Gold has broken out from a two-month-long consolidation (from $1680 to $1770), but the other precious metals markets have not confirmed Gold’s strength.

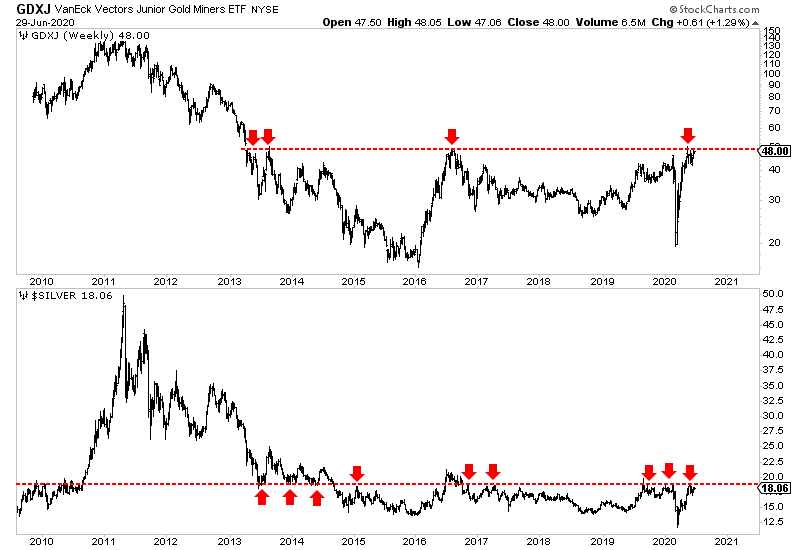

The gold stocks (NYSE:GDX), (NYSE:GDXJ) remain below their May highs while Silver remains below significant, multi-year resistance around $18.75. Silver closed Monday at $18.06.

Furthermore, Gold, when priced against foreign currencies, has not broken out. This move has been driven mostly by dollar weakness.

It is possible other markets could follow Gold higher, but there is work to be done.

Moreover, the breakouts in GDXJ and Silver would be far more significant for the sector.

GDXJ is close to a fresh 7-year high while Silver is close to a new 4-year high.

In addition to the above, we should note Gold’s resistance at $1800, where Gold tried and failed three times (in late 2011 and 2012) to reclaim $1900. Gold closed Monday at $1781.

Upon reviewing Gold, Silver, and GDXJ, we can see that no real sector breakout has occurred yet.

The trend is higher throughout the sector, and the fundamentals are strong, but we should temper our immediate expectations for the entire sector.

That does not mean sell or hedge. It just means adjusting expectations until the market gives us a signal either way.

The senior producers are currently lagging, but the juniors (GDXJ) and explorers (NYSE:GOEX) are performing best. I expect that to continue during and following the next breakout, whenever it comes.

Regardless of where things move, this remains an excellent time to get into quality juniors with the most upside potential. Once the sector breaks higher, many stocks will no longer be cheap.