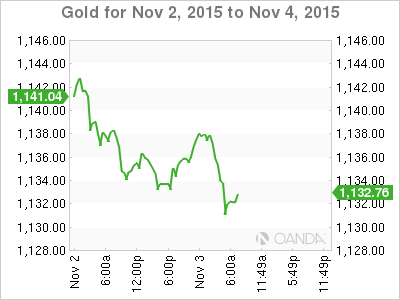

Gold is steady on Tuesday, as the metal trades at a spot of $1131 per ounce in the European session. Gold prices have now dropped for four consecutive days. It could shape up to be an uneventful day, as there are no major US events on the schedule. Later on Tuesday, the US releases Factory Orders, with the markets expecting a decline of 0.8%. Traders should keep a close eye on several US key events on Wednesday, led by Nonfarm Payrolls. As well, Janet Yellen will testify before the House Financial Services Committee in Washington.

Gold has not fared well in the past four weeks, with the precious metal losing over 4 percent in that period. Echoing the movement of the euro, gold was hammered by the ECB and the Federal Reserve in late October, sustaining sharp losses as a result of statements from the two central banks. In the case of the ECB, it was a broad hint of further easing that sent gold lower. Last week, gold prices slipped as the Federal Reserve surprised the markets, stating that a rate hike in December was very much on the table. Investors snapped up US dollars after the ECB and Fed announcements, ditching euros and gold holdings in the process.

Last week, the Federal Reserve caught the markets off guard with a hawkish policy statement. The Fed stated that a rate hike was a possibility in December, depending on the strength of employment and inflation numbers. The markets had essentially written off a move by the Fed before 2016, so the statement caused sharp volatility in the currency markets, with the US dollar showing broad gains after the dust had settled. The next Fed meeting is mid-December, and the markets will be in alert mode for any further hints about a rate hike. As well, upcoming key US numbers will be closely monitored, especially employment and inflation data, as the strength of these numbers will play a critical role in determining whether the Fed presses the rate trigger in December. Still, traders should keep in mind that the markets sometimes overreact to Fed statements or comments from Fed policymakers, and the central bank could easily continue to wait on the sidelines until 2016.

With the Federal Reserve statement behind us, the markets are once again focused on economic releases. There was much anticipation ahead of the US Advance GDP for the third quarter, which was released on Thursday. As it turned out, this key event didn’t shake up the markets, as the reading of a 1.5% gain was almost identical to the forecast of 1.6%. Still, this figure was much lower than the Q2 Final GDP of 3.9%, pointing to a slowdown in the US economy. Meanwhile, Unemployment Claims beat the estimate for a fourth straight week, coming in at 260 thousand. The estimate stood at 264 thousand. Will the upcoming Nonfarm Payrolls also beat the forecast? On Friday, US key releases wound up the week on a positive note. Employment Cost Index jumped 0.6%, pointing to an increase in wages for US workers. The UoM Consumer Sentiment, an important gauge of consumer confidence, improved to 90.0 points, within expectations.

XAU/USD Fundamentals

Tuesday (Nov. 3)

- 15:00 US Factory Orders. Estimate -0.8%

- 15:00 US IBD/TIPP Economic Optimism. Estimate 47.5 points

- All Day – US Total Vehicle Sales. Estimate 17.8M

Upcoming Key Events

Wednesday (Nov. 4)

- 13:15 US ADP Nonfarm Employment Change. Estimate 183K

- 13:30 US Trade Balance. Estimate -42.7B

- 15:00 Federal Reserve Chair Janet Yellen Testifies

- 15:00 US ISM Non-Manufacturing PMI. Estimate 56.6 points

*Key releases are highlighted in bold

*All release times are GMT

XAU/USD for Tuesday, November 3, 2015

XAU/USD November 3 at 10:55 GMT

XAU/USD 1132 H: 1138 L: 1130

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1043 | 1080 | 1098 | 1134 | 1151 | 1162 |

- XAU/USD was flat in the Asian session and has posted slight losses in the European session.

- 1134 has switched to a resistance line and is under strong pressure.

- 1098 is an immediate support level.

- Current range: 1098 to 1134

Further levels in both directions:

- Below: 1098, 1080 and 1043

- Above: 1134, 1151, 1162 and 1180

OANDA’s Open Positions Ratio

XAU/USD ratio is showing marginal movement, which is consistent with the lack of activity from the pair. Long positions continue to command a strong majority (64%). This is indicative of trader bias towards gold moving to higher levels.