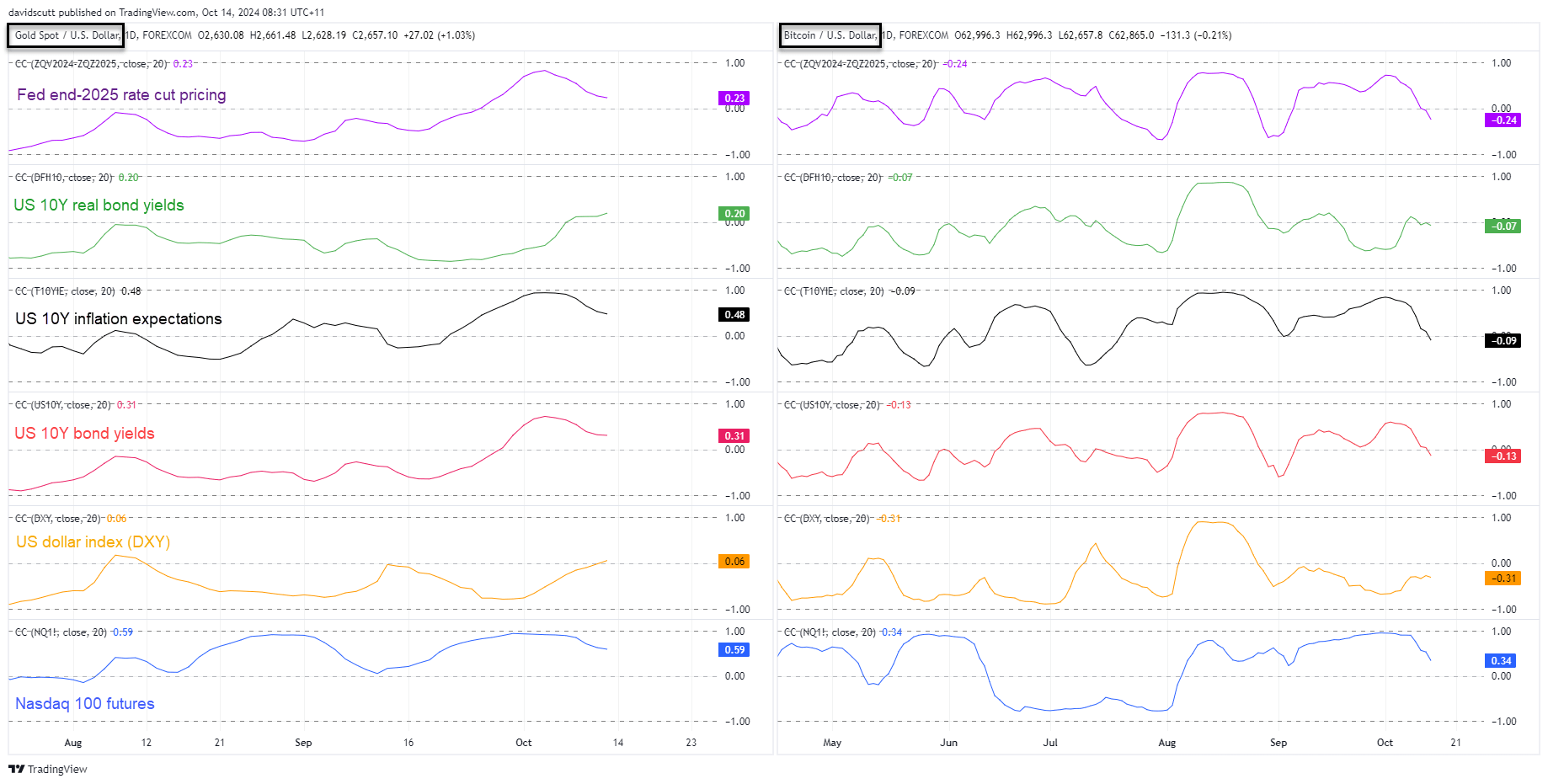

- Gold and bitcoin have not been overly correlated with any market over the past month

- Given the quiet data calendar this week, price signals may be more useful when assessing potential trade setups

- Both assets have broken key downtrend resistances, signaling potential bullish momentum in the near term

Overview

Gold and Bitcoin are not particularly correlated with any market right now, suggesting increased emphasis should be put on price signals when assessing trade setups in the week ahead. Having broken minor downtrends on Friday with gusto, the bias for both is higher near term.

Gold, Bitcoin Not Influenced by Macro Environment

The correlation analysis below tracking the rolling 20-day relationship with a variety of market variables shows both gold (LHS) and bitcoin (RHS) have been doing their own thing recently, showing little to no relationship with the US dollar, real or nominal US bond yields, US inflation expectations or other long duration assets like tech stocks.

