The gold markets are at a point where two strong trend lines are about to intersect. The outcome of the face-off will determine the direction of gold markets for the next few months.

All the talk from the central banks recently has added a little volatility to the gold markets, especially with the FED remaining committed to an interest rate rise by the middle of this year. A reduction in the global risk landscape, i.e. Greece and Ukraine, has sent plenty of investors away from the safety of the shiny yellow metal.

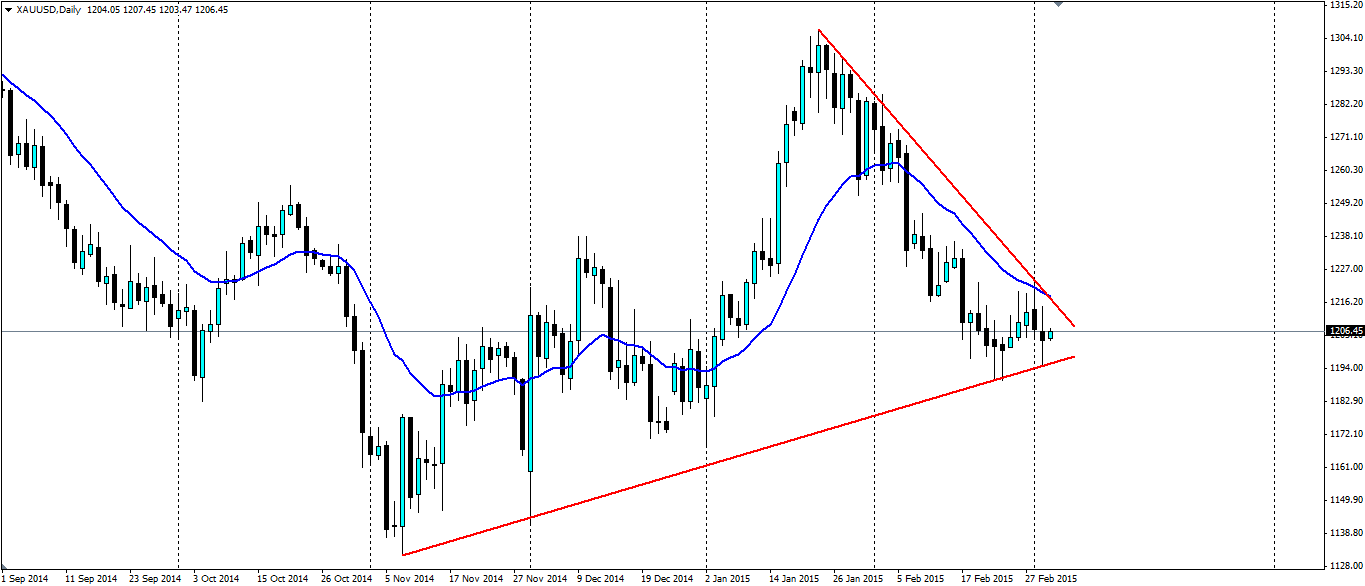

The technicals show a month old bearish trend line that gold has followed down from the highs at $1300 an ounce to the current level just above $1200. So far it is looking robust having been tested several times. The only problem is that it is about to smash head first into an older bullish trend line. This has taken gold up from the low at $1130 with a series of higher lows.

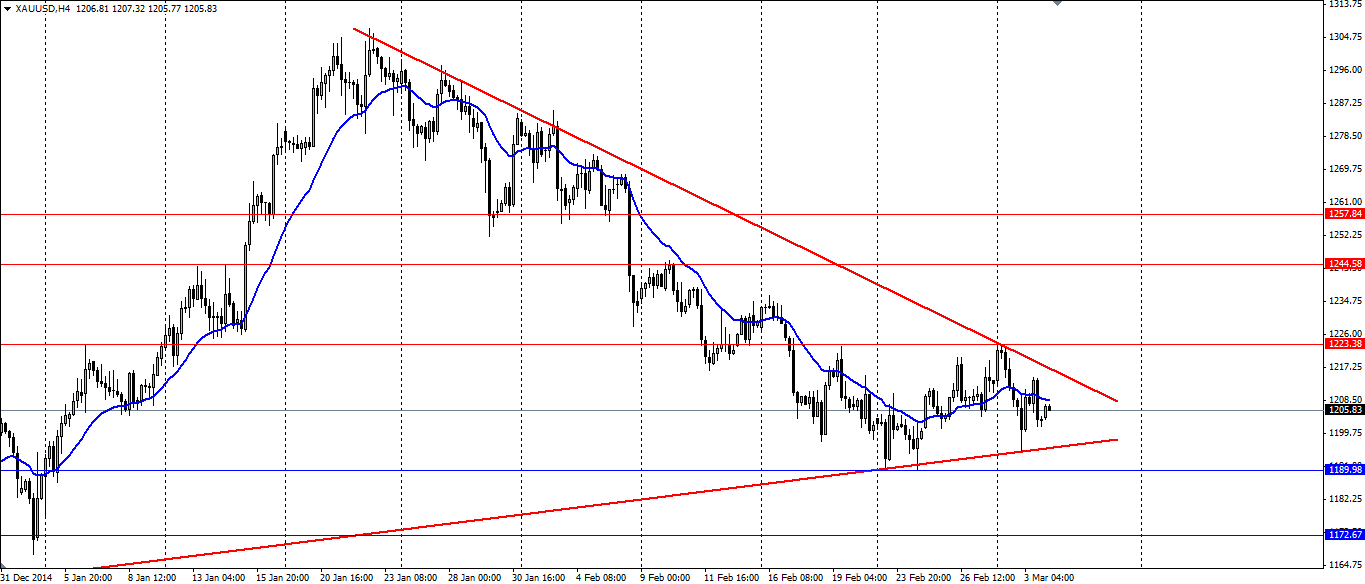

The Squeeze is one that will interest gold traders because it is likely to result in quite a large breakout given the size of the overall structure. Logic would suggest the older, flatter bullish trend line would hold firm and result in a bullish breakout. However, the overall trend is bearish so we could see a continuation of that trend. Certainly the fundamentals point to a lower gold price in the future, thanks to an expectation of rising US interest rates.

Either way, traders can take advantage of a breakout by setting either a stop buy above the shape or a stop sell below, this will take advantage of the momentum of the breakout. Resistance will be found at 1223.38, 1244.58 and 1257.84 and a downside breakout will look for support at 1189.98, 1172.67 and 1146.93.