The current precious metals market movements may seem boring (and to be honest, they actually are, observed from a short-term perspective). However, there are some important and rather interesting indications in this sideways movement.

Yesterday, I commented on gold's strength regarding the USD Index and the mining stocks' strength in relation to gold. Both were weak, which resulted in a bearish combination. So, did yesterday’s and today’s pre-market movements validate or invalidate these observations?

In short, they’ve confirmed them. Despite its recent very short-term breakout, the USD Index moved lower, moving to new short-term lows.

How much did things change? Hardly anything changed. What matters the most is the breakout above the declining medium-term resistance line. More significant than it initially seemed, the post-breakout consolidation is still just that–a post-breakout consolidation. This means that the USD Index will most likely rally significantly anyway.

However, if we consider the next few days, the USDX could move lower, perhaps as low as 92. This target presupposes that the pullback could take the classic zig-zag form, where the two short-term declines are alike. The aforementioned is marked with dashed lines on the chart above.

At the same time, this would take the USDX close to its September lows, which would complete the broad bottom formation. It’s important to note that this final bottom would take place after the USD Index had already broken above the declining medium-term resistance line—that’s what increases the probability that this move lower would be the final part of the broad bottom and not the beginning of a new big slide.

Yes, the breakout above the declining short-term resistance line was just invalidated, and it’s not certain that the breakout above the medium-term resistance line will not be invalidated as well. But resistance lines based on more profound price extremes and formed over a longer timespan are more important. Consequently, just because the very short-term breakout failed to hold, doesn’t mean that the breakout above the medium-term line will also fail. Conversely, it’s a bullish factor that remains intact.

Now, the USD Index moved below its previous October lows. So, in response to the above, did the yellow metal move above its October highs as well?

It didn’t. Instead, it has just made another attempt to break above the declining resistance line. Now, if the US Index declines further, it might be successful in this attempt. But I wouldn’t count on it too much. After all, the previous effort was invalidated relatively quickly.

Let’s also keep in mind that the USD Index moved below its October lows only in today’s pre-market trading. It could be the case that it invalidates this small breakdown and rallies right away, thus triggering a decline in gold as a result.

Right now, it seems that this is the outcome that mining stocks favor.

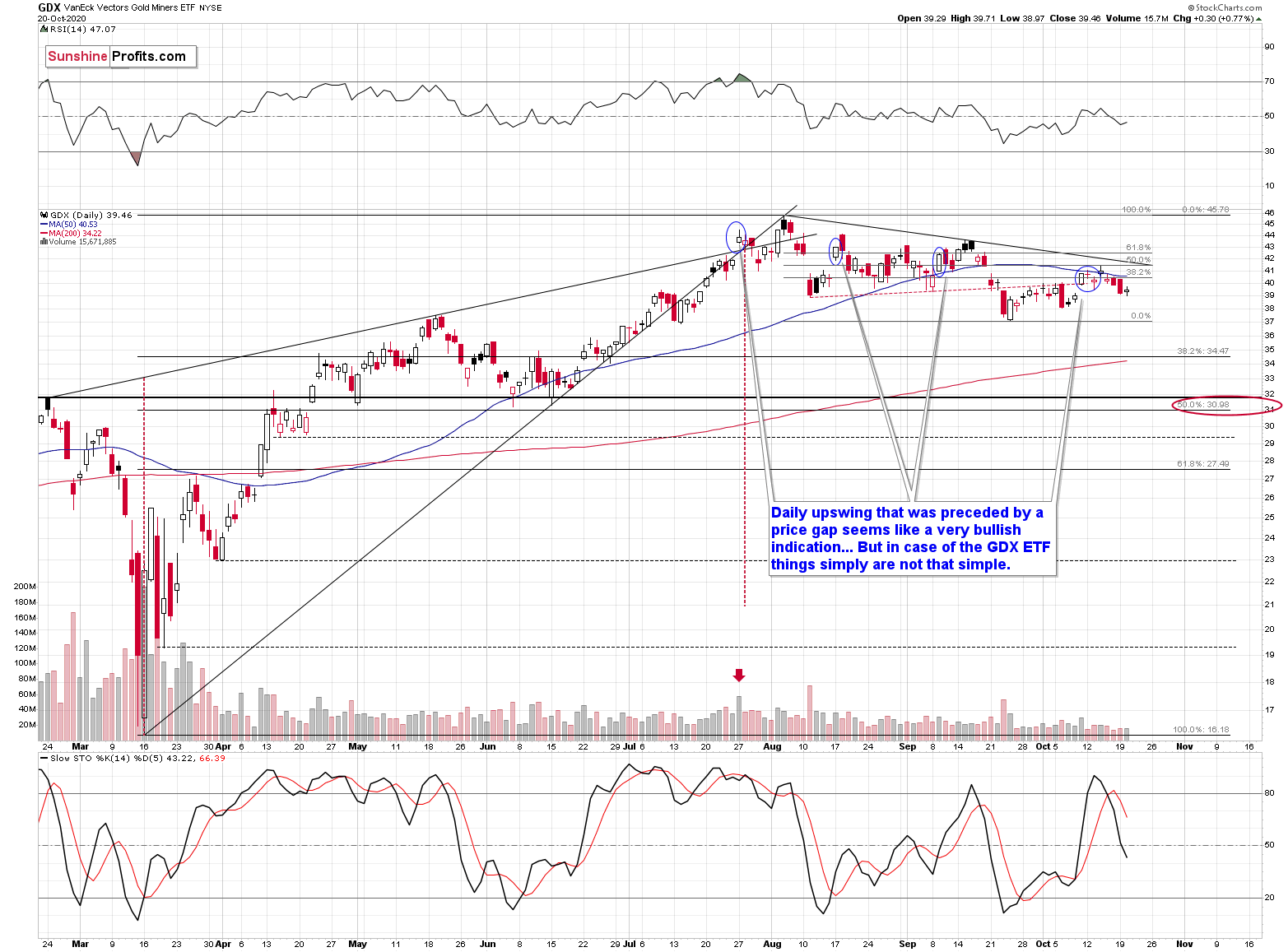

Looking at the miners alone, one wouldn’t probably say that they are moving higher this week.

They closed higher yesterday, but it was a move higher by just $0.30, which is hardly anything compared to the previous days’ decline and the upswing in gold and the USDX downswing.

In other words, we saw yet another bearish confirmation from the miners, as they were once again weak.

This means that even if gold rallies due to the USD Index declines, miners’ upswing would probably be limited. And on the other hand, if gold declines due to USD’s rally, miners would likely drop significantly.

At the same time, let’s keep in mind that gold itself didn’t magnify USDX’s bullish signals, but instead, it magnified the bearish ones.

All in all, given the limited bullish and the sizable bearish potentials, from today’s point of view, the bearish outlook for the mining stocks continues to be justified.