We had been optimistically forecasting a recovery and summer rally for the gold price. And indeed, from its low at $1,680 gold rallied to significantly over three weeks. However, since mid August, it tumbled and is now training just slightly above $1,700.

Although gold prices have held up much better against the US Dollar (-6.74%) and especially against the euro (+5.83%) than almost all other asset classes so far this year, investors’ nerves have also been strained here. While official inflation rates shot up to record highs, the gold market has instead seen first euphoria, then sheer panic and finally a disappointing summer rally over the past eight months.

The first three months, however, brought an attack on the all-time high with a top at $2,070. From mid-March, though, gold bears gradually took control again and pushed prices down mercilessly in the wake of the crashing financial markets. Only at a low of$ 1,680 on July 21 (= a discount of almost 400 USD from the high on March 8) the gold bear temporarily disappeared after a four and a half months assault.

Since then, there was an initial brisk recovery and then a deep pullback towards $1,702.

In the wake of Fed President Jerome Powell’s speech last Friday in Jackson Hole, all markets came under such significant pressure. Hence, the end of the bear-market rally in financial markets is likely in place.

Gold prices also had to let go again and trading at a five-week low. Thus, the threat of dropping below the extremely important support at $1,680 is growing by the hour.

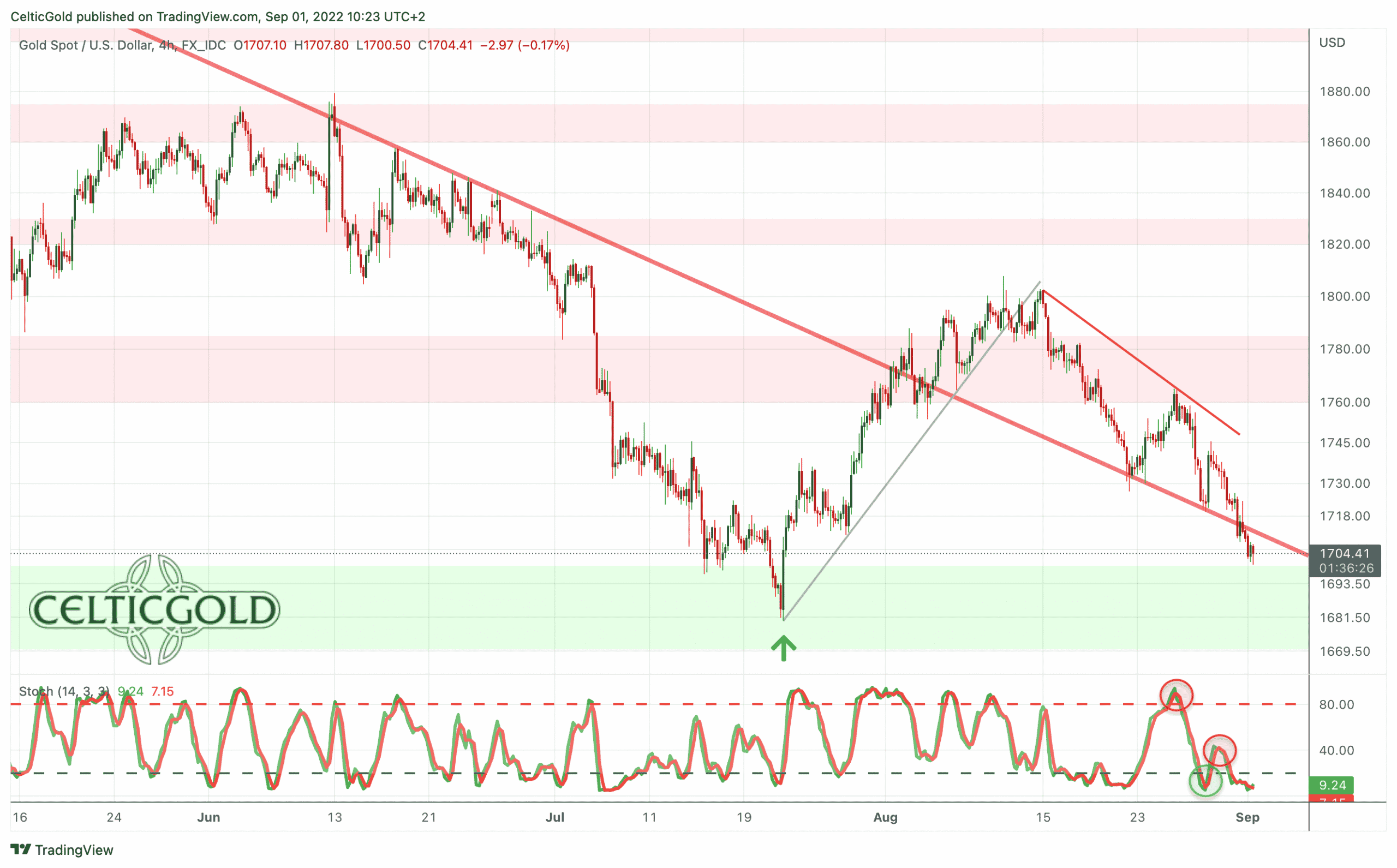

Technical Analysis: Gold in US Dollar

On the weekly chart, gold managed to catch a bid just below the upper edge of the light green uptrend channel five and a half weeks ago. This fourth low around $1,680, in conjunction with a strongly oversold condition, provided a quick bounce in the order of +7.55%. However, at a high of $1,808 the summer rally did not run very far and did not even reach the 38.2% retracement ($1,820) of the entire correction wave down since March 7. The promising buy signal from the stochastic oscillator was quickly lost again due to the weak price performance since August 10.

Thus, the situation on the weekly chart has deteriorated significantly. If gold bulls could stabilize price action around the upper edge of the light green up-trend channel once again, a second recovery wave towards the middle Bollinger Band ($1,819) and higher is still a possibility. But as prices are already flirting with the round psychological number of $1,700, a fifth test of $1,680 seems to be rather imminent and would further soften this support.

