Pressure is building up in gold, which has traded in a tight range since October 11th. Demand for the yellow metal softened amid optimism over a US/China trade deal, but it is also supported by rising expectations of a Federal Reserve rate cut at the end of October.

On October 11th, US President Trump announced that China and the United States had reached a tentative agreement for the "first phase" of a trade deal. Later that week, he stated his feeling that the deal would be signed ahead of the November 16-17 Asia-Pacific Economic Cooperation meetings in Chile. On Monday, President Trump’s tone remained optimistic. Speaking to reporters before a Cabinet meeting he said: “The deal with China’s coming along very well. They want to make a deal.” The prospect of a trade deal reduces the risk of a global economic recession and cuts the demand for safe-haven assets such as gold.

According to the CME Fedwatch Tool there is currently a 93% chance that the Fed will cut interest rates by a quarter-point at the October 30 meeting, which would mark a third consecutive rate cut. On Friday, Fed Vice Chairman Richard Clarida cited risks that weakness from abroad, which has already impacted manufacturing, could affect the broader US economy. A lower interest rate in the US dollar makes non-yielding assets such as gold a more appealing investment.

Continued uncertainty surrounding Brexit also serves to underpin bullion. On Monday, UK Parliament Speaker John Bercow rejected an attempt by the government to hold another vote on the deal, stating that the motion was the same in substance and circumstance as the one considered on Saturday. However, on Tuesday lawmakers are set to vote on the Brexit withdrawal agreement.

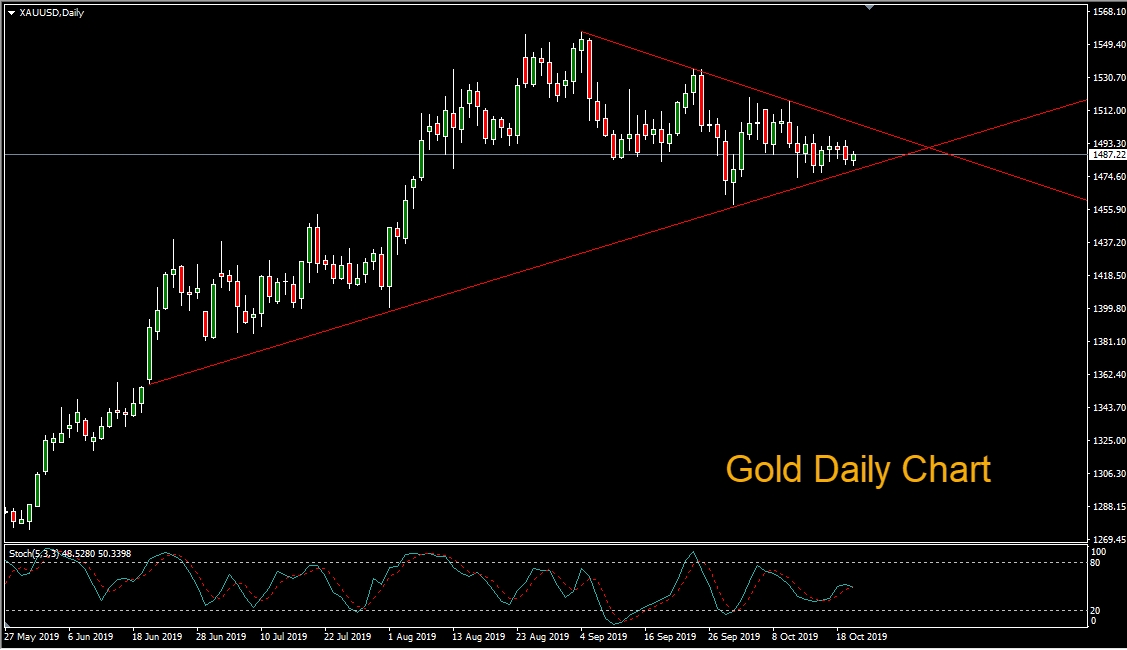

Looking at the gold daily chart we can see that multiple consecutive inside days have formed since the 11th and that price is contained within a well defined symmetrical triangle pattern.