The lack of any meaningful correlation suggests that rather than trying to assess setups using macro events, the price action in these markets may be more useful for traders to consider.

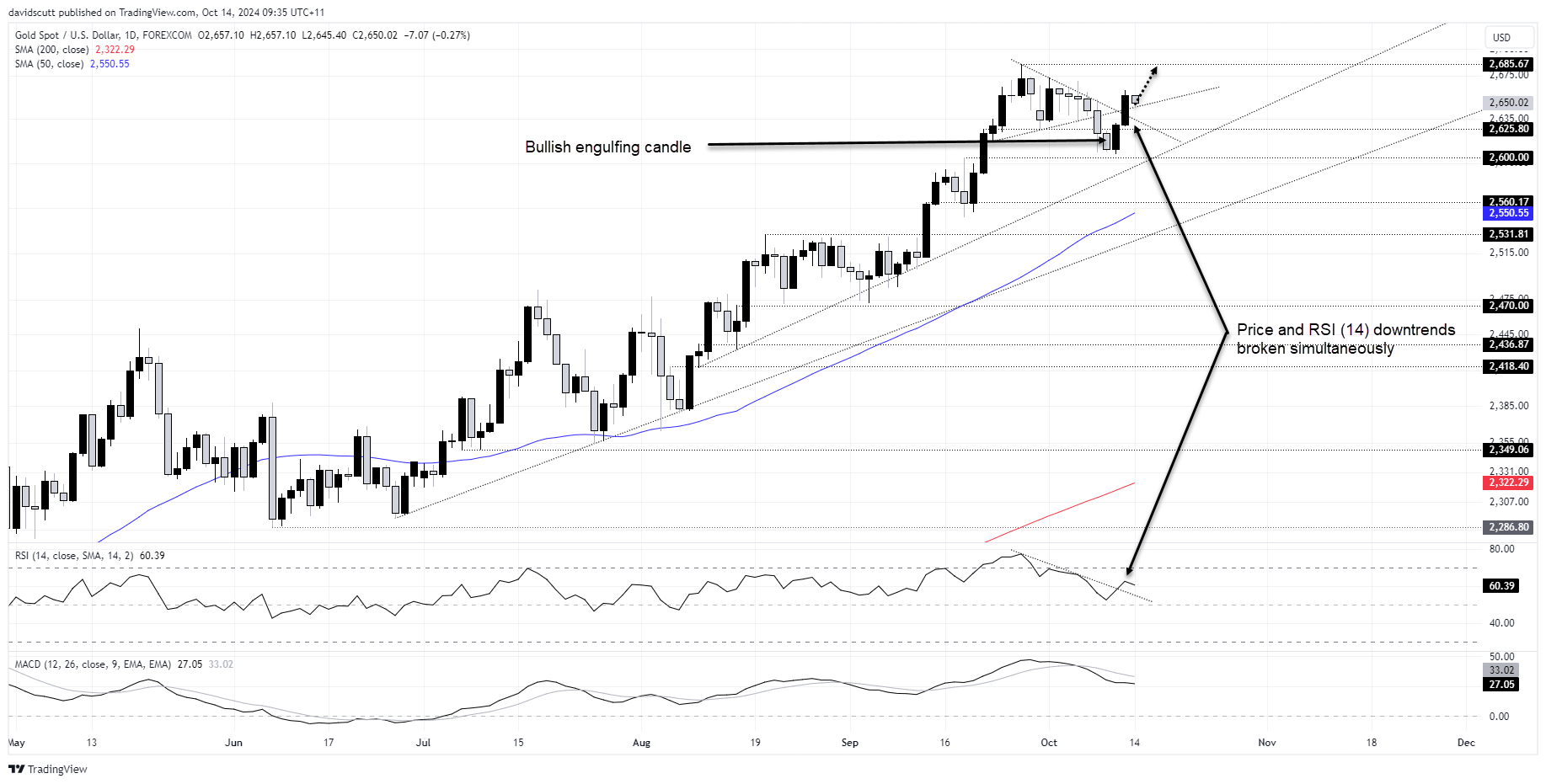

Gold Breaks Downtrend, Bearish Momentum May Be Turning

The key reversal candle that I wrote about late last week proved to be a reliable signal for the price action on Friday, seeing gold break downtrend resistance dating back to the record high of late September.

With RSI (14) also breaking its downtrend, it looks like the mildly bearish picture of the past month is turning brighter for bulls, putting a retest of the record highs on the radar for traders. MACD is yet to confirm the signal, although it’s showing signs of bottoming.

We’ve seen a minor pullback in early Asia trade on Monday, seeing the price retest the minor uptrend from mid-September that provided support until broken early last week.

If the price holds above this level, consider buying above with a tight stop below for protection targeting a push towards the record high of $2685.7. If it were to be taken out, traders may look for a push towards $2700.