Hence, a breakdown below this extremely important support is very likely after all. In this case, gold could quickly plunge lower and prices around $1,625 would be the minimum target. However, since a break below $1,680 would also mean a clear dive back into the old uptrend channel, a test of the bottom of the channel (currently around $1,350) would be the “worst case” scenario.

Overall, the weekly chart is neutral, but a directional decision should crystallize over the coming weeks. As long as gold can defend the zone between $1,700 and $1,720, there is a chance of a continuation of the summer rally. However, below $1,700 at the latest, the path is clearly pointing to the downside and gold is likely to sail further south in the fall together with the presumably collapsing financial markets.

On its daily chart, gold is currently trading $130 below its slightly falling 200-day line ($1,835). This classic moving average would have been predestined as the minimum target of the summer rally. So far, gold has not made it back to that line in the sand. Instead, bulls already ran out of steam at $1,808 and the deep pullback towards $1,713 rather confirms the bearish setup.

At least, the daily stochastic oscillator is extremely oversold. But markets can remain oversold for much longer than most investors can imagine! At the moment, the lower Bollinger Band ($1,705) is bending to the downside and hence not offering good support.

All in all, the daily chart is bearish and gold looks very weak. Given the oversold stochastic and the numerous support between $1,680 and $1,700, a continuation of the recovery towards $1,835 plus X still has a chance for now. Nevertheless, the dangers on the downside must be taken very seriously in view of the unstable overall situation in financial markets.

Commitments of Traders for Gold: Close to the edge

Source: Sentimentrader

The cumulative net short position of commercial market participants has recently reduced slightly again and stood at 138,072 short sold contracts as of Tuesday, August 27th. The commercial net short position is thus again close to the threshold of 100,000 short contracts, at which one can speak of a rather bullish CoT report for the gold market.

In summary, the CoT report is to be classified as cautiously bullish.

Sentiment for Gold – Close to the edge

Source: Sentimentrader

In July, gold´s sentiment had fallen to its lowest level in four years. The interim recovery led to an initial relief. Now, sentiment analysis is again measuring relatively high levels of pessimism, pointing to a contrarian opportunity in the bigger picture. However, a bottoming process may well take some time, similar to the fall of 2018. Back then, high pessimism levels occurred repeatedly over a period of almost five and a half months. This bombed-out sentiment then laid the foundation for the fulminant rise from $1,160 to $2,070 within the following two years.

Overall, the sentiment traffic light is green and continues to provide a contrarian buy signal!

