- Gold delivers topping signal on daily timeframe

- US 10-year yields push higher, pressuring non-yielding assets

- Ebbing geopolitical tensions add to near-term headwinds

Summary

Given renewed speculation about a potential peace deal in Ukraine, the price action in US Treasuries heading into the key January consumer price inflation report, and signs of exuberant retail participation in Chinese gold markets, the bullish backdrop for bullion took a hit on Tuesday. Throw in some unconvincing moves seen during the session and there appears to be a growing risk of a near-term market pullback.

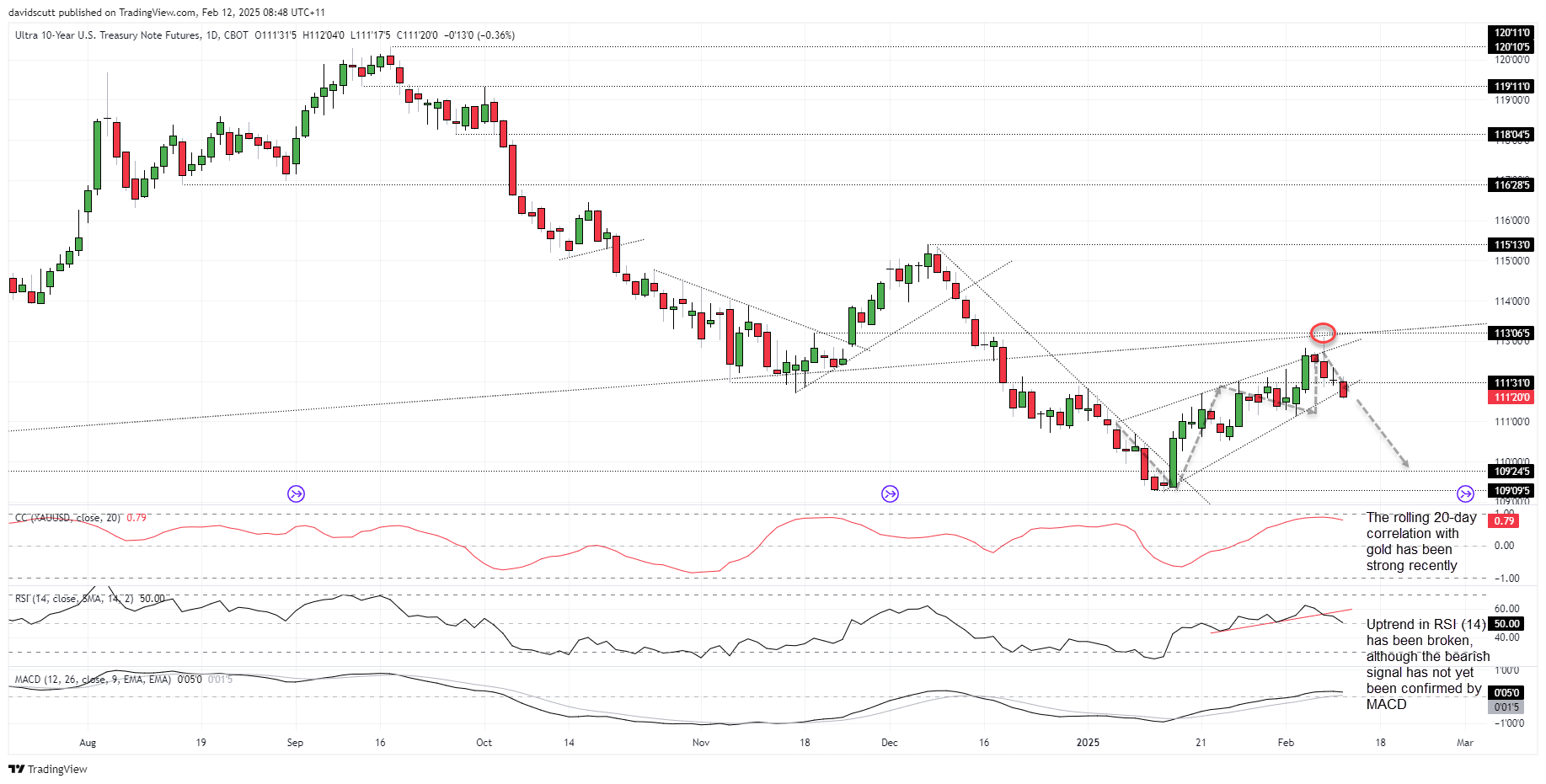

Technical Picture Turning Bearish for Bond Bulls

If you’re dabbling in interest rate-sensitive asset classes, one market you should keep on the radar is US 10-year Treasury note futures. As a liquid contract that provides potential price signals for benchmark 10-year yields, it can be used as an additional screen when assessing trade setups.

Source: TradingView

Having looked so good for the bond bulls last week following a topside break, the price action since has been less convincing with the rally stalling at the intersection of uptrend and horizontal resistance before reversing lower, unwinding the entire bullish move.

Sitting in what resembles a rising wedge, the price is threatening to break out on the downside, as convention would suggest. That implies higher US benchmark 10-year yields, an important consideration for interest-rate sensitive asset classes like gold.

