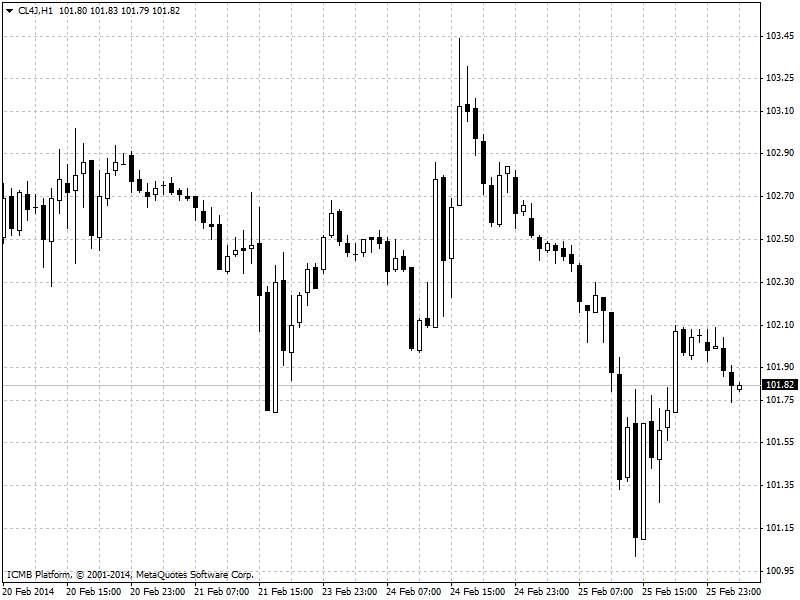

CL

Yesterday, West Texas Intermediate crude fell the most in three weeks on projections that U.S. supplies rose and concern that the weakening Chinese Yuan will hurt growth in the second-biggest oil-consuming country. U.S. crude inventories will increase for a sixth week to 363.6 million barrels, according to the estimates before an Energy Information Administration report tomorrow. WTI for April delivery decreased 99 cents to settle at $101.83 per barrel. It was the biggest decline since February 3. The volume of all futures traded was 23 percent below the 100-day average. Prices were little changed from the settlement after the American Petroleum Institute reported supplies rose 822,000 barrels last week. WTI was down 79 cents, or 0.8%, during this morning to $102.10 per barrel in electronic trading.

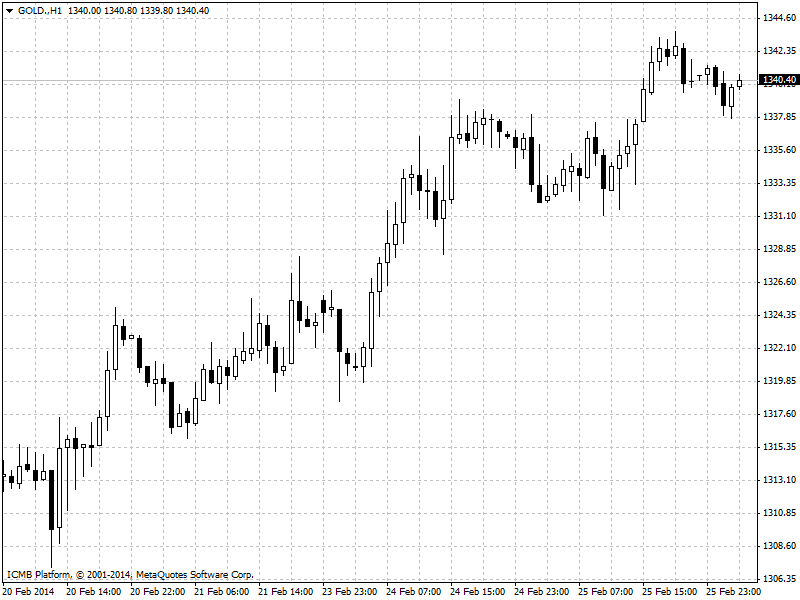

GOLD

Gold futures climbed to the highest in almost 17 weeks on speculation that a sputtering U.S. economy will boost demand for the metal as an alternative investment. U.S. consumer confidence fell more than forecast in February from January. Home prices rose at a slower pace in the 12 months that ended in December, according to a separate report. Gold futures for April delivery rose 0.4% to settle at $1,342.70 per ounce this morning. Yesterday, the prices reached $1,343.60, the highest for a most-active contract since October 30.