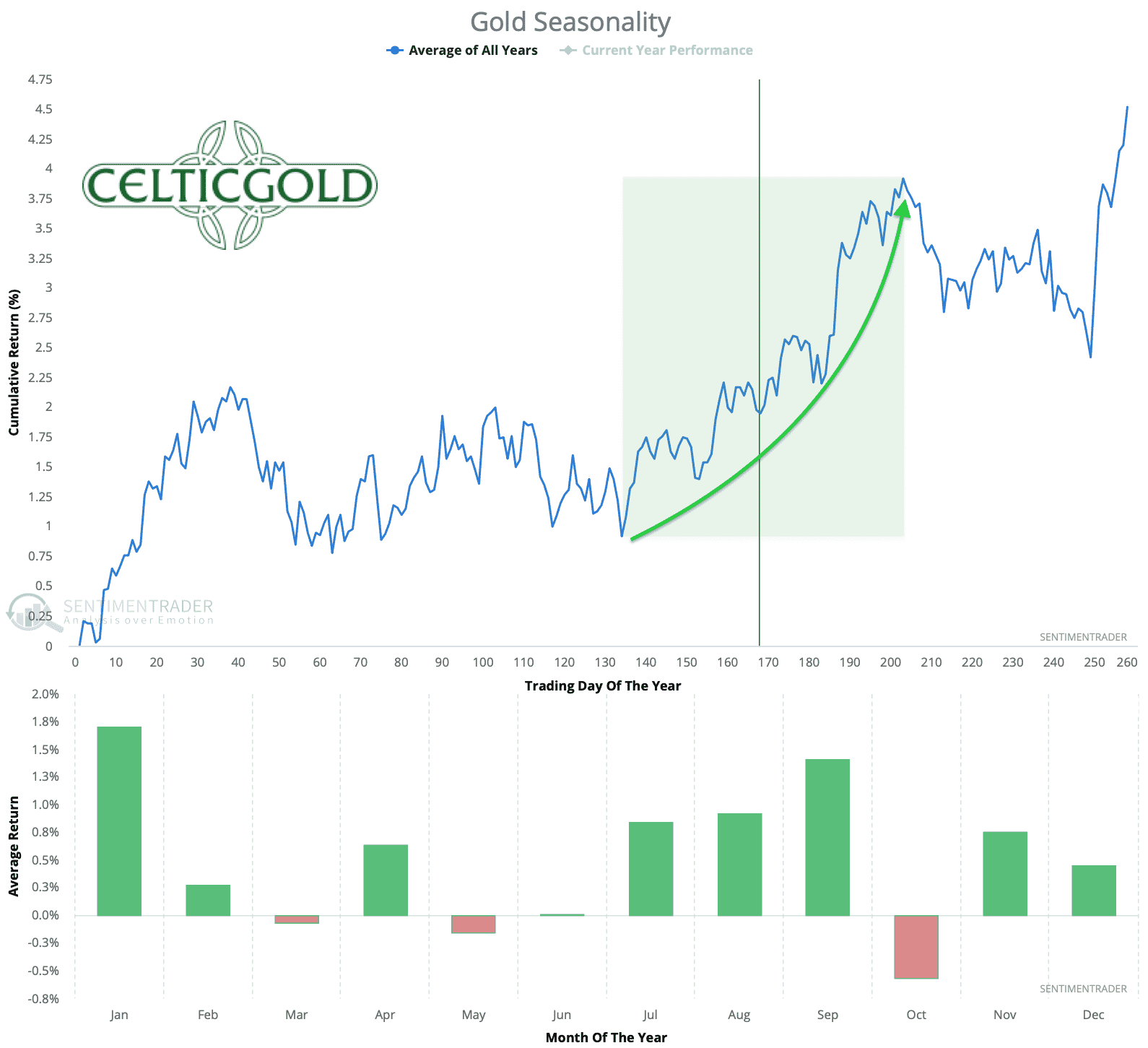

Seasonality for Gold – Close to the edge

Source: Seasonax

From a seasonal perspective, gold is currently right in the middle of its best phase of the year. According to the statistics of the last 54 years, this favorable timeframe typically extends from the beginning of July to the beginning of October. Accordingly, the seasonal component would still be very supportive for the next four to six weeks.

