Since I wrote my last analysis, I find the gold bulls continued to face stiff resistance on Dec. 28, 2023, despite making the last attempt of the year to sustain above the immense resistance at $2083.

This move was looking strong initially, pushed the gold futures to retest the day’s high at $2098.15 from the day’s low at $2076.35, and currently trading nearby before today’s closing.

Undoubtedly, the formation of a bearish candle in the daily chart has enhanced the importance of the candles formed on the last trading of this year by the Gold futures on December 29, 2023, in different time frames (from daily to monthly) to define a lot for the traders to remain cautious during the upcoming weeks and months, as the last two wobbly weeks have made it mandatory to have a remain cautious while trading gold amid looming uncertainty due to lower recessionary fear and reversal of strength in weak dollar.

Let me define the meaning of different probabilities by the formations of candles on Dec. 29, 2023. Undoubtedly, this assumption is based only on the basis of the technical formations amid changing geo-political conditions and spreading fear of JN.1, the New Coronavirus Strain, impacting the movements of precious metals and other commodities.

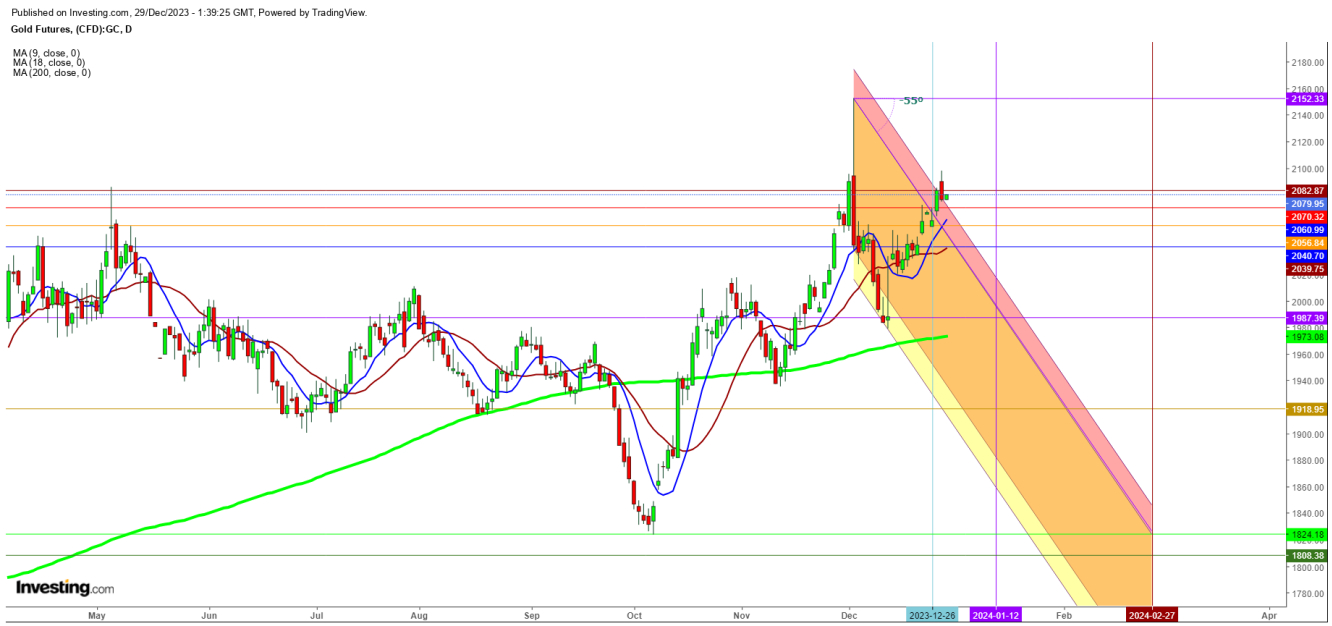

In 1-hour chart, bearishness seems to hover around as the gold futures are still trading below the formation of a bearish crossover, formed on Dec. 28, 2023, likely to extend selling spree on the last trading session of this year if the gold futures find a breakdown below the 200 DMA, whilst at $2060.

