Keeping up with the subject of irrationality, it’s not just key stock indices working in reverse to the fundamentals; I believe gold bullion prices are facing the same issue. They are moving in the wrong direction in spite of fundamentals suggesting otherwise.

India, the biggest gold bullion-consuming country, is experiencing robust gold demand in spite of the government and central bank working together to curb it. According to traders in India, gold bullion premiums have reached a record high of $100.00 an ounce—about eight percent above London prices. Why? There’s a shortage in the supply of gold bullion to meet the demand in India. (Source: Reuters, October 15, 2013.) As per the World Gold Council’s estimates, the demand for gold bullion in India will be about 1,000 tonnes for the year.

Consumer demand for gold bullion elsewhere is significantly higher as well. And one of the gold bullion buyers I follow closely, central banks, are active, too.

According to the International Monetary Fund, in August, Russia, Turkey, and six other central banks across the global economy increased their gold bullion reserves. The Russian central bank purchased the greatest amount since December of 2012, bringing its gold bullion reserves to 1,015.52 tonnes. Turkey’s central bank bought 23.34 tonnes of the precious metal, and its total gold bullion holdings stood at 487.35 tonnes in August. (Source: Reuters, September 25, 2013.)

Looking at all this, I am more bullish than ever on gold bullion, because I’m focused on the long-term prospects of the precious metal.

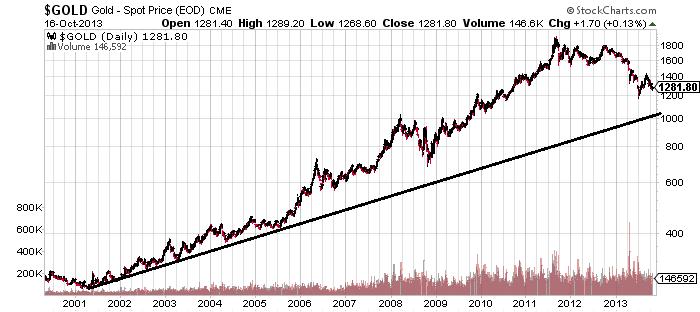

In spite of the weakness in gold bullion prices we witnessed in early summer this year, the long-term trend in gold bullion prices is still intact. You can see it for yourself in the chart below.

I believe opportunities in the form of depressed prices for well-managed senior and junior mining companies are knocking on the doors of investors. No one likes them right now because they have shed a significant amount of value. There’s blood on the streets for gold, it seems, and that’s why the contrarian investor in me likes gold-related investments so much.

What He Said:

“What group of stocks are next to fall in light of the softening U.S. housing market? The stocks of companies that sell retail products to the American consumer, I believe, are next on the hit list. Many retail stocks are already reporting soft sales. In my opinion, they haven’t seen anything yet in respect to weaker sales.” Michael Lombardi in Profit Confidential, August 30, 2006. According to the Dow Jones Retail Index, retail stocks fell 42% from the fall of 2006 through March 2009.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Bullion: Victim Of Market Irrationality?

Published 10/18/2013, 02:12 PM

Updated 07/09/2023, 06:31 AM

Gold Bullion: Victim Of Market Irrationality?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.