Seasonality for gold and silver is still strongly bullish until early October.

Macro update: Recession and stagflation

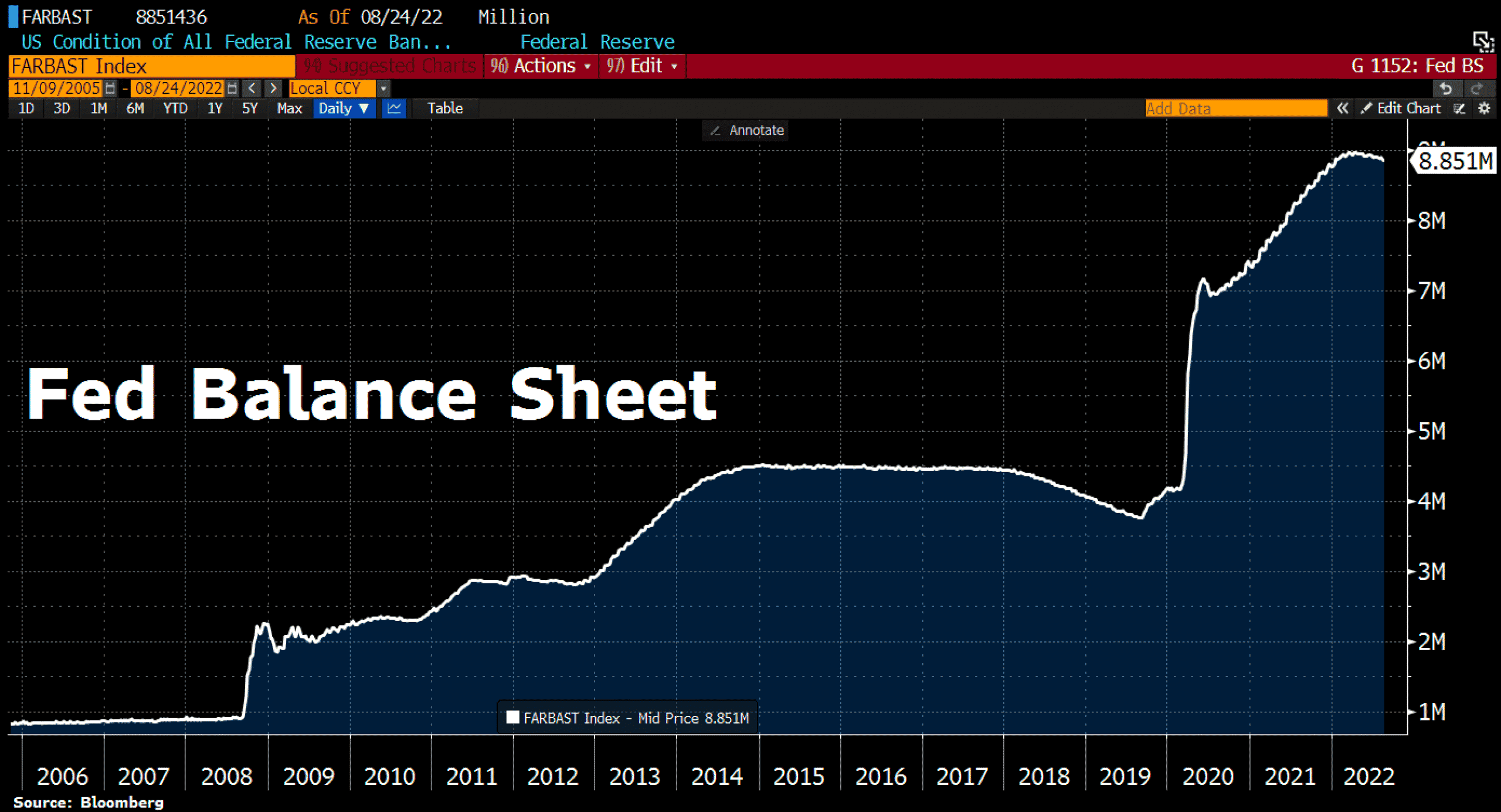

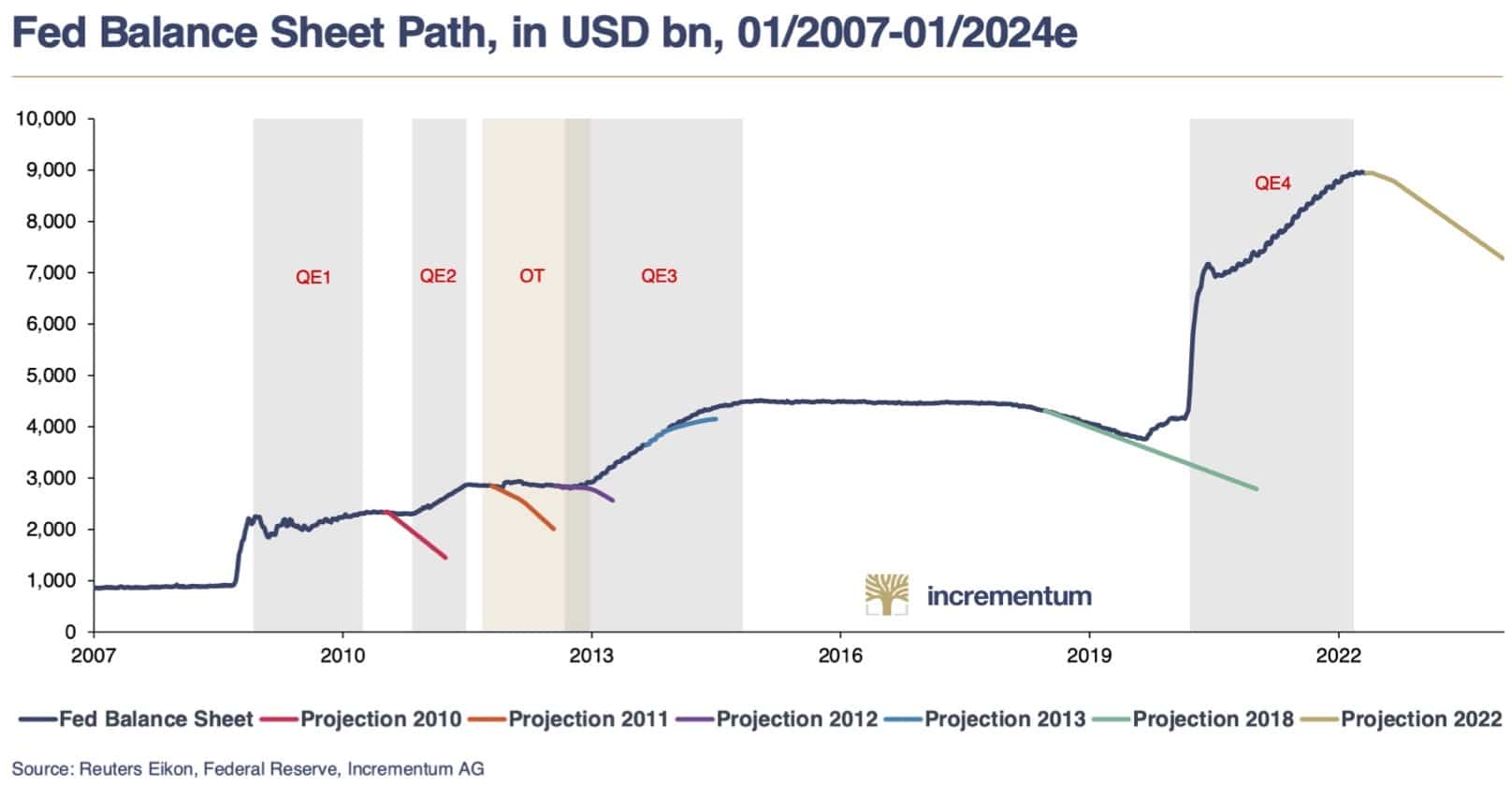

Last Friday, U.S. Federal Reserve Chairman Jerome Powell announced a tough stance on inflation in his speech at the key central bankers’ meeting in Jackson Hole. He signaled new rate hikes and prepared investors for a weaker economy. In reality, however, shrinking the Fed’s balance sheet does not appear to be that easy. Last week, for example, the Fed’s total assets rose by $1.7 billion to $8,851.4 billion. In retrospect, total assets have been reduced by just $114 billion, or 1.3%, since the start of quantitative tightening.

