A couple of weeks ago we highlighted Gold’s potential to re-test the October highs and, given the turn in investor sentiment and favourable seasonality, we still think it will eventually break higher.

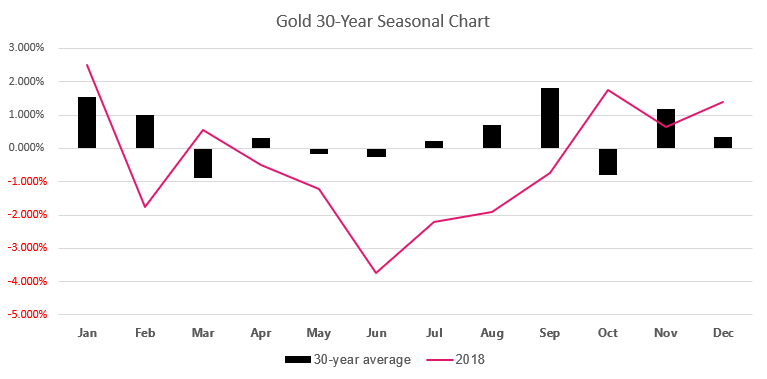

Over its 30-year monthly average, gold has appreciated eight months in a year, four of which have occurred between November through to February. We note that this seasonal tendency started a little earlier this year in October, and this month is currently outperforming its long-term average for December. Of course, there is nothing to say gold must follow its seasonal tendency, but it’s encouraging to see none the less.

We can see on the daily chart that prices have paused for breath beneath the October high. Yesterday’s inside day shows compression is underway, which can often be a prelude to higher volatility. As the ascending channel remains intact and a bullish piercing pattern at 1211.28 shows the daily structure is building in strength, an upside break remains the bias.

However, due to the 200-day average sitting right near October’s high we should be open to the potential for a retracement before breaking higher. A break beneath the 1230.13 high signals a deeper correction and places gold on the backburner, although technically the trend remains bullish whilst above 1211.28.

Hopefully prices will continue to compress above 1230.13 support, in which case look for a clear break of 1243.49 resistance / 200ma before seeking bullish setups above this key area.