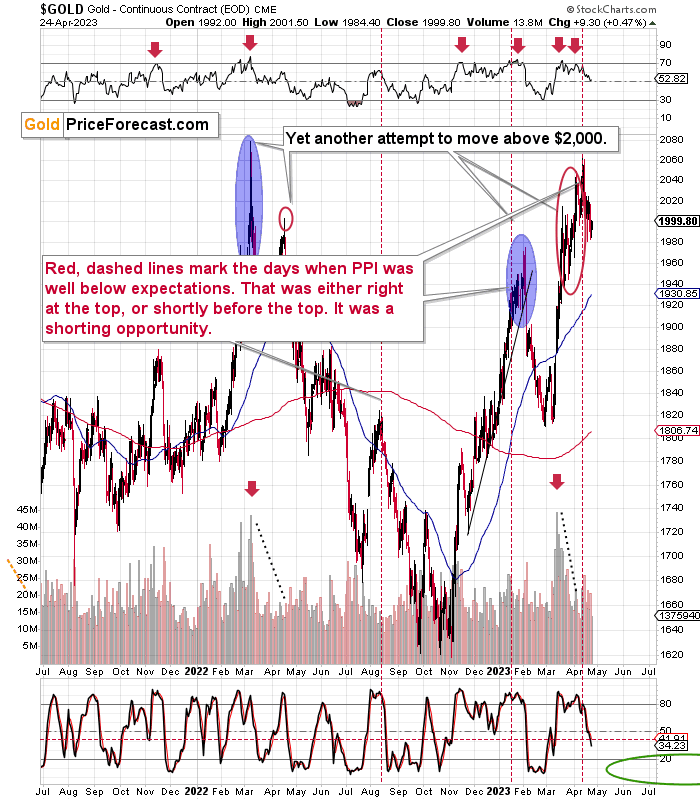

The price of gold moved higher yesterday, but did it manage to rally back above $2,000?

No! Despite US Dollar Index’s weakness, it didn’t.

And this means that the odds for a bigger rally from here declined while the odds for a bigger decline increased.

Moreover, the volume on which gold moved higher yesterday was small, suggesting that the move higher was a countertrend one.

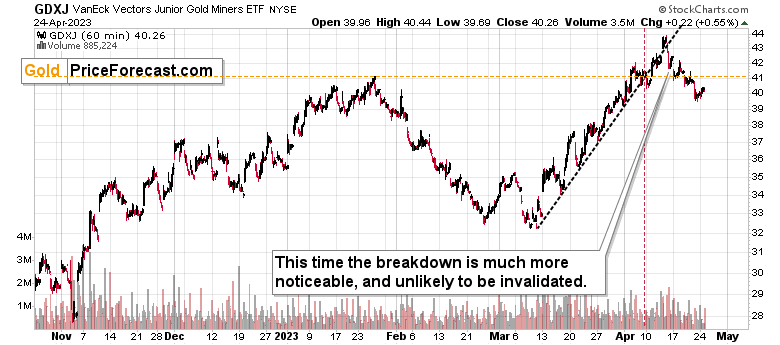

The rally in the junior mining stocks was negligible as well.

The VanEck Junior Gold Miners ETF (NYSE:GDXJ) ETF price moved slightly higher but didn’t move to, let alone above its previous 2023 high.

This means that moving back below that high was not accidental, and the GDXJ wants to move lower.

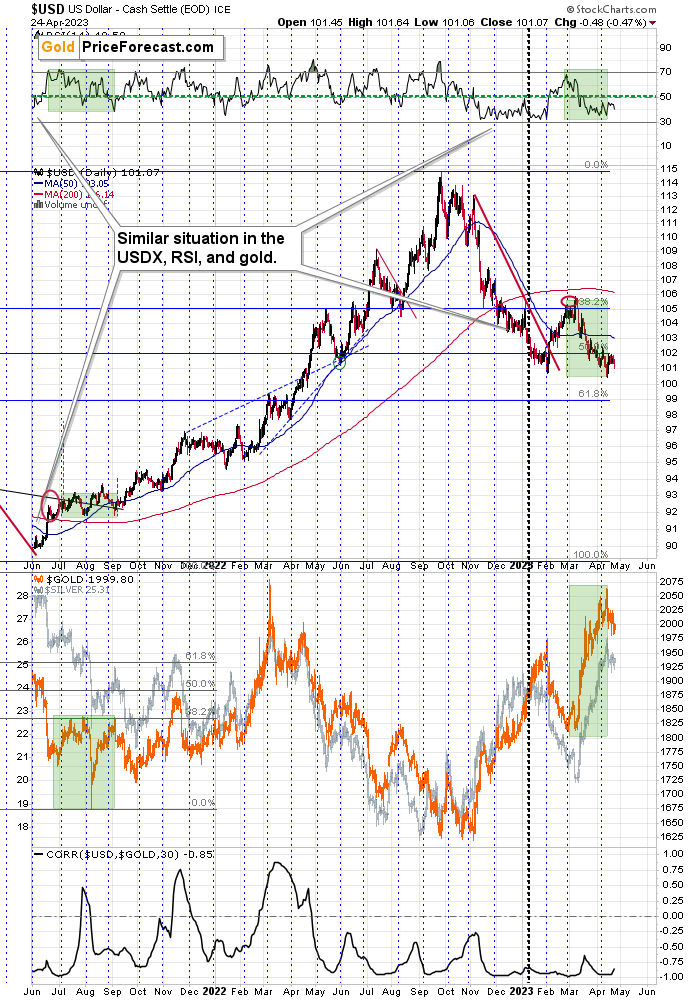

As always – context is very important. And at this time, it’s provided by the USD Index.

The U.S. currency declined in a way that wasn’t particularly significant from the long-term point of view, but the near-0.5 move was quite notable on an intraday basis. It was big enough to trigger bigger declines in gold and mining stocks.

But it didn’t – and that’s the key thing here.

The precious metals sector could have used USDX’s decline as an excuse to move higher in a visible manner and move back above the $2,000 (gold) and previous 2023 high (GDXJ) price levels. The fact that this didn’t happen shows that the precious metals are already in a downtrend.

All in all, the points that I made yesterday remain up-to-date. If you haven’t had the chance to read my yesterday’s analysis, I suggest reading it today.

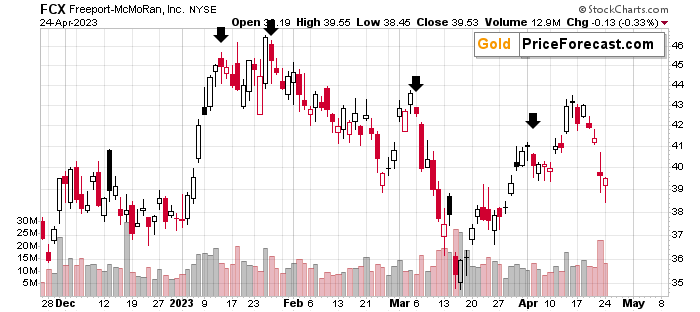

In other news, the FCX share price declined a bit yesterday.

This means that our profits in this position increased a bit. Given the situation in the precious metals market, it seems that the GDXJ will join in in this profitability in the not-too-distant future. Both positions will become very profitable in the following weeks.