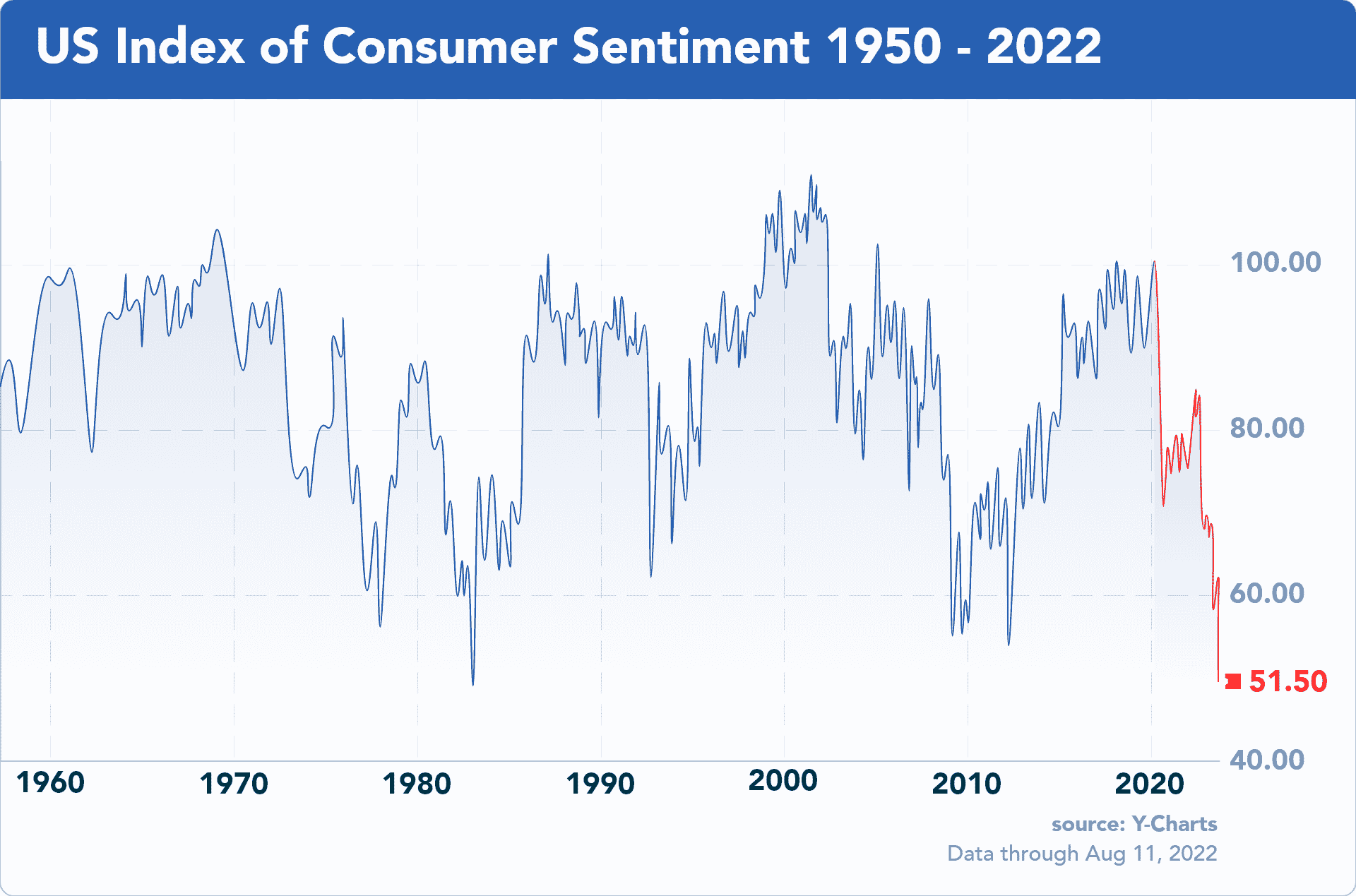

However, financial markets have responded to this minor reduction in the balance sheet total in recent months with a sharp correction and a bear market. Already, U.S. consumer confidence has fallen to its lowest level since the early 1980s! Likewise, CEO confidence in the U.S. has fallen to its lowest level in 14 years. Many other key data are on the verge of rolling over. A recession has already been confirmed. The only question now is how bad it will actually get.