In 4-hour chart, the formation of four bearish candles indicates the sliding speed of the gold futures, which is likely to accelerate on Dec. 29, 2023, if the gold futures hit the immense support at $2056 on the last trading session of this year.

Undoubtedly, a daily candle formed on Dec. 28, 2023, seems to be a dark shadow over the bullish candle formed on Dec. 27, 2023 indicating a thick presence of big bears above $2083, likely to remain in control during the upcoming weeks till the Fed’s next meet on Jan. 31/Feb. 1, 2024.

In the weekly chart, a candle going to be completed on Dec. 29, 2023, looks evident enough to turn into an ‘Exhaustive Candle’ from a ‘Hanging Man’ and finds a weekly closing below $2065.

Undoubtedly, the weekly candles formed this month are still holding above the formation of a bullish crossover, but this week’s candle is likely to turn into an ‘Exhaustive candle’ if the gold futures close this week below $2065.

Technically, in such a case, the first weekly candle of 2024 will confirm the next directional move by the gold futures during the upcoming weeks.

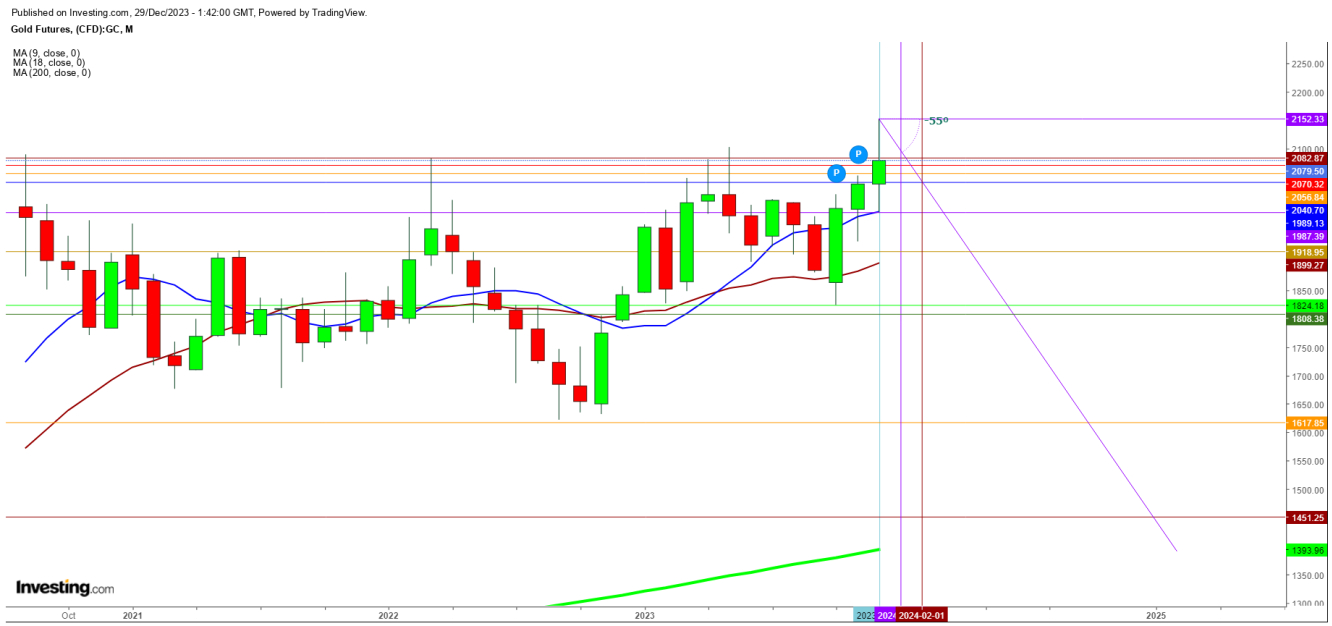

In the monthly chart, the December candle shows extreme indecisiveness and is likely to grow if the main body of the candle shrinks a little more in the last trading session of this month. Though the lower leg of this monthly candle is still balancing above the formation of a bullish crossover, but the weakness could grow if the immediate support for the gold futures in a monthly chart at 9 DMA, at $1988, is broken down during the Jan. 2024.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. Readers can take any long or short trading position at their own risk.