We are on the verge of recession. The Fed tightens and in the past it has never ended well. Yield curve is almost flat. When it inverses, it will be the end. All the bubbles will burst, pushing the global economy into another crisis. It will be more serious than all the previous cases, especially given that Trump will trigger a trade war or maybe even a conventional one.

Have you heard these gloomy prophecies? We have. Many times, probably too many times. But what if they are wrong? Let’s run our imagination wild and think what if this time is really different. We know, we know: it isn’t. But, as a counterweight for all these pessimistic narratives, let’s see what is the most rosy scenario for the world – and what does it imply for the gold market.

In our ultra optimistic story, the global economy grows steadily for another several years, marking the longest economic expansion in the modern history. The scars after the Great Recession have healed completely. As the confidence returns, entrepreneurs increase real investments. Inflation is under control and real wages rise, gradually lifting the standard of living. The public is satisfied and chooses Trump for another term. The president continues implementing a pro-business agenda, but abandons trade protectionism. He removes regulations restricting the economic activity. After easy fiscal policy during the first four years, he gradually reduces deficits, balancing the budget at the end of the second term. It reduces the uncertainty and frees more resources for the private sector. And monetary policy is not too easy, not too tight. The Fed gradually raises interest rates to their natural level, keeping the economy on an even keel avoiding any abrupt actions which could trigger another financial crisis; but at the same time it does not allow for building up of dangerous asset price bubbles.

Sounds like a dream? And rightly so, because it’s really unlikely that everything goes well (although Trump may really withdraw some of its most radical trade ideas). In such a world, there is no particular reason to buy any safe-haven assets, including gold. But in a real world, in which we live, something always goes wrong. You know, people do not possess perfect knowledge, so some plans and forecasts fail. Because of that inherent, irreducible uncertainty, there will always be reasons for buying gold.

However, what is even more important is political, monetary and financial systems we have today. We agree that people are greedy and they make mistakes, but the real problems are systemic. What do we mean? First, in our democracy, fiscal deficits are practically the norm. It means that the financial consolidation is unlikely, unless the budgetary crisis occurs. In the long run, it should support the gold prices.

Second, in our monetary system based on flat currencies, the central bank intervenes in the market all the time, distorting the money supply and interest rates. It means that there will be next recession for sure, because the Fed creates cyclicality. The key question, also for gold investors, is not ‘whether’, but ‘when’.

So we don’t claim that this time is different and the Fed finally learnt how to manage monetary policy (this is what the pundits used to say before the global financial crisis). What we are saying is that the Great Recession was a really shocking event, after all these years of moderation, which turned the financial markets upside down. Households had to deleverage. All the resources had to be reallocated to other projects. It takes time.

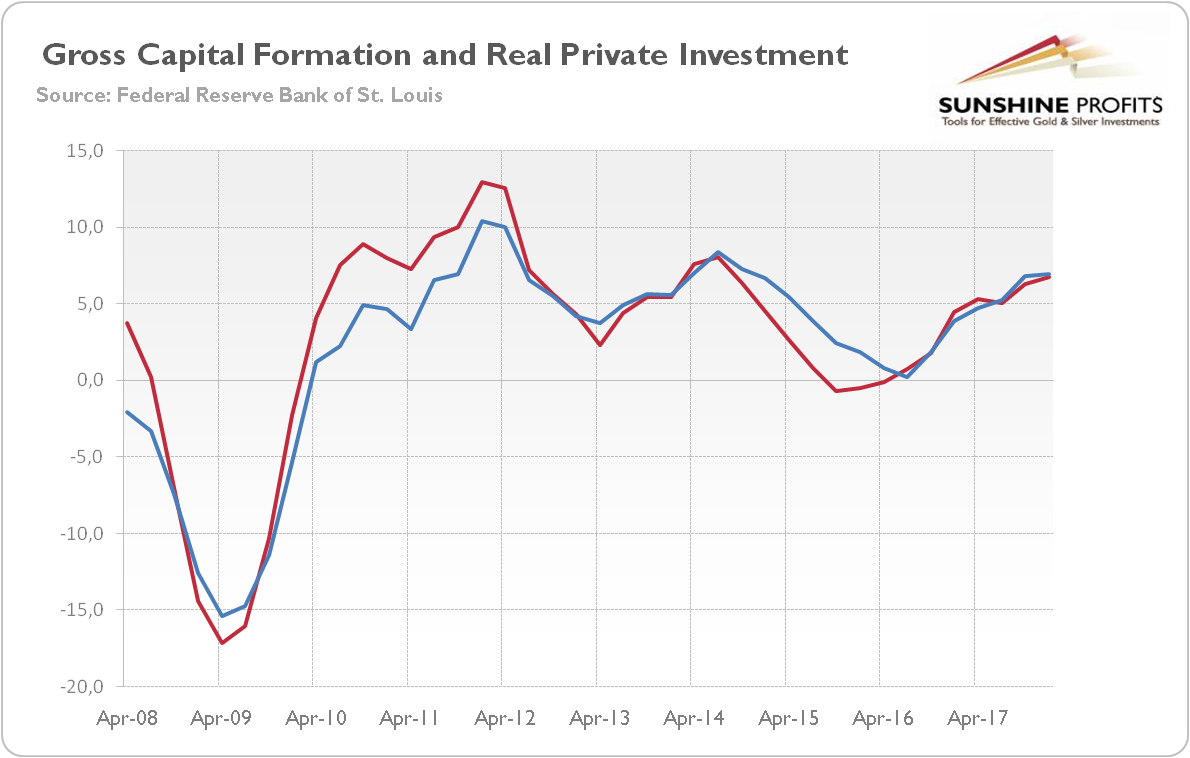

And the ultra low interest rates themselves created a lot of uncertainty about when the monetary policy normalizes and when yields increase. So investors used their ‘real options’ and adopted a wait-and-see approach, delaying their investment. Therefore, the recent tightening cycle, if it’s not too aggressive, and so far it hasn’t been such, might actually be something positive for the general economy. So we could have another few years of economic expansion, especially given the fact that entrepreneurs seem to finally invest more, as one can see in the chart below. This is bad news for the yellow metal.

Chart 1: US Gross Fixed Capital Formation (blue line, annual % change) and US Real Private Nonresidential Fixed Investment (red line, annual % change) from Q1 2008 to Q1 2018.

So what is wrong with our story? We have already stated it. Financial policy could probably still be irresponsible. The Fed will be very careful and will unwind its monetary stimulus only gradually. As it will remain behind the curve, it shouldn’t trigger next crisis, at least not in the very near future (although with the current level of indebtedness even gradual hikes might be harmful).

It might be the case that the price we pay for its too easy monetary policy is a very sluggish recovery. The probability of the next crash is lower, but at the expense of a slower business dynamism. Indeed, both the rate of entry of the new companies and the rate of exit have declined after the Great Recession. The global economy might thus continue to rise moderately, but with gradually rising interest rates, we believe that the near future is bright, especially if Trump makes deals he wants, ending the trade disputes. This is why we remain rather bearish on gold, seeing more downside than upside risks. Surely, the road is likely to be bumpy, but the bumps should be overcome.