Precious metal sector is breaking its short term downtrend…

Source: Short Side of Long

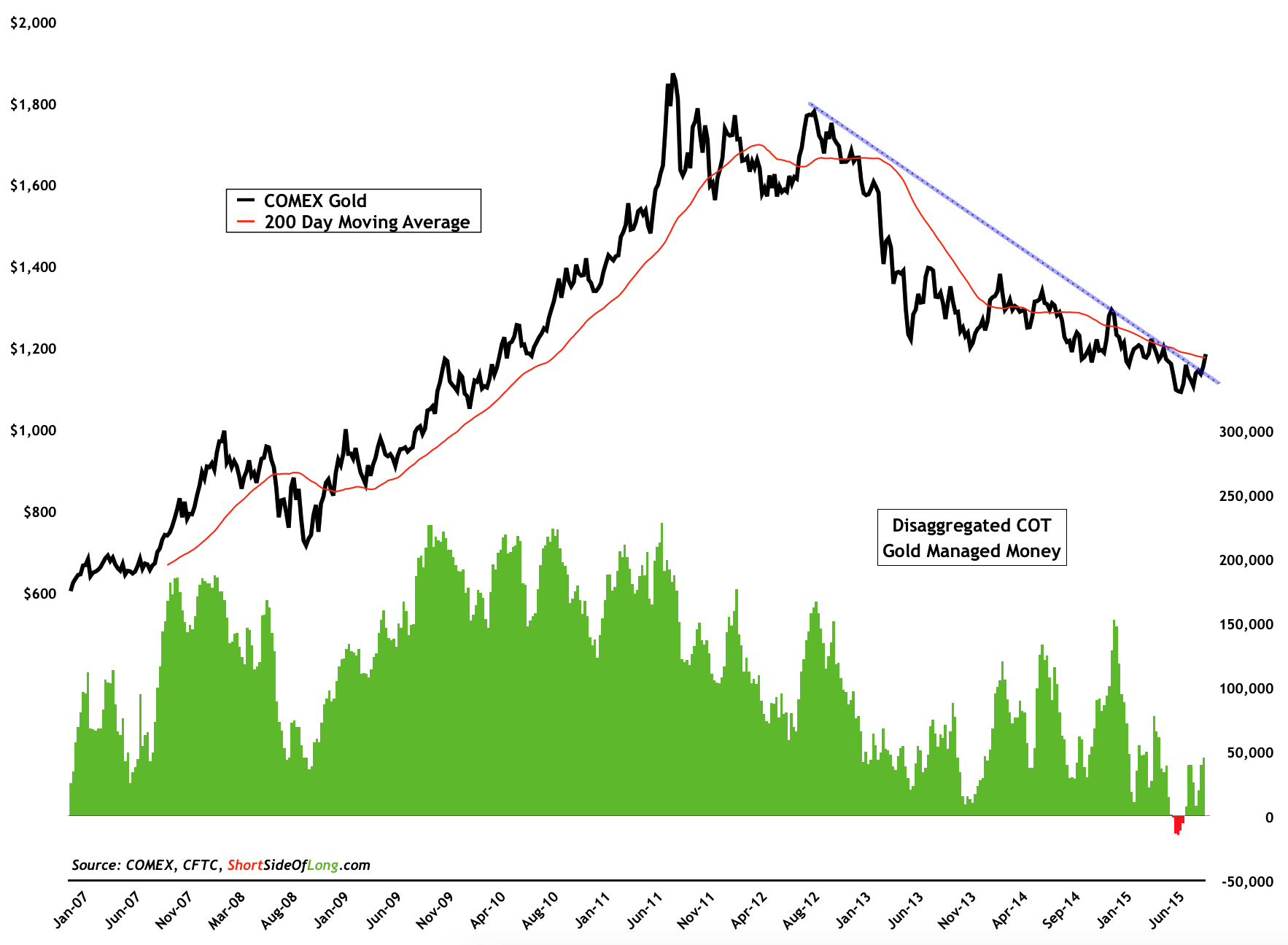

We continue to update our readers on important asset classes, their recent price action and the return (or loss) they are producing. Over the last several weeks, we have written about US and EM stocks, commodities including Crude Oil and Energy sector (N:XLE), Treasury bond market (N:TLT) and the yield curve, US dollar and its inverse correlation with the Precious Metals sector. At the end of September, just as we called a double bottom in global equities (O:ACWI), we also started forecasting a decently high probability that Gold might rebound further. In an article titled “Precious Metals Could Rally” we stated that:

“Recent price action is becoming more and more constructive with Gold (NYSE: GLD), Silver (NYSE: SLV) and Junior Gold Miners (NYSE: GDXJ) all pushing against their downtrend lines. With a breakout now becoming a possibility, Gold traders seem to be anticipating (or speculating) that FOMC won’t rise rates in 2015.”

…with Gold also breaking its long term downtrend too!

Source: Short Side of Long

So far our thinking seems to be on track, as the sector has enjoyed decent gains over the last two weeks. Looking at both of the charts in this post, three out of the four major assets within the Precious Metals sector (SPDR Gold Shares (N:GLD), iShares Silver (N:SLV), Market Vectors Gold Miners (N:GDX), Market Vectors Junior Gold Miners (N:GDXJ)) have broken out from their downtrends (only GDX lags). However, from a technical perspective, that doesn’t necessarily signal more gains ahead, as another resistance looms just above. Gold, Silver and various PMs mining indices are now all pressing against their 200 day moving averages.

Bears will conclude that failure to break out above this important pivot point will most likely signal the end of yet another dead cat bounce. On the other hand, bulls are pointing to Gold Mining Exploration Index (N:GLDX), the most speculative of all mining juniors, which has recently broken out above its 200 day moving average for the first time in a year. Could this be a leading indicator Gold bugs have been waiting for? Only time will tell. Our advice to investors is to closely monitor the price action in coming days and weeks ahead, as we will soon have our answers.