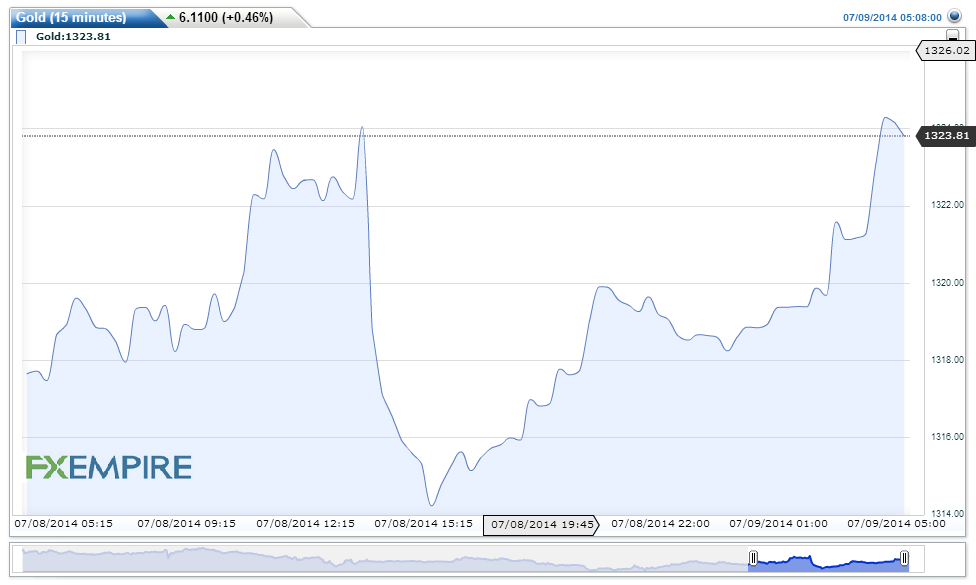

Gold gained another $8.00 this morning ahead of the release of FOMC minutes due mid-day in the US session. Gold is trading at 1324.50 while silver added 160 points to trade over the $21 level at 21.173 at this writing. Platinum also gained to break the $1500 price and is trading at 1505.45 in the Asian session.

Gold turned lower on Tuesday even as the dollar’s recent rally faded and investor’s awaited clearer signs from the US Federal Reserve that it is on track to raise US interest rates next year. Spot gold prices continued to trade lower as investors awaited clear signs from the U.S. Federal Reserve that it is on track to raise U.S. interest rates next year. Prices turned lower after U.S. Fed policymaker Jeffrey Lacker said he sees inflation firming this year. The gold held losses after Minneapolis Fed President Narayana Kocherlakota said inflation may run below the central bank’s target, while his Richmond counterpart Jeffrey Lacker curbed his previous expectation for more robust growth.

Lack of support from physical markets could weigh on prices; however, tensions in the Middle East and Ukraine are ensuring that there is still some demand for gold as insurance against geopolitical risk. Gold held below a three-month high as investors weighed the outlook for higher borrowing costs against increased holdings in the largest bullion-backed exchange-traded fund. Palladium headed for the longest rally in 14 years. Palladium for immediate delivery traded at $873.11 the metal climbed to $875.25, the highest since February 2001. A 13th day of gains today would be the longest streak since June 2000. Assets in exchange-traded products backed by the metal rose to a record yesterday, according to data compiled by Bloomberg.

Copper eased a few pips this morning after the release of Chinese consumer inflation and PPI data came in close to expectations. Traders sold off the metal to book profits as copper traded at 3.257. China’s producer-price index declined 1.1 percent from a year earlier, the National Bureau of Statistics said today in Beijing, compared with the median estimate of analysts for a 1 percent drop. The consumer-price index (SHCOMP) increased 2.3 percent, below projections for a 2.4 percent gain.

The easing of factory deflation follows reports showing manufacturing expanded at a faster pace last month, indicating that government efforts including speeding up infrastructure spending are helping to defend the economic-growth target for the year of about 7.5 percent. Inflation remaining below the official goal of 3.5 percent gives Premier Li Keqiang room for additional stimulus if needed to deal with threats including a property-market slump. China will release second-quarter gross domestic product data on July 16. The economy probably grew 7.4 percent from a year earlier, the same pace as the previous period, according to the median estimate of analysts in a Bloomberg News survey in June. That projection rose from 7.3 percent in May, as the central government intensified efforts to support growth.