I get a bearish signal, you get a bearish signal, bearish signals for everyone! Yes – we just saw another one.

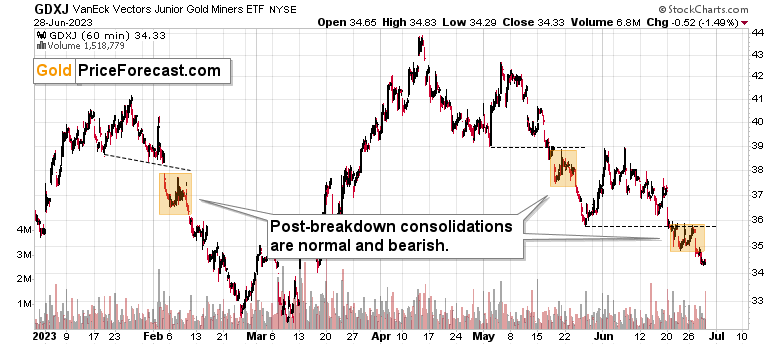

Yesterday was quite a pleasant day, wouldn’t you say? Our profits in the VanEck Junior Gold Miners ETF (NYSE:GDXJ) (short position in it) increased once again, and we just got a confirmation that it’s not the end.

Before moving to the above-mentioned extra confirmations, let’s recall what I wrote yesterday about the GDXJ and about the US Dollar Index Futures:

The back-and-forth trading that we saw recently was followed by the same kind of action that followed the previous ones – a decline. And since the history definitely appears to be rhyming, the next verse is also likely to be similar. This means another move lower in the short term.

[And that’s what we saw yesterday.]

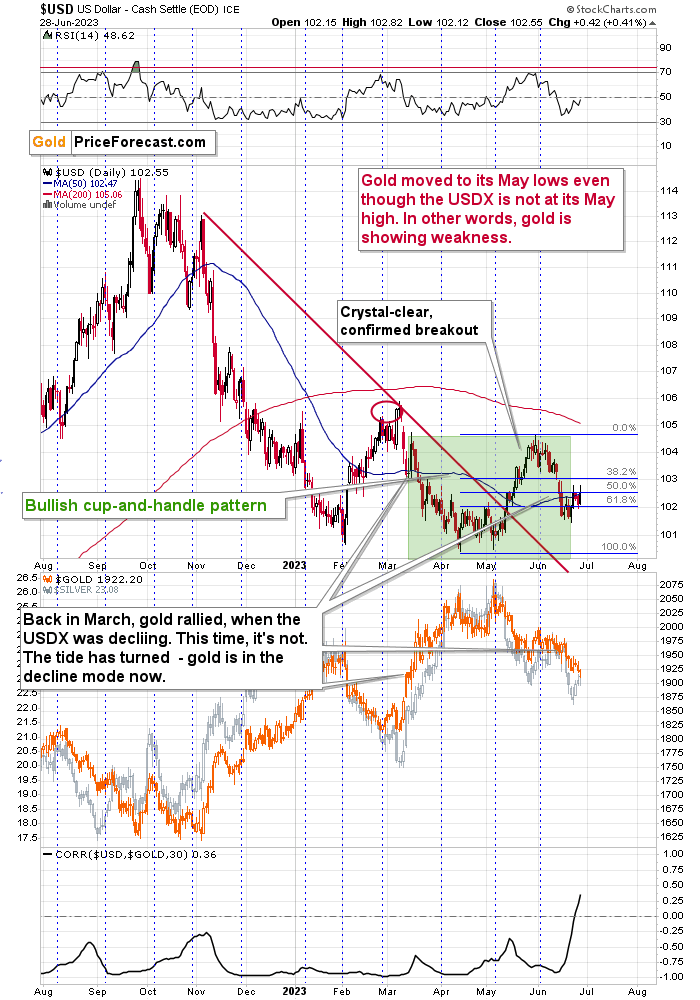

Now, the importance of verifications extends to other markets as well, including the USD Index.

In mid-May, the U.S. dollar broke above its declining resistance line, and it’s been consolidating since that time. The breakout was not invalidated and it’s now more than confirmed as the USDX remained above this line for over a month.

You just saw what happened after a verification of a breakdown in the GDXJ – it moved lower once again.

Based on the same principle, the USD Index is likely to move higher in the following weeks, thus contributing to lower precious metals prices.

The very interesting thing about the USD Index right now is that we see the same kind of pattern in the near term.

The above chart is based on 4-hour candlesticks, and it zooms into the June decline as well as the most recent rally, along with its correction.

Just like it was the case with the medium-term moves, we saw a double-bottom with the very recent performance o the USDX. In the past, it was the February and April/May bottoms that created the bottoms and this time its this month’s bottoms.

Based on today’s pre-market rally, it seems that the corrective downswing might already be over.

If this is the case and we do indeed see a rally shortly, it’s very likely that we’re about to see the start of another medium-term rally soon. And more precisely, its continuation, as it seems to have started last week.

[Again, that’s what happened – the USDX moved higher.]

It looks like the PMs are about to get another push lower, and the market itself seems to “feel USD Index’s chilling breath on its neck”.

