Gold markets have taken a large dive over the recent week, as the currency war has heated up with Bank of Japans recent move, which in turn has led to large gains for the US dollar. This trend looks likely to continue and this week could see us touch in the low 1150-1100 range quite easily. Below are a few catalysts which I believe will cause the move lower as well as a quick recap of the things that are improving in the U.S.

The global growth slowdown is not going to make the Fed anymore dovish than it already is, especially since U.S growth continues to be strong and sustained, even after Quantitve Easing has finished up.

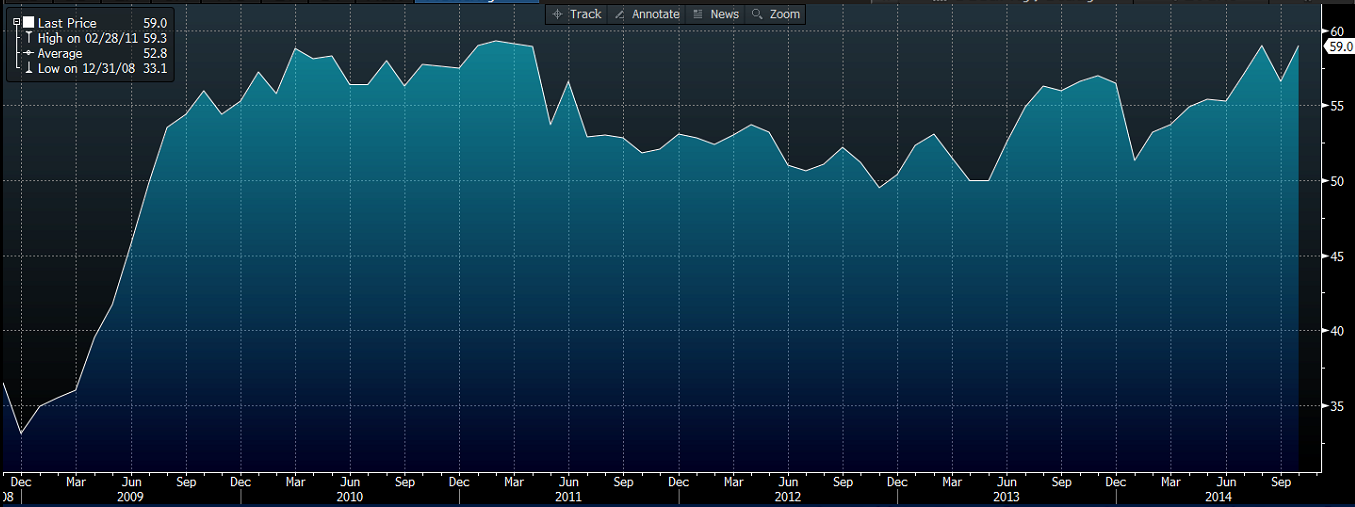

A recent look at the US ISM Manufacturing Index (chart below) points to strong growth in this sector after a period of weakness during the start of the year, when last winter caused havoc as it put the US into a deep freeze

Source: Bloomberg (US ISM Manufacturing Index)

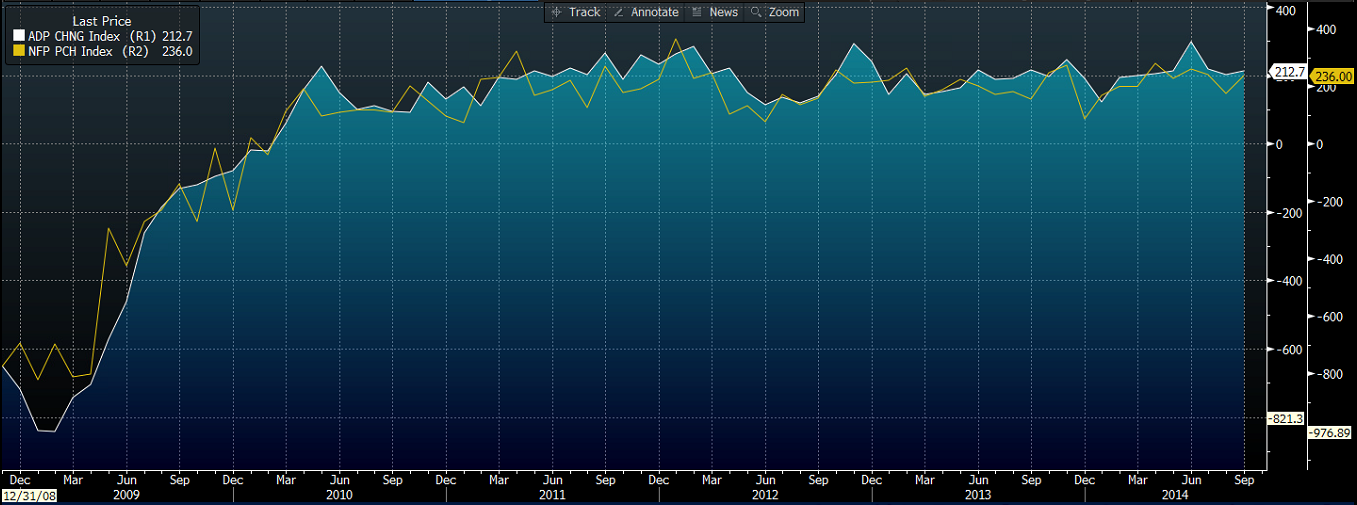

As for the current week, we generally see big moves when it's non-farm payroll week. The ADP figures are generally released the day before and follow non-farm payroll figures quite closely. This week it’s expected that we will see roughly 220k jobs, thus just below what we have been seeing in the past. I believe this is conservative given the rise in the USD and how low unemployment claims have been recently.

