Gold is consolidating, below the sixteen-week high of 1332.10 that was established on Monday, as the market awaits the minutes from from the January FOMC meeting. Those minutes will be released at 14:00ET.

It is widely expected that the minutes will affirm the Fed’s commitment to tapering, but in light of the recent soft economic data, investors are hoping to get a sense of what exactly might prompt the Fed to pause tapering. St. Louis Fed President Bullard told The Wall Street Journal today, “It would be a powerful signal if we decided to deviate from our taper.”

Indeed! It would signal that the Fed doesn’t have the courage of its conviction, despite what the central bank has already described as the ‘declining efficacy of QE.’ It would scream ‘risk on!’ It would further erode confidence in the Fed’s guidance and the institution as a whole.

Atlanta Fed President Lockhart, speaking at Mercer University, suggested the possibility that the Fed was misreading the strength of the recovery. “Fed policy will remain highly accommodative until well past the 6.5 percent unemployment rate threshold,” Lockhart said.

So what was the purpose of that guidance then? As I recall, it was touted as clarifying guidance, but now that we’re close to the employment threshold at least, suddenly it’s no longer relevant.

“It is time to move away from numerical markers,” San Francisco Fed President Williams said in a CNBC interview. Those numerical markers where implemented just over a year ago, we haven’t even hit them yet, and the Fed is ready to scrap them.

So, what’s the point of providing guidance if you’re going to consistently move the goal-post? Why not just acknowledge that we are Japan and that monetary policy is going to remain über-accommodative for decades to come?

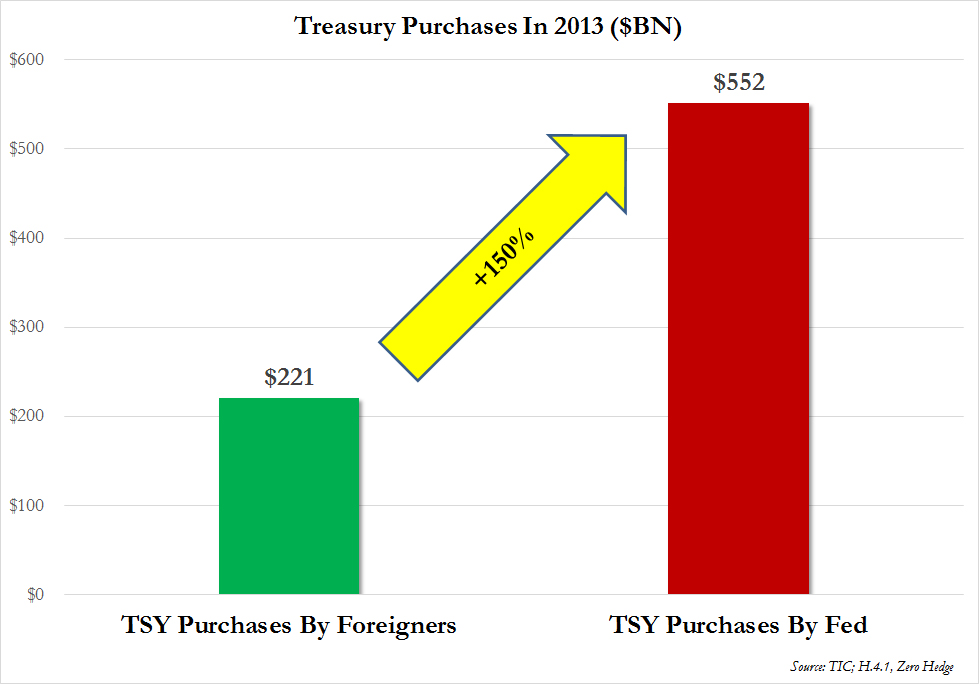

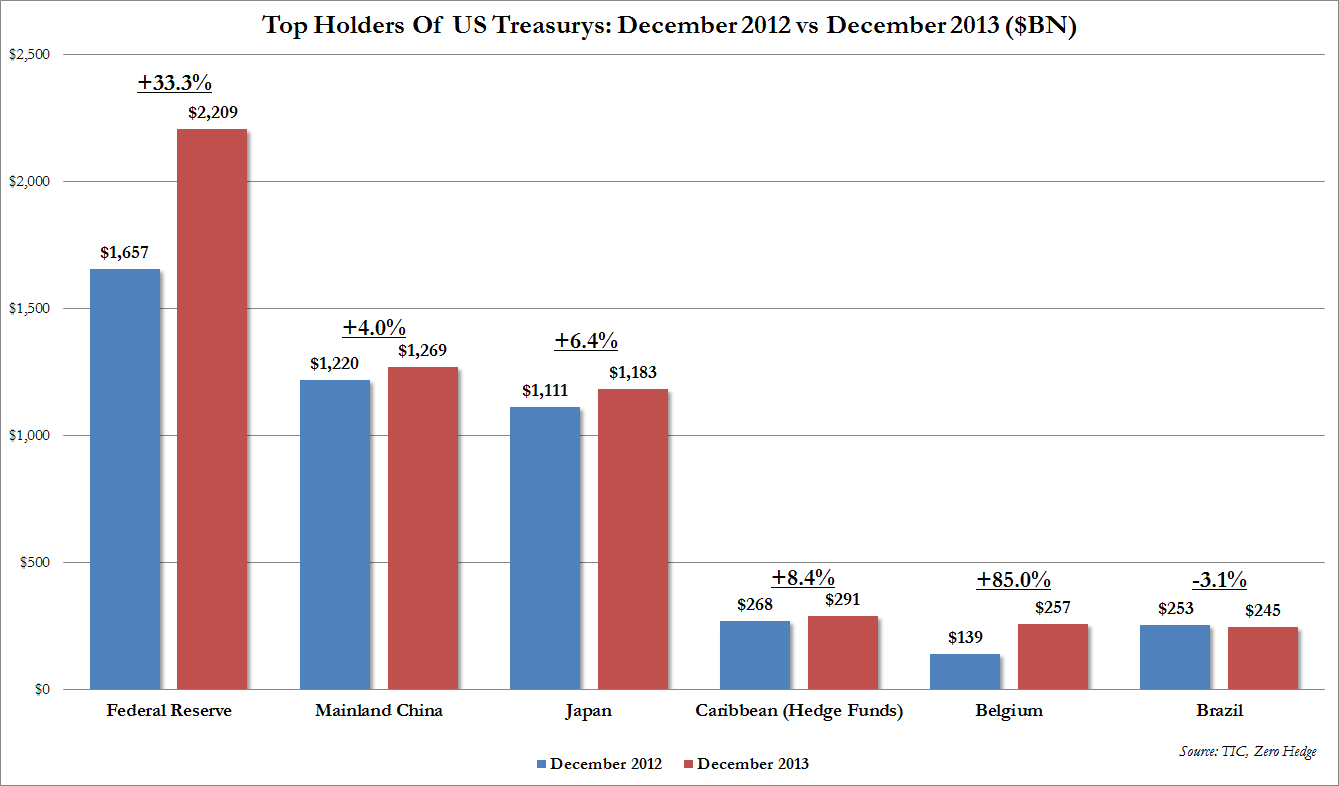

With that in mind, digest the following charts from a ZeroHedge piece entitled, In 2013 The Fed Bought 150% More Treasurys Than All Foreigners Combined.

And then ask yourself: Can the Fed really remove itself from the Treasury market, when the FED clearly IS the Treasury market?

If you come up with the same answer I did, the next step would be to go buy some physical gold.