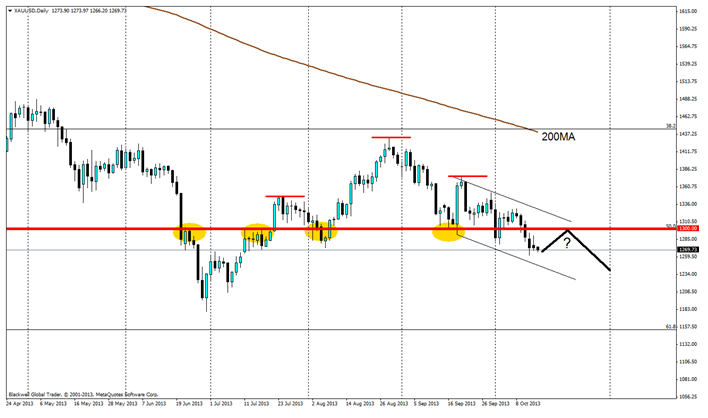

For those of you who read my article on how I am approaching the precious metal in October, let’s take a step back and re-evaluate the situation since it is mid-month. We now have 10 more daily candles to give us further clues as to what is happening from a technical standpoint. We would have 3 main observations from the Daily charts:

1. Price is still below the 200-day Moving Average.

2. Price has broken past the $1,300 zone an important area of confluence for 3 reasons:

a. Neck-line of the D1 head and shoulders pattern

b. 50 fib level of the Oct '08 swing low and Sep '11 swing high

c. There has been price action in this zone of support/resistance

3. There is on official mid-term downtrend as 2 consecutive lower lows and lower highs have been form as depicted by the bearish channel

We might be able to identify good bearish entries on an intra-day time frame off price reactions to the $1,300 zone. I for one will be looking for a pullback and reversals of those pullbacks for possible re-entries short.

I am aware many gold bulls are calling bottoms right now but I am not really concerned with that at the moment as there is still room to the downside seeing that on the weekly chart the previous swing low in June this year is around the $1,200 zone.

As trend traders, we are not clairvoyant; I cannot tell you with absolute certainty that price will head down. What I have done is to merely describe that price is trending downwards now and that we would like to find places to join the bear as it is walking through the markets.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Bear Walking Through Markets

Published 10/15/2013, 06:22 AM

Updated 05/14/2017, 06:45 AM

Gold Bear Walking Through Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.