Tom Petty said it well.

The Waiting is the Hardest Part.

Precious Metals remain in a correction, and we’ve been waiting and waiting for a better entry point.

After a spectacular four-month move, Gold and Silver stocks still have not corrected enough in price and time.

But the good news is, they are starting to make some progress.

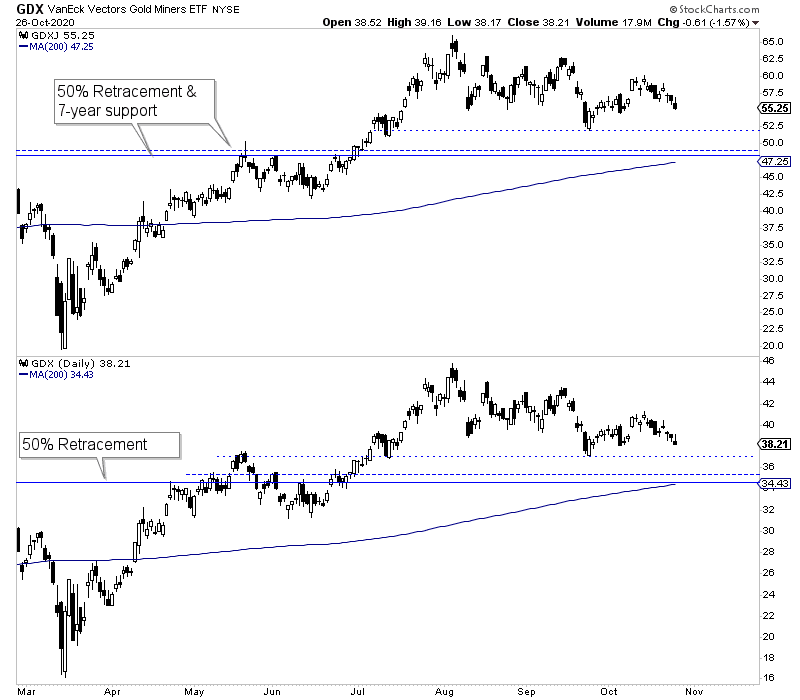

It appears that GDX (NYSE:GDX) and GDXJ will test their September lows at $37 and $52 reasonably soon.

Should GDX and GDXJ break those lows to the downside, then we should get ready to buy. GDXJ has a confluence of strong support just below $50, and GDX does just below $36.

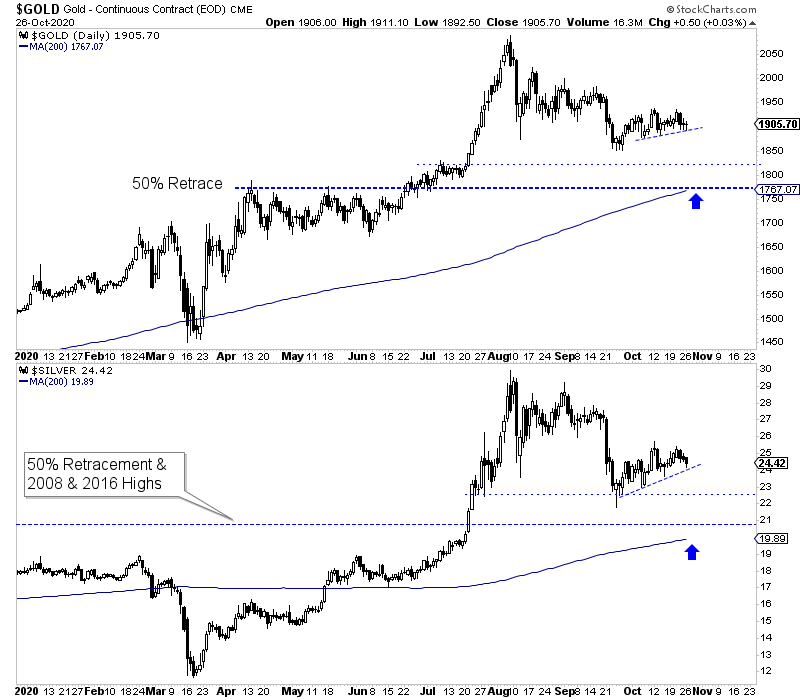

Turning to the metals, we can see a similar outlook. The action since the September lows appears to be corrective or what I call “weak strength.”

Should Gold break below its September low of $1850, it could find support in the upper $1700s. Silver meanwhile has support in the mid $22s and then reliable support at $21.

As the election beckons, keep in mind that the primary bull trend remains well intact. The outcome cannot change that because regardless of who wins, fiscal stimulus is coming, and the Federal Reserve will remain extraordinarily easy.

The technicals do argue the correction has more to go. By the way, sentiment makes the same case. Since the metals peaked in early August, the net speculative positions in Gold and Silver have not decreased.

In short, resist the urge to make rash decisions or trades unless precious metals decline towards the support levels mentioned above. In that case, we want to buy.