- The bullish rally in gold is fueled by concerns over the Russia-Ukraine conflict stirring safe haven demand.

- Market sentiment is torn between the prospect of fewer Fed rate cuts in 2025 and rising geopolitical risks

- Goldman Sachs analysts predict gold will set new records by the end of 2025, further bolstering bullish sentiment.

Gold (XAU/USD) bulls came out of the blocks with speed this week as heightened geopolitical tensions in Europe dominated the weekend. News that the US has authorized Ukraine to use ATACMS missiles to strike in Russian Territory saw the precious metals safe-haven appeal return.

There is no doubt that Gold has also benefited from a weaker US Dollar to start the week.

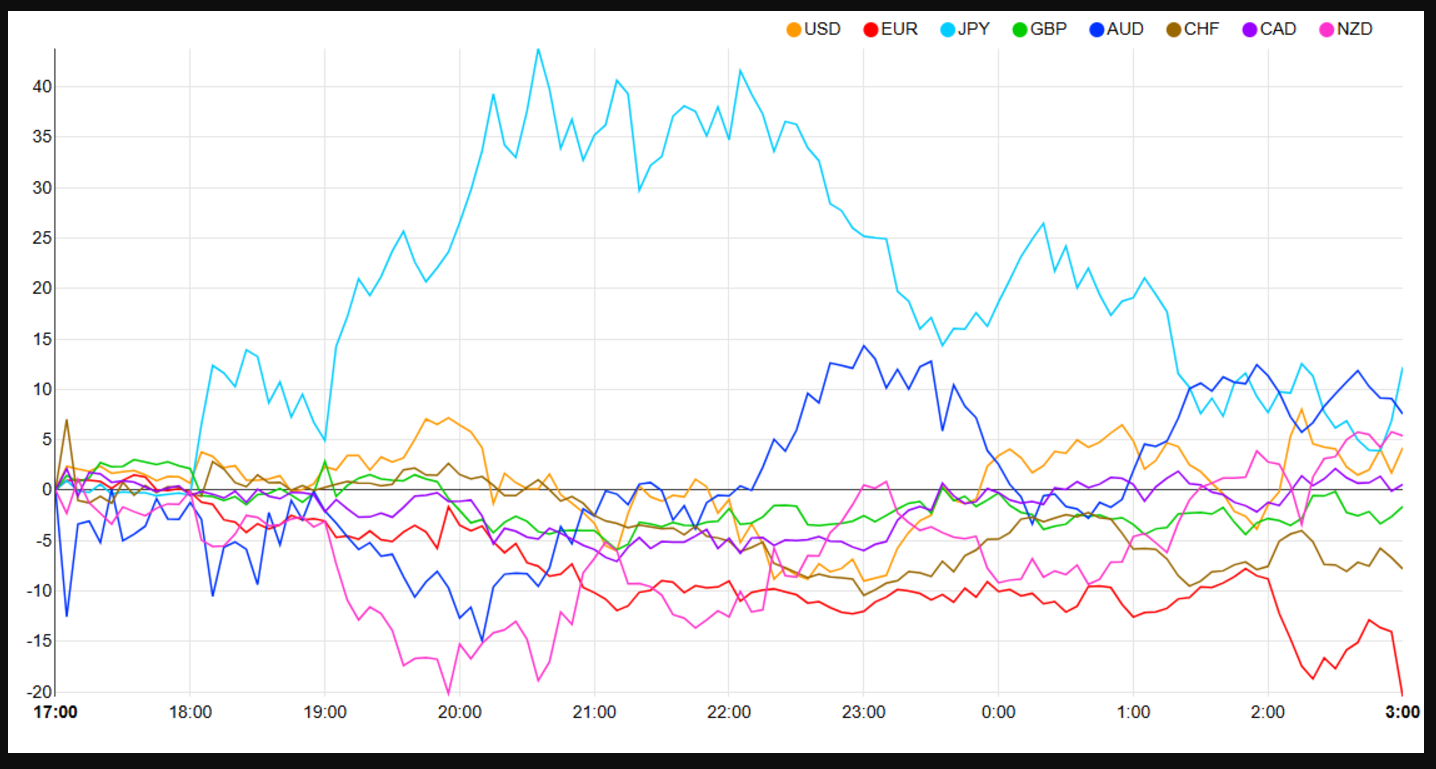

Currency Strength Chart (Strongest to Weakest): JPY, AUD, NZD, USD, CAD, GBP, CHF, EUR

