Gold notched its third straight week of higher prices as the yield on the 10-year Treasury dipped below 1.3% for the first time since February. The highly transmissible Delta variant was also ruled the most dominant strain of coronavirus in the U.S., threatening economic growth and raising uncertainty about the next interest rate hike.

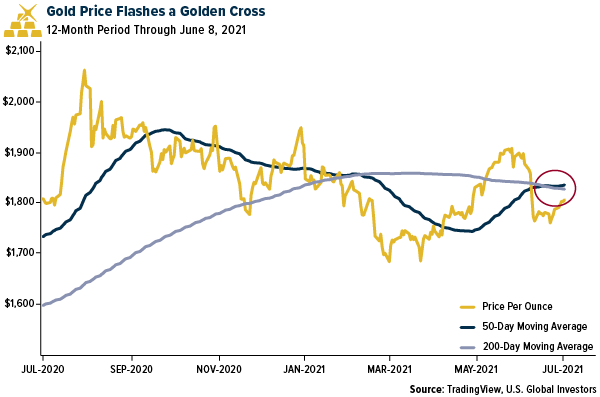

Against this backdrop, the yellow metal is now flashing a golden cross, meaning the 50-day moving average is trading above the 200-day moving average. In the past, this has been a bullish indicator for gold prices, which are still off some 12% from their all-time highs set last summer.

In the short to medium term, it appears as if gold demand will continue to be driven by central bank policy, which should remain accommodative even as inflation fears increase. According to the CME Group’s FedWatch Tool, there’s a 75% probability that interest rates will stay in the 0.00% to 0.25% range a year from now, leaving plenty of time for gold to test $2,000 an ounce or more.

Pandemic Still Tops Central Bankers’ List of Worries; Inflation Not Too Far Behind

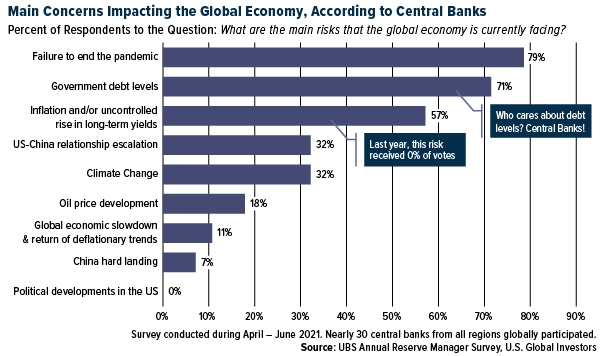

Speaking of central banks, UBS released the results of its annual reserve management survey last week, which show that managers are still very much concerned with the handling of the pandemic.

Nearly 80% of respondents cited failure to end the pandemic as their number one concern impacting the global economy right now, with more than half of them saying they believed it would be over only after 2022. Here in the U.S., the rate of vaccination has slowed considerably in certain populations, allowing Canada, the United Kingdom, Italy and Germany to catch up. In low-income countries, meanwhile, only 1% of people have received one dose of the vaccine.

Central bankers’ concern is not unfounded. IHS Markit’s chief business economist published an article last week showing there’s a strong correlation between vaccination rates and economic growth. The higher a country’s vax rate, the higher its PMI reading was in June; the reverse was also true.

Rounding out the top three concerns impacting future growth were government debt levels (71% of respondents), something I’ve written a lot about, and inflation (57%). I should point out that inflation did not even appear on the list of concerns one year ago when the last survey was taken. The London Bullion Market Association (LBMA) also notes, in its review of the second quarter, that there were more than 100,000 press articles published about inflation in May, far more than on COVID-19.

Gold Can Help Manage Risk

All of these concerns, I believe, favor gold as a portfolio diversifier. Low bond yields have pushed investors into riskier assets, including stocks. This has been a winning strategy as major indices have been hitting all-time highs, but it’s important to maintain a position in gold to help manage risk.

I recommend a 10% weighting, with 5% in physical gold and 5% in gold stocks. A 1% to 2% allocation in Bitcoin and Ether, not to mention crypto mining stocks, also makes sense right now.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.