Source: Bloomberg (ADP vs Non-farm Payroll)

There is certainly room for a lift higher, and if the past is anything to go by, expect the ADP figures to be a relatively close to the upcoming non-farm payroll release.

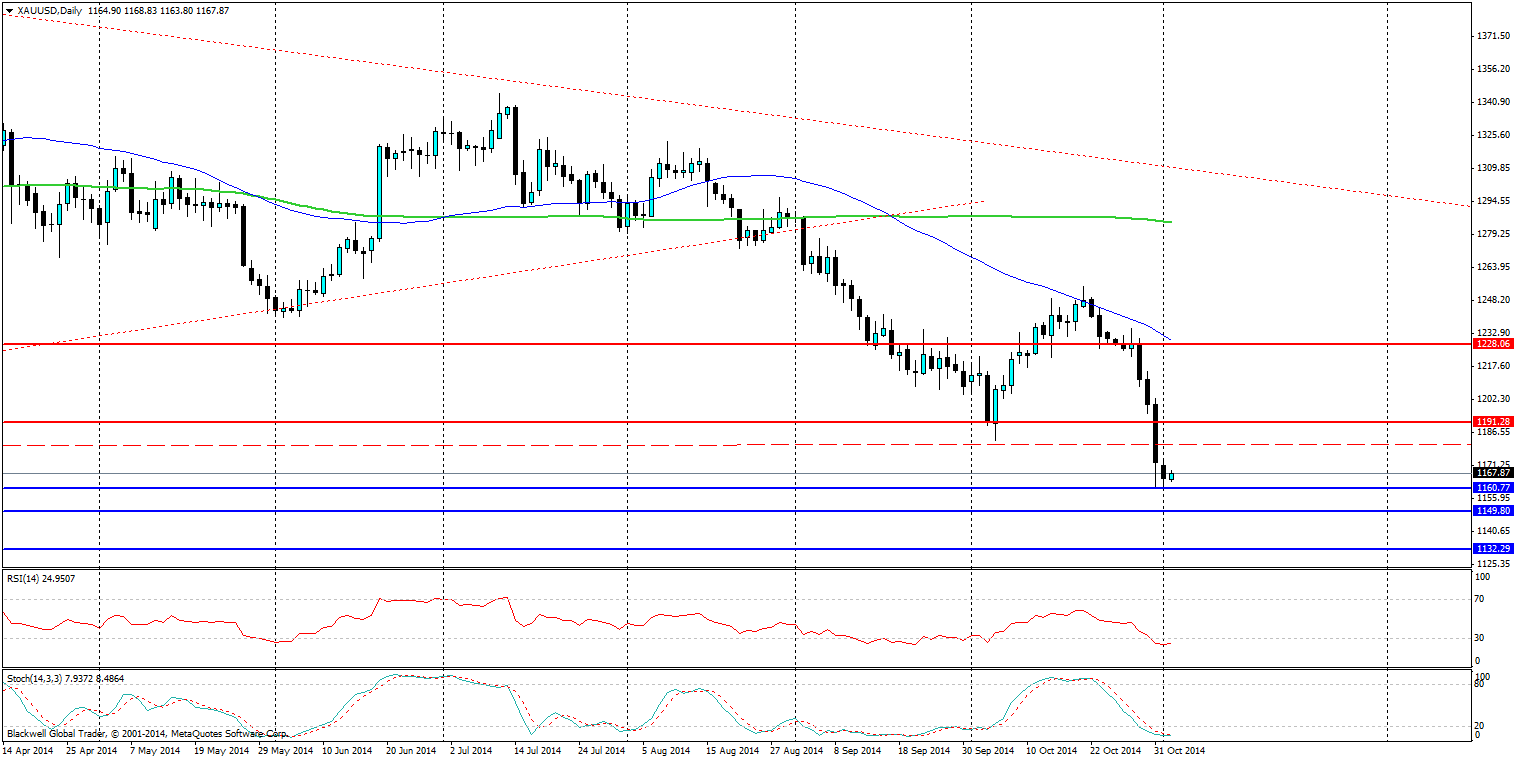

Source: Blackwell Trader

On the charts, gold is showing the scars of that USD strength. But what is key is that the 1180 floor, which has been in play for some time, has now failed and the market looks hungry to take further swipes out of the price of gold.

At the moment, there are no further events likely to prop up the price, bar the odd minor pullback. We could certainly see long term trending of gold prices down to record lows and even back to $1000 a troy ounce.

When targeting key support levels I would aim for 1160, 1149 and 1132; with 1132 acting as hard support in the market. But even that might not be able to stand up to a solid non-farm payroll release. Overall, there is room for further drops lower and traders should remain bearish in the short term, especially with the recent strong US data results.