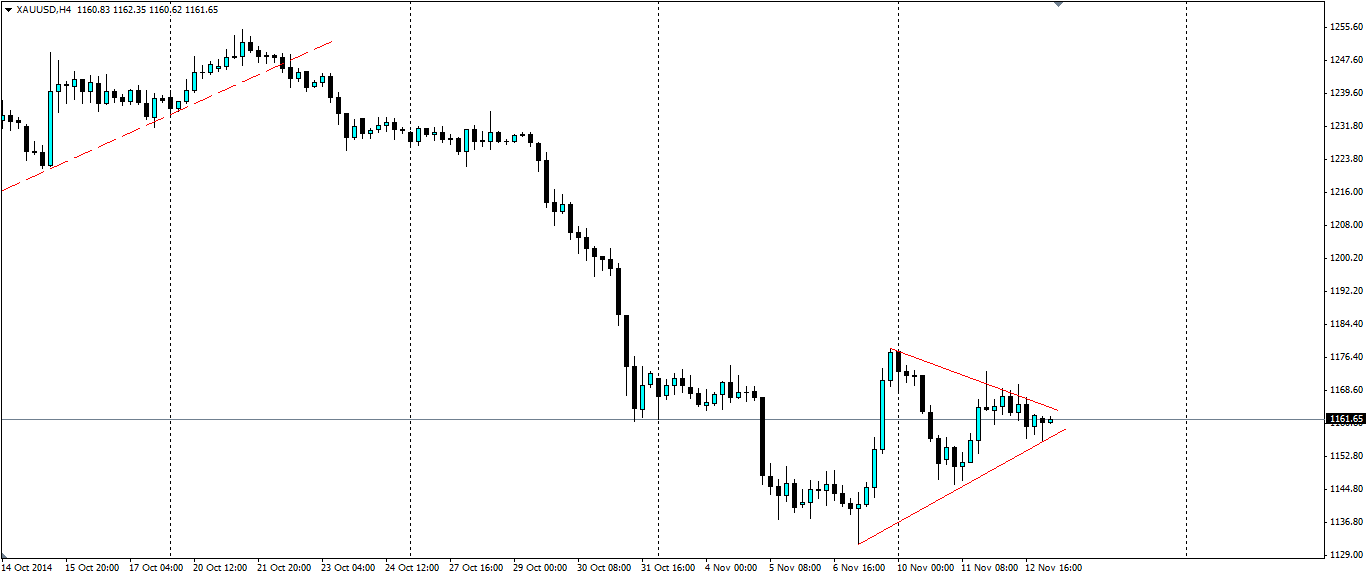

Gold has seen plenty of volatility in recent weeks and it looks increasingly bearish on the back of US Dollar Index strength. That has led to a consolidating pennant pattern that could see a breakout lower and a continuation of the trend.

Source: Blackwell Trader

The strong data coming out of the US, particularly in the employment sector, and the recent second round of easing by the Bank of Japan has seen gold tumble from the mid-1200s to as low as 1,131.64 as the US dollar strengthens and the risk of an interest rate rise becomes more apparent. The gold bulls did get some help from FED Chairwoman Janet Yellen’s surprisingly dovish comments at the end of last week when she urged central banks to do all they can to encourage growth.

The tug o’ war between the bulls and the bears in the gold markets is becoming ever more interesting and it has led to the formation of a pennant pattern as it consolidates. The likely outcome is a pressure releasing breakout and the likely direction is to the downside given the fundamental situation in the US and the trend leading into the pattern.

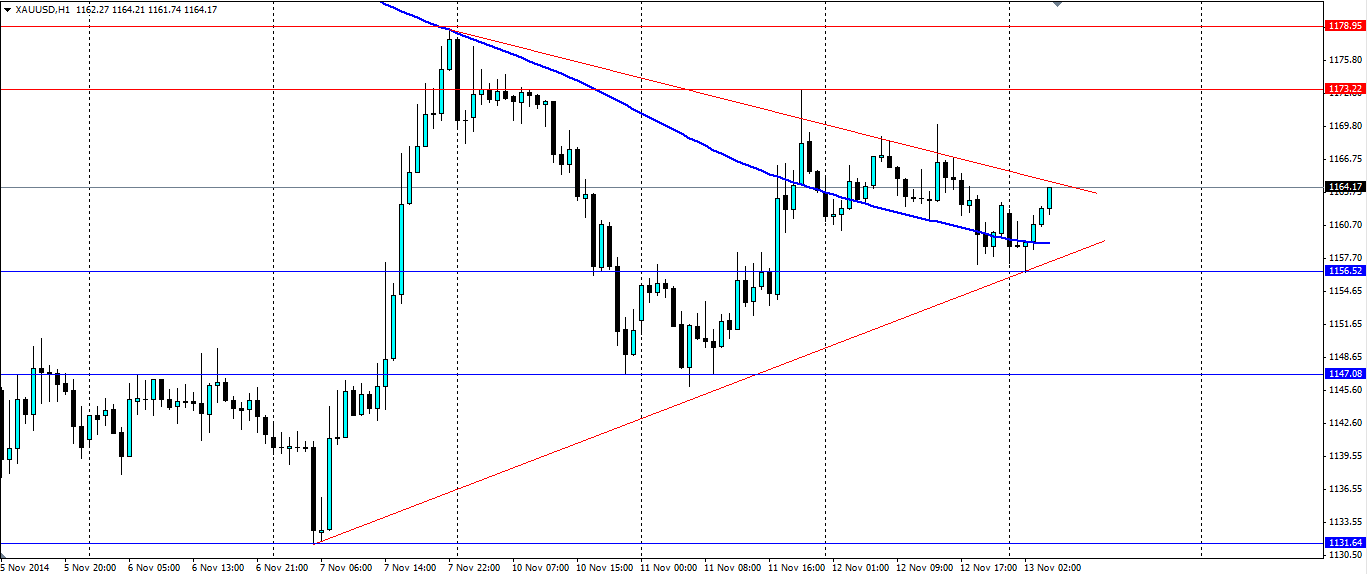

For any traders looking to take advantage of this situation, it would pay to catch the momentum of a breakout, rather than looking to predict it. Set an entry below the support at 1156.52 as a break below this will have broken not only that support, but the lower trend line of the shape and the 200 hour moving average, which has acted as a pivot point as below.

Further support will be found at 1147.08 and 1131.64 and these levels will likely act to hold up the price so could be good targets for this trade. If we see an upside breakout, look for resistance to be found at 1173.22, 1178.95 and 1186.42.

Source: Blackwell Trader

A couple of news items to note coming up is the US Unemployment data, US Retail Sales figures and the Michigan Consumer Sentiment. These three items alone give a fairly good view of the state of the US economy and if they surprise the market to the upside, we will see gold look even more bearish.

One thing that could provide a bit of support for gold is the referendum in Switzerland on 30th November on whether or not the Swiss National Bank should increase their holdings from 8% to 20% of reserves. This is a curious question to pose to the general public and will put the price floor on the EUR/CHF under immense pressure. It does not look like passing, with many (unsurprisingly) undecided, but it will be something gold traders should watch nonetheless.

Gold is forming a consolidating pennant pattern as the bulls and bears fight it out for direction. The likely outcome is a downside breakout and a continuation on the recent trend, and traders should look to take advantage of the momentum.