China. The citizens of this economic superpower have been the “prime mover” for the latest collapse of global government fiat money against gold.

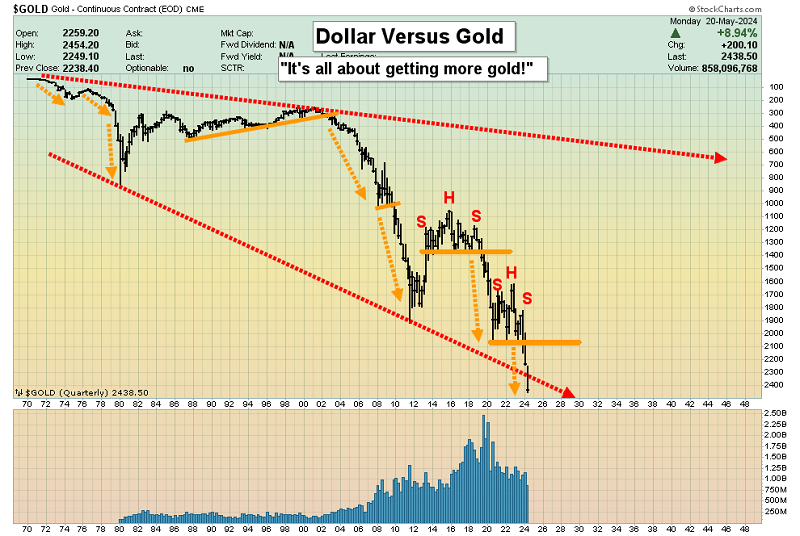

What is arguably the greatest chart in the history of financial markets? The collapse of fiat against gold is incredible.

Chinese and Indian citizens eagerly gobble up most of the gold produced by the mines of the West, and their gobbling is set to intensify over the coming decades.

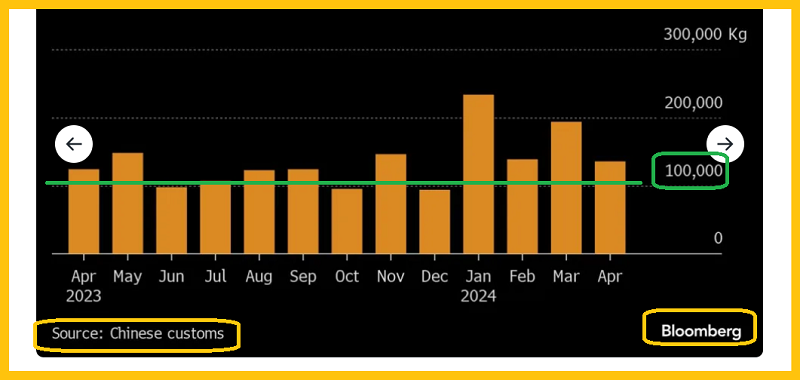

Chinese gold bullion imports have been averaging 100+ tons/month.

That’s solid action and if gold does swoon a bit more significantly in the coming weeks, Indian citizens are ready to buy. That would put a new floor of size under the price. The bottom line:

Gold is incredibly stable here, even after the huge move up. A look at the daily chart. There was a breakout from a drifting rectangle (a bull flag on some charts) but basis RSI and Stochastics, gold is again overbought.

Chinese citizens are the world’s biggest gamblers and they’ve been gambling with gold on their futures market (SHFE).

The April 12 high for gold at about $2448 was created by the exchange hiking margins, and another hike was announced yesterday.

It takes a few weeks for these gamblers to adapt to the new capital requirements. The good news is that the Indian election results will be announced soon.

Once that’s out of the way the citizens there will be ready to buy any sale in the price. That’s likely to be quickly followed by Chinese gamblers racing to buy. The bottom line is that the month of June could see gold and silver wearing space helmets… and heading straight for a fiat price moon.

The palladium ETF chart. This metal is showing signs of basing.

A look at platinum, the abrdn Physical Platinum Shares ETF (NYSE:PPLT) ETF chart. A large base pattern is also in play.

A lot of commodities look very perky and grocery store inflation is obvious. Governments want lower rates so they can borrow more fiat to spend on themselves with outrageous recklessness, but “man on the street” inflation and buoyant commodity markets are going to make those cuts a very difficult task for the Fed to accomplish.

A view of one way that it could happen. While the Nasdaq and SP500 have made strong new highs, the Dow Industrials have only barely done it.

The action of the Dow Transports is even more concerning.

The US government’s failed proxy wars in Ukraine and Gaza could soon become much bigger quagmires than they already are. An ominous turn of events in either war could create a stock market crash and the Fed would race to cut rates.

Many black swans are in flight. Any one of them could crash the market. Aug 1-Oct 31 is US stock market “crash season” and out-of-control US government debt, war mongering gone wrong, and marked to model bond market losses held by banks are just three of the many catalysts that could take the market down.

What about crypto? While bitcoin has failed as a currency, it’s a great tool to make fiat profits that are then converted to ultimate money gold. I walk new investors through the maze that is crypto with simple zones to buy and sell (with ETFs) in my crypto palace newsletter.

With all fiats heading to the dust bin and de-dollarization moving into a more aggressive stage, Western gold bugs are wisely transitioning their focus from making temporal fiat profits… to getting more gold.

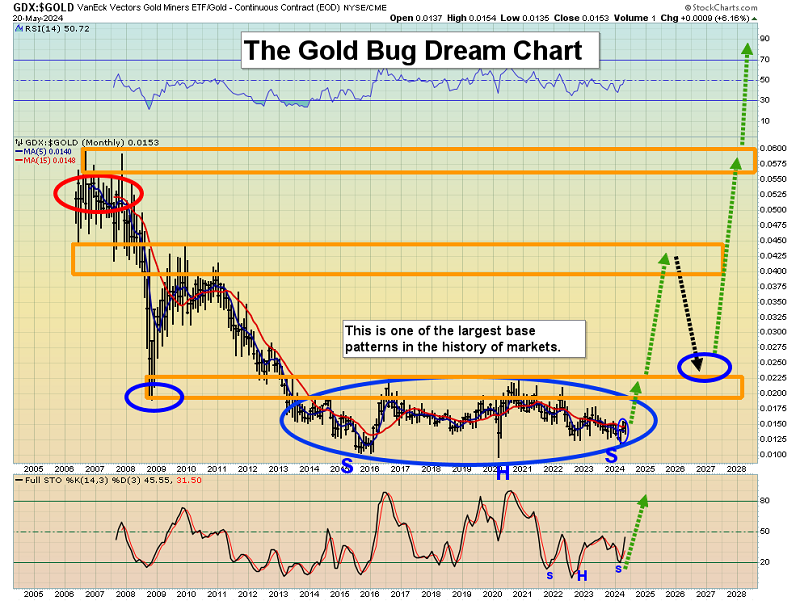

Importantly, with the stock and bond markets ridiculously overvalued and crypto a niche market, it’s clear that mining stocks are the best way to quickly make large fiat profits that can later be converted to gold.

The phenomenal silver stocks ETF chart. A situation much like that of the 1970s is emerging, except this time the most exciting futures trading and margin hikes are in China. The metals and miners surge and the authorities try to temper the action, but then the rallies resume even more aggressively than before.

The fabulous GDX (NYSE:GDX) daily chart. The oscillators are slightly overbought, but any pullbacks can be bought… with the expectation of an even bigger upside surge being imminent.

The stunning GDX versus gold ration chart. Mainstream analysts and even some gold bugs are puzzled by the gold stock rally that “just won’t quit”, but this chart suggests that the party is just getting started.