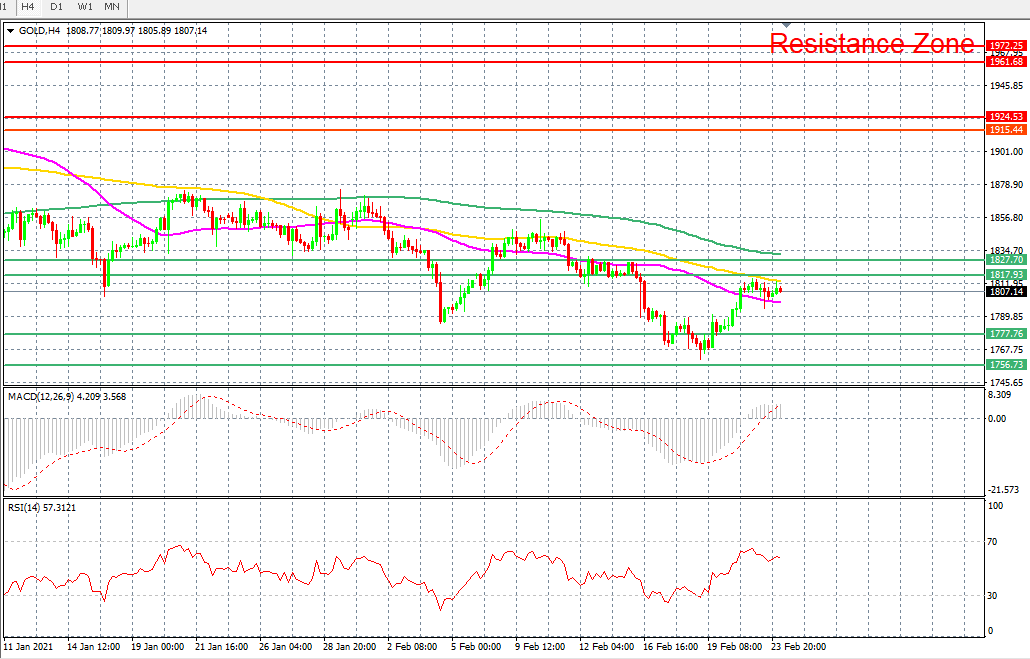

Gold prices are trading at a very critical junction. On the 4-hour time frame, an intra-day time frame, the price is trading between the 50 and 100-day simple moving average. Basically, the fact that the price has crossed above the 50-day SMA is a positive sign as it shows that the bulls have started to take back some control of the price.

But the gold price still has some challenges to overcome and one of the most imminent is the 100-day simple. The gold price is currently trading below this moving average. If gold price breaks above the 100-day SMA, it is likely to send a very strong signal that bulls are back on the driving seat and another bull rally is about to take off.

The fact the gold price is trading above the 1,800 is a positive sign anyway and as long as the price continue to trade above this price level, we are likely to see some more gains.

As for the RSI, it is approaching fast near the overbought zone and this means that the gold price is over bought. Hence traders may want to adopt some cautious approach.