The heaviness likely reflects persistent concerns about the impact of a trade war on the US inflation outlook. Even before it truly starts, the case for Federal Reserve rate cuts appears weak, with unemployment at 4.0% and underlying inflation measures above the Fed's 2% mandate. Even if the core CPI reading prints at 0.3% in January on Wednesday, that would annualize near double the target.

Beyond higher US interest rates, reports overnight that Ukraine is willing to cede territory to Russia to facilitate a peace deal is another marginal headwind for gold price, not only helping to reduce risk aversion but also potential sanctions that have been placed on Russia. A long way to go—for sure—but that’s a stronger possibility today than yesterday.

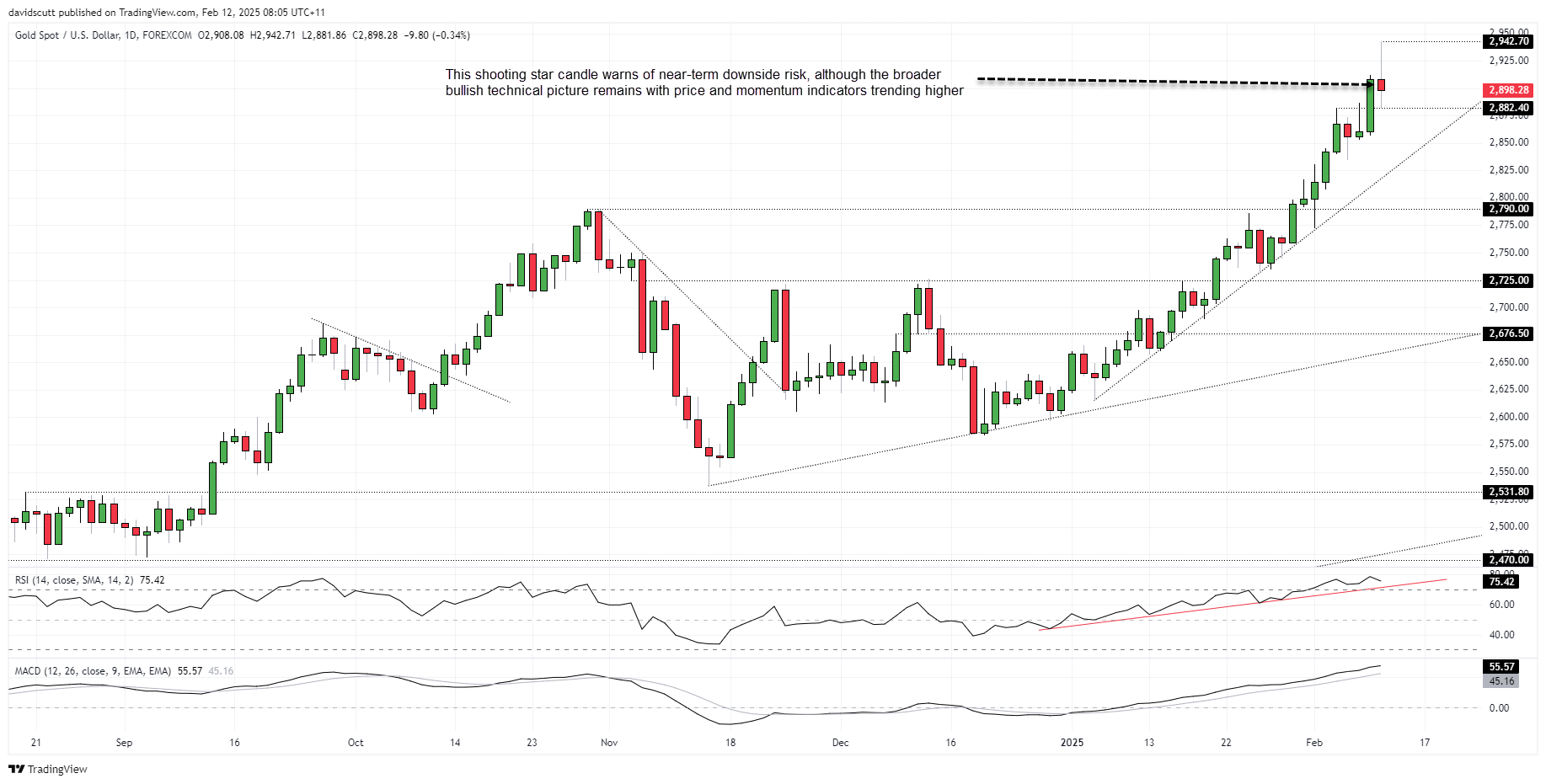

Gold Technical Outlook

Perhaps unsurprisingly, the price action in gold on Tuesday was not convincing for the bulls, with an initial surge to record highs reversing sharply in Asia, delivering a shooting star candle on the daily timeframe.

Source: TradingView

While the broader bullish technical picture remains—price, RSI (14) and MACD continue to trend higher—there is growing evidence of a significant pickup in gold trading activity among retail investors, especially in China. While not enough to warrant turning bearish, along with the topping signal delivered on Tuesday, it adds to the case for near-term caution.

Minor support is located at $2882.40. Beyond, strong uptrend support is found around $2825. On the topside, resistance may be encountered around $2942.70.