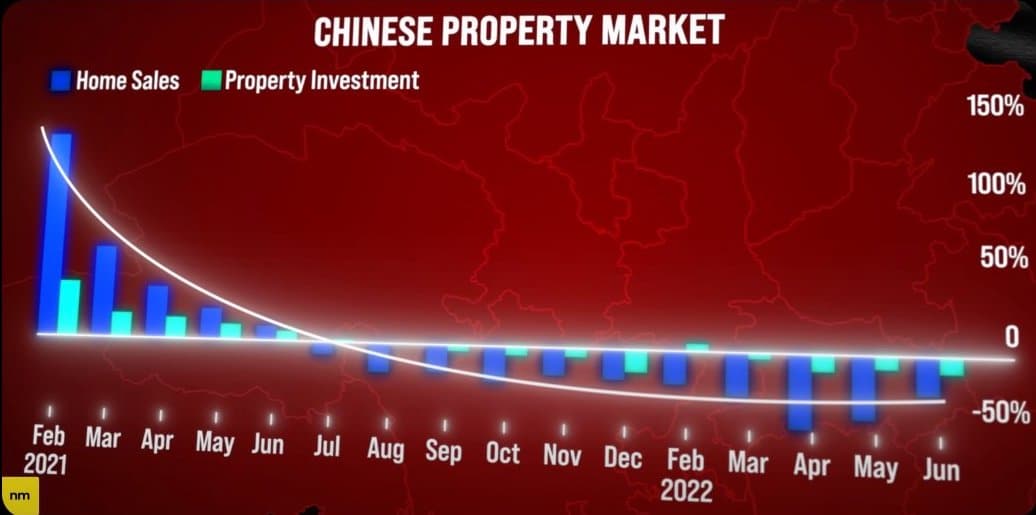

The already dramatic situation is intensified by the collapsing Chinese real estate market. The world’s largest and thus most important sector has already been under tremendous pressure for over a year and is increasingly collapsing. The total value amounts to more than $60 trillion, i.e. more than the entire US stock market and more than twice the US real estate market. S&P recently predicted a further decline of about 30%, which would be about 1.5 times worse than the 2008 financial crash.

As a result, the Fed will not be able to follow its announced course, as it has in the past (see 2010, 2011, 2012, 2013 and 2018). Instead, the Fed will have to cut interest rates next year at the latest to prevent a complete collapse. The amount of liquidity that will then be needed to stabilize the global economy will be absolutely overwhelming, dwarfing anything that has been seen until today.

In the short term, however, the Fed will initially pursue its destructive course unflinchingly, thus further exacerbating the stagflationary environment. As a result, all market sectors will remain under considerable pressure in the coming weeks and months. We recommend absolute restraint and a consistent risk-off mentality, as well as a large portion of patience. However, as soon as the Fed will be forced to turn around due to the collapsing markets, gold will quickly bounce back and then also break out to new all-time highs.

Conclusion

After a three-week summer rally of more than $125, gold prices quickly fell back by more than $100. Due to the restrictive U.S. Federal Reserve policy and the collapsing financial markets, the way towards south seems to be the most likely road ahead. Technically speaking, the picture is quickly deteriorating, too. Only if gold can defend the last support zone between $1,680 and $1,700 on a daily closing price basis, the second part of the summer rally could still start. But currently trading close to $1,705, gold is practically right on the brink of the abyss as last year’s support at $1,680 is unlikely to hold for a fifth time! Hence, a further wave down is likely to be unleashed. The scope of a breakdown could quickly assume enormous dimensions due to a then collapsing market technique and the many stops waiting below $1,680.

Overall, gold doesn’t look good here. The chance for another bounce is still there and would be typical for the season. At the same time, however, trading so close to the edge, the danger of falling into the abyss increases with each day. Therefore, the highest caution and restraint are recommended. In this difficult market environment, risk-off is your only choice! Cash is king right now! But don’t sell your physical gold. In fact, if gold were to correct even more sharply lower, it would be a great buying opportunity. Eventually, the Fed will have to turn around and print incredible amounts of new fiat money. But we’re not there yet. Alternatively (probability decreasing by the hour), gold can continue its summer rally. But to do so, it must stage a turnaround rather immediately.