Source: FinancialJuice

At the moment though, the precious metal is caught between a rock and a hard place. Markets continue to bet on less rate cuts in 2025 from the Federal Reserve which is keeping the USD supported. At the same time, the heightened geopolitical risk around Russia-Ukraine and the ongoing situation in the Middle East are keeping Gold buyers interested. The question is, which of the two opposing forces will win?

The longer-term picture for Gold does appear to favor the bulls. Looking back at President Trump’s first term in office, Gold prices rose as much as 55% on account of the trade war with China and tensions with Iran and North Korea. Looking at the picks by President Trump for some of the key positions in his administration and a lot of them are what you would call ‘China hawks’.This has only ramped up expectations of a potential US-China trade war, one of the driving forces behind the Gold rally in Trump’s previous term. Will history repeat itself?

Adding to the idea that Gold might be beginning the next leg to the upside, Goldman Sachs analysts predict the precious metal will set a new record by the end of 2025.

Economic Data Ahead

US data is sparse this week with geopolitics and more names for Trump’s cabinet likely to drive market sentiment. This morning, news that Russian President Vladimir Putin may use nuclear weapons to any strikes on Russian territory have added a new safe haven narrative.

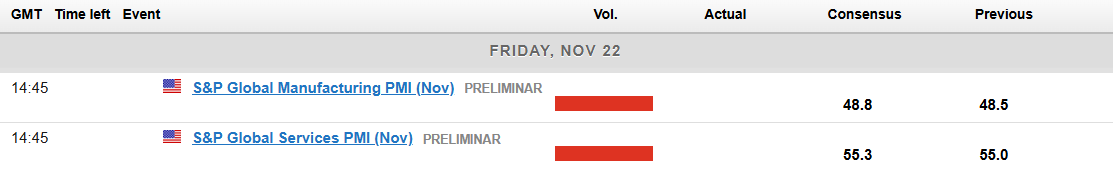

On Friday, the only high impact data release from the US is due. The S&P global PMI report will be watched closely as markets are still weighing up the actual health of the US jobs market. This is a direct result from two broad-based downgrades to the numbers since June.

Following the US PPI data release last week, markets will also focus on the pricing of manufacturing and labor costs. Any uptick here usually trickles downstream to consumers and could suggest an uptick in inflation is indeed on its way, even before President Trump officially takes office.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold has failed to maintain its bearish momentum despite a daily candle close below the outer trendline. Earmarks of a false breakout as the precious metal found support at the 100-day before rallying over the last two days to rise around 2.7% thus far.

The previous breakout of the inner trendline was followed by a retest before a continuation to the downside. This time, however, the geopolitical landscape has helped the precious metal push toward a key resistance area around the 2650 handle.

The move higher this week mirrors the selloff over the past week or two, the question is will it be able to match the selloff in terms of the size of the move. If Goldman Sachs is right, this could potentially be the beginning of the next upside leg leading to new ATHs.

Immediate resistance rests at 2639 and 2650 before the longer-term zone around 2673 comes into focus.

On the support side, we have potential support resting at 2624 and 2600 before last week’s lows come into focus.

GOLD (XAU/USD) Daily Chart, November 19, 2024

Source: TradingView

Support

- 2624

- 2600

- 2574.5

Resistance

- 2639

- 2650

- 2673

Most Read: Will the Fed-ECB Policy Gap Sink the Euro? EUR/USD Analysis