- Gold is about to end 2023 on a bullish note.

- Current technical setup is pointing toward another charge toward all-time highs.

- Fundamental factors, such as the macro environment and rising geopolitical risks are also favoring the gold bulls.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The year 2023 can be marked as notably successful for gold, boasting a return rate of just over 14%.

The surge in demand can be attributed to geopolitical tensions in the Middle East and the anticipation of the Federal Reserve shifting away from its restrictive monetary policy in the upcoming year.

This shift signifies the initiation of an interest rate cut cycle, expected to weaken the U.S. dollar and lead to a decline in U.S. Treasury bond yields.

Technically speaking, the current scenario indicates an attempt to break out from the long-term consolidation that has persisted since approximately the first half of 2020.

The most likely scenario in the current context points towards a continued upward trajectory, with the initial target in the vicinity of $2100 per ounce.

Will the bullish trend continue in 2024?

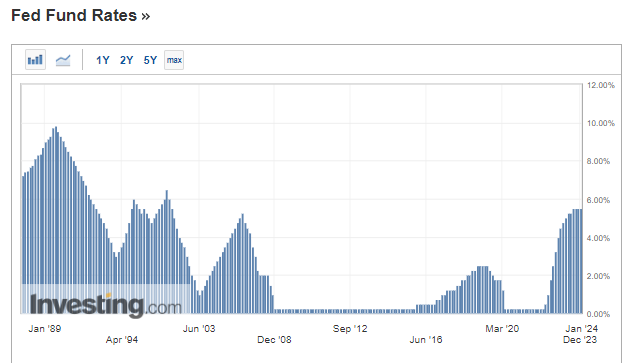

In the first quarter of 2022, the Federal Reserve initiated one of the most robust cycles of interest rate hikes in decades, elevating the range from zero to 5.25-5.50% by July.

This trajectory was already factored in earlier in 2021, acting as a significant impediment to gold's dynamic bull market and ushering in a phase of an extended sideways trend.

Not even the war in Ukraine provided substantial support, triggering only a weak upward impulse. The overarching determinant remains the policies of major central banks, led by the Federal Reserve.

Currently, the macroeconomic environment coupled with the rising geopolitical tensions seem to be creating a combination conducive to a free-flowing bull market.

The Federal Reserve's latest meeting confirms the scenario of the end of the hike cycle and the execution of a pivot with 4 reductions next year.

The situation in the Middle East remains tense, which seems to be underscored by Benjamin Netanyahu's words ruling out a quick end to the conflict.

Stability in the region is also certainly not improved by attacks by the Houthi rebels (a Yemeni armed organization) on merchant ships in the Red Sea basin and the death of an Iranian general who was killed in Israeli Air Force air strikes in Syria.

Gold bulls target $2100 next

The recent strong demand shot established a new historical high in the $2150 per ounce price area, but these were quickly negated.

Buyers are not short of fuel, however, and all indications are that they will be able to permanently overcome the key resistance area tested several times over the past few years located near the round barrier of $2100.

The natural target for demand is the area around $2150 and the next round barrier of $2200.

Possible corrective movements should be limited by the local upward trend line and demand zones near $2000 and $1950 per ounce.

As we approach an election year, we stand at the threshold of a period marked by various declarations that could impact the trajectory of fiscal spending, posing a potential risk of maintaining inflation above the target.

Different ways to gain exposure to gold

In the upcoming year, investors seeking to allocate their funds specifically to gold will have a diverse array of options, including:

- ETFs (Exchange Traded Funds): These funds are designed to mirror the price of gold and are traded on exchanges. One notable advantage is that these funds are backed by physical gold, enhancing their credibility.

- Physical Gold: The most common method of acquiring physical gold involves purchasing bars and coins, with the choice depending on the size of your portfolio. Given the mint's commission, this option is more suited for long-term investments, requiring a few percent profit to offset costs.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.