Gold added for the sixth consecutive trading session, showing persistent but very cautious gains. Sustained buying brought the price closer to $1800, almost recovering from a violent two-day sell-off after a strong NFP. Despite steady buying, downside risks still prevail in gold.

Gold finds buyers after an overly sharp sell-off, but it is unlikely to rely on such speculative interest.

Gold’s positive momentum late last week has been renewed on a drop in US consumer sentiment, which cooled expectations of an imminent tightening of monetary policy and restored some of gold’s attractiveness as a savings vehicle.

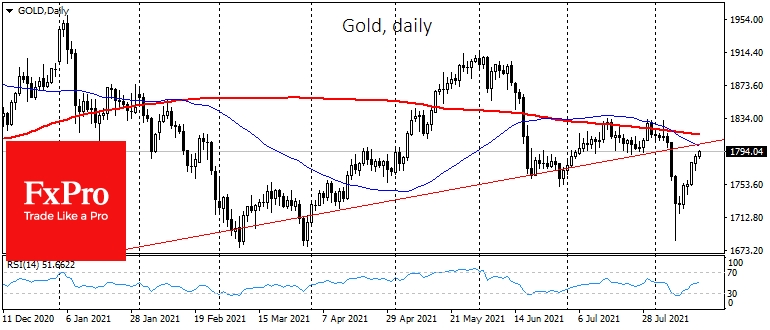

But this growth momentum has an important test to pass. The dip at the beginning of the month had a much higher amplitude, reflecting the increased interest in selling gold. The same can be said of the downward price impulses in June and January. Gold seems to be slowly climbing uphill only to plummet off a cliff.

The collapse at the beginning of August sent gold below the long-term trend support for the upside. On the other hand, this failure has not technically been confirmed, as the price has not rewritten the previous lows from April.

The bulls can only be serious after the price returns above $1800, where the long-term support and the 50-day moving average are located. Just above that level, at $1814, is the 200-day moving average. An increase above this level might not only increase the current momentum, but it could also bring back the long-term buyers in the precious metal after the 12-month correction from the historical peaks.

However, it is worth expecting that the bears in gold have taken a pause but have not lost control of the situation. The dip in the sentiment indices, which supported the momentum from last Friday, stands out from the generally very positive mood of the reports. Fed officials are openly talking about a possible start of tapering as early as September-November and an end to the buying by the middle of next year.

This is a solid bearish factor for gold, which follows the pattern of post-2008 dynamics. The price peak coincided with the peak of the recovery in the stock market. Equities then continued to rise, and gold went into a correction. In 2013, at the rally’s start, the price of gold broke the uptrend, losing 30% or 2/3 of its rally before going into a more measured decline.

Globally, the pressure on gold only stopped with the interest rate hike when all the negativity was built into the quotes. This pattern creates the potential to fall into the area of $1450-1500 per troy ounce unless the bulls manage to push the price back into an up-trend.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold: Climbing Uphill Only To Plummet Off A Cliff

Published 08/17/2021, 06:13 AM

Updated 03/21/2024, 07:45 AM

Gold: Climbing Uphill Only To Plummet Off A Cliff

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.