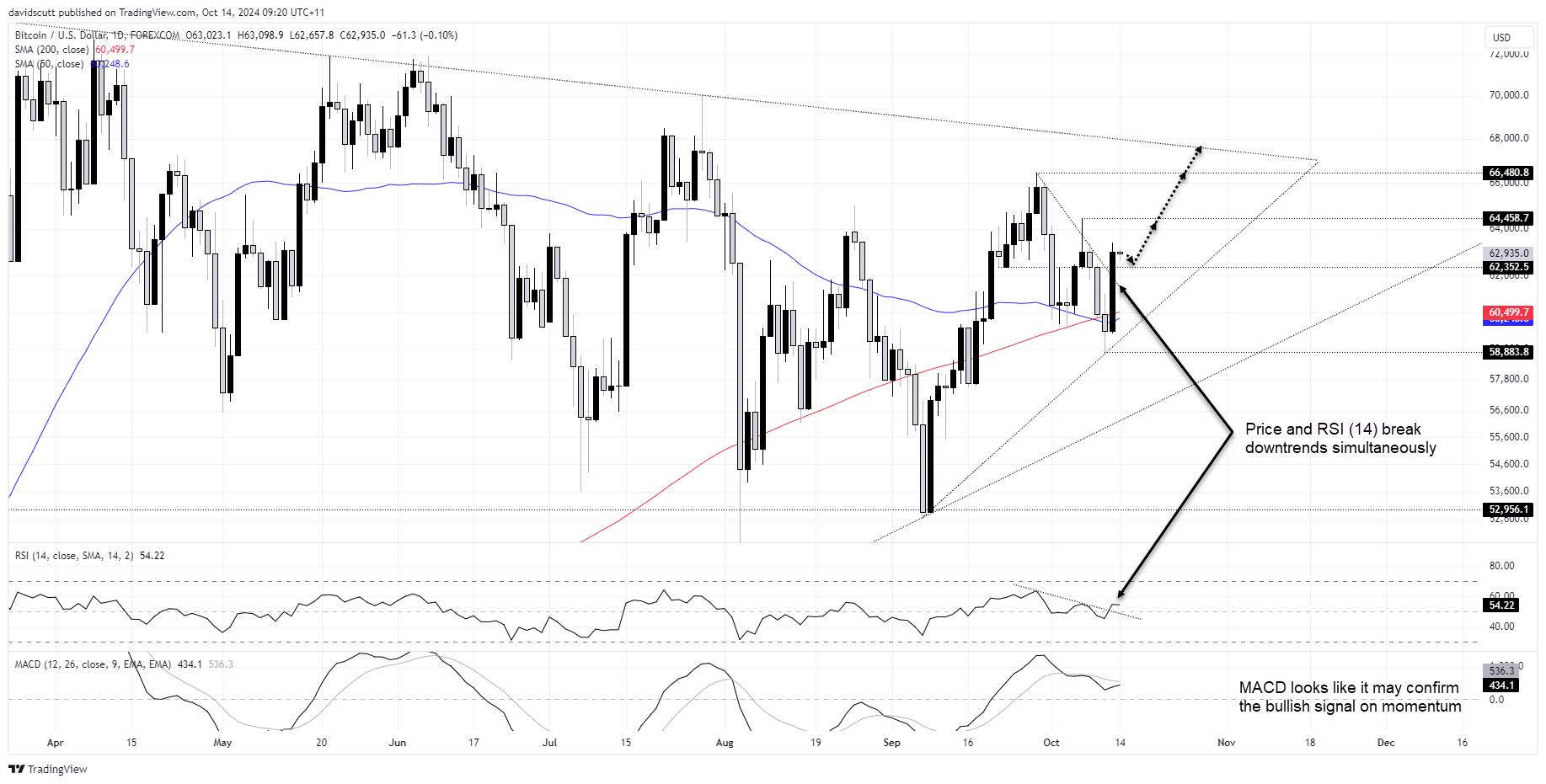

Bitcoin Dip-Buying Preferred Near-Term

Bitcoin had a strong end to last week, bouncing from the 50 and 200-day moving averages after falling below them Thursday, completing a morning star pattern in the process.

The push higher saw the price break downtrend resistance dating back to late September, pushing above $62352.50 which acted as both support and resistance during periods over the past month.

Like price, RSI (14) also broke its downtrend, signaling a potential turn in bearish momentum. As yet, MACD has not confirmed the bullish signal, but it’s getting close.

Given the price action and momentum signals, buying dips is favored in the near term.

Those considering longs could buy around these levels or wait for a potential pullback towards $62352.50, allowing for a stop to be placed below the level for protection. Topside targets include $64458.70, $66480.80 and major downtrend resistance currently located around $68000.