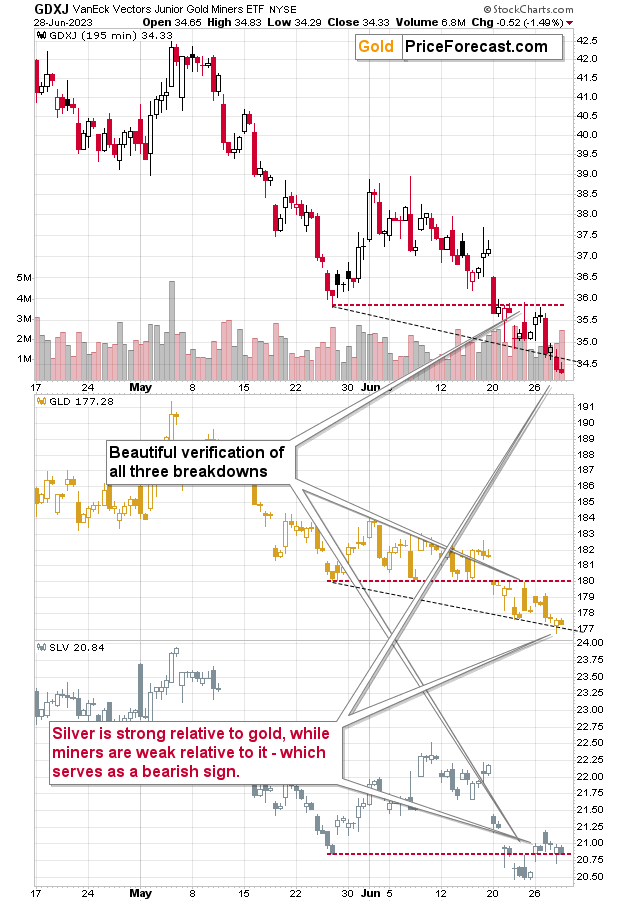

It’s clear in the way juniors and silver price performed yesterday.

GLD (NYSE:GLD) declines steadily, SLV is showing strength, and the GDXJ is declining at an accelerated pace.

Silver’s weakness relative to gold is a bearish sign as well. Is silver really strong relative to gold? It is – it’s close to its May lows while gold is below them.

Miners’ weakness relative to gold is a bearish sign. Are they really weak? Yes, the declining, black, dashed line helps to see it. GLD is slightly above it, while GDXJ is below it.

So, what’s next? Another move lower and a turnaround seem the most likely outcome.

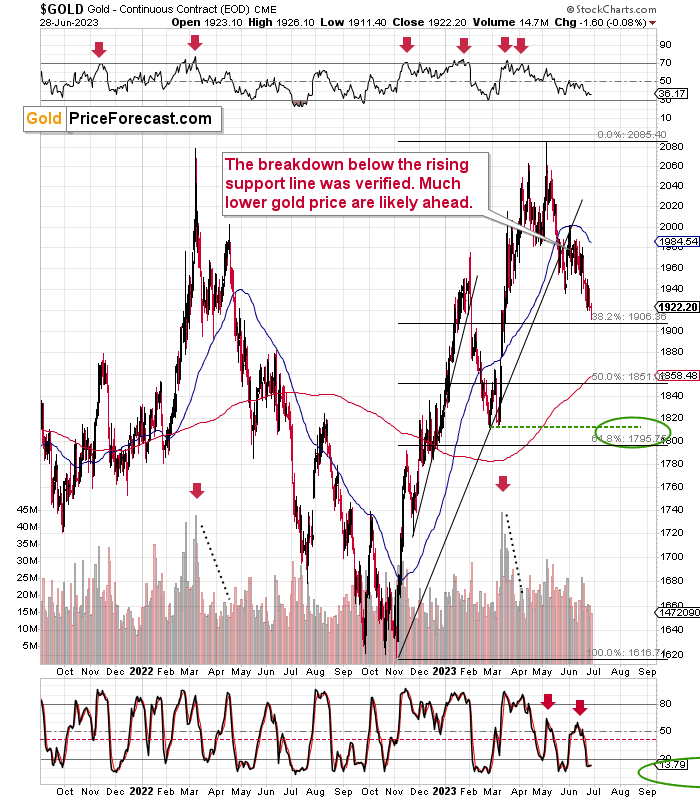

- But PR, gold just reversed close to the 38.2% Fibonacci retracement level – wasn’t that a reversal?”

Those two factors are indeed bullish. However:

- I wrote about other bearish factors earlier today and in the previous days, which still overweight the importance of the above.

- The supposed “reversal” took place on low volume in gold futures, and huge volume should confirm reversals if they are to be viewed as such.

- The 38.2% Fibonacci resistance is usually important, but this time gold is just after a quite long consolidation, and it declined just a little below it. The decline is so far not even nearly as big as the decline that preceded the consolidation.

Just like I stated in the title – the bullish reversal in gold is coming – it’s most likely not here just yet, though.

So, while it’s not clear when it’s going to take place (this could take place above the target that’s visible on the chart), it seems that yesterday’s price action wasn’t it. Fortunately, the situation is clearer in the case of the mining stocks, and it looks like we might see a short-term buying opportunity very soon – similar to the ones that we took advantage of in May and in July last year. Naturally, I will keep my Gold Trading Alert subscribers informed about this great opportunity.