One must live under a rock to not know the precious metals have been on a bull run lately. Gold has now reached the psychologically important $2,000 level. Suffering from FOMO (Fear Of Missing Out)?

Should you, therefore, buy it now, or may be later?

A simple way to invest in gold is with the Exchange Traded Fund (ETF) called GLD (NYSE:GLD). So, let’s assess its price chart to answer the question more objectively.

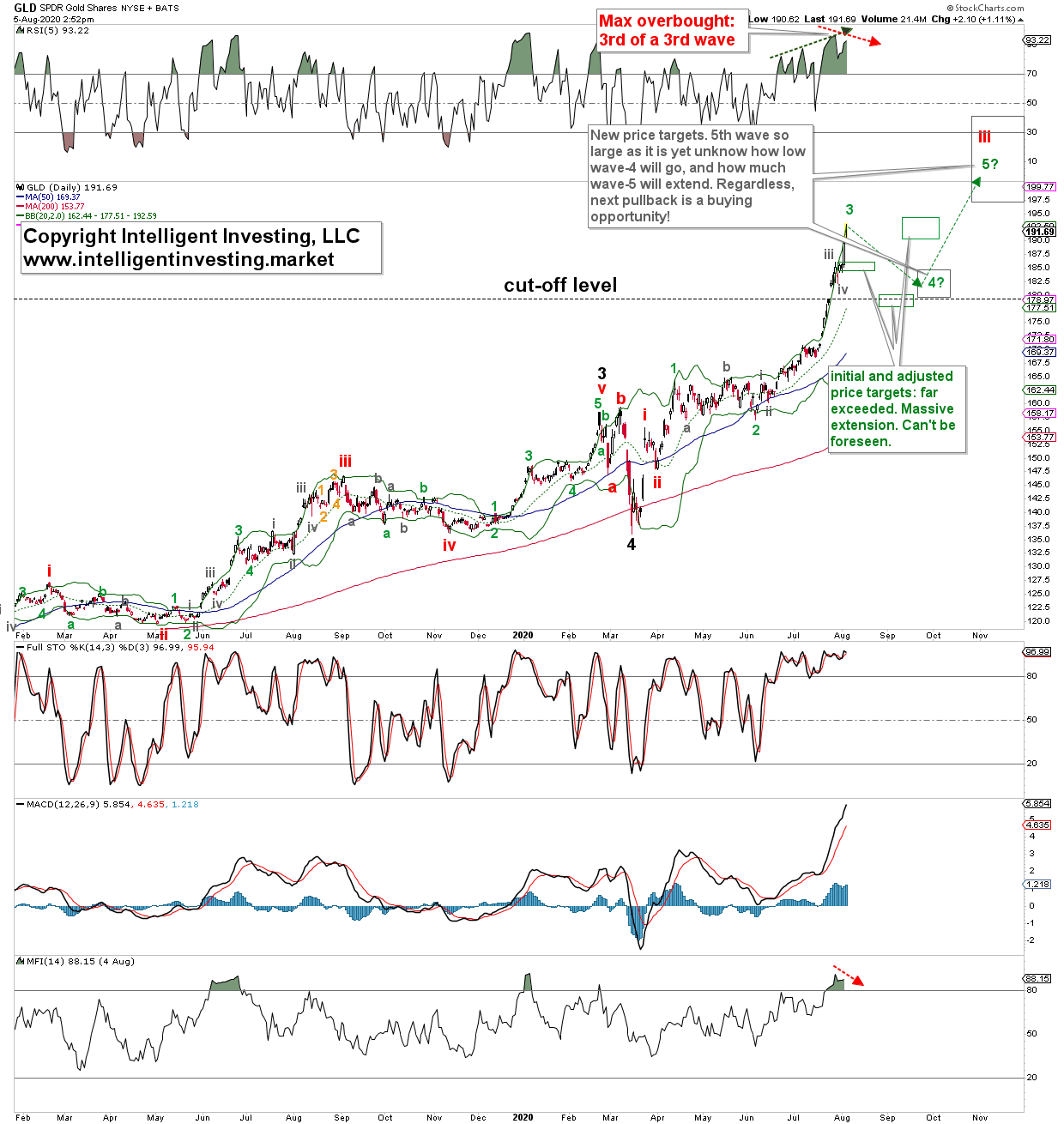

Applying the Elliott Wave Principle (EWP) to this ETF, as well as several technical indicators, I find GLD is reaching maximum overbought levels. Also, it has surpassed, i.e., called “extended” in EWP terms, my

initial daily-forecasted upside targets (green boxes). That’s a sign of a bull market: upside surprises and downside disappoints. Some negative divergences (red dotted arrows) are creeping in, foretelling us of a

potential pullback before resuming higher considering the current strength. In EWP-terms, I would label the current advance as green wave-3, the pending pullback as wave-4, and then the next more significant rally as green wave-5. See figure 1 below.

Figure 1. GLD daily candlestick chart with EWP count.

As long as the green wave-4 pullback holds the $179 level on a closing basis, I anticipate GLD to reach $197.50-213.00 for wave-5. This price target zone is rather large at this moment because I do not know yet how low wave-4 will go, and how much wave-5 will extend. The 5th waves are often between 0.618 to 1.000x the length of wave-1. Once that upper target zone is reached, it should complete red wave-iii.

GLD should then experience another (larger) pullback, wave-iv, which will hold above the green wave-4 low at ideally around $185-188, before an even more significant 5th wave to new uptrend highs (think

mid to high $200s) should take place. Thus, based on the price charts, technical indicators, and EWP, it may be more advantageous to wait for the next pullback before entering GLD. As long as $179 holds, I expect higher prices.