A lot of Americans getting a myriad of government entitlements thought that President Trump would recreate the 1950s for them.

If Trump had eliminated the PIT (personal income tax), capital gains tax, and corporate income tax, I’ve estimated that around $100 trillion in capital would have surged into America.

That would have created a super-sized version of what Switzerland achieved at its peak.

Sadly, Trump and his team didn’t do that, mainly because they are giving the citizens what they want; bigger government, more debt, and more storytelling.

Mike Wilson does a near-perfect job of outlining what I believe is in store for H2 of 2019.

Yesterday, Goldman Sachs’ chief economist was quite adamant that the consensus prediction of three rate cuts in the second half of this year would go awry, and the Fed will not cut at all.

The risks are clearly rising for US stock market investors.

My biggest concern is that many Americans sold a lot of their gold stocks into the lows and are now aggressively buying the US stock market. The size of their buying is quite large.

Unfortunately, their buying appears to be based mostly on Trump’s frequent “Let’s make America great!” pump-up tweets, rather than prudent study of the business cycle.

The US business cycle is very late stage now, and that’s when investors must reduce stock market exposure and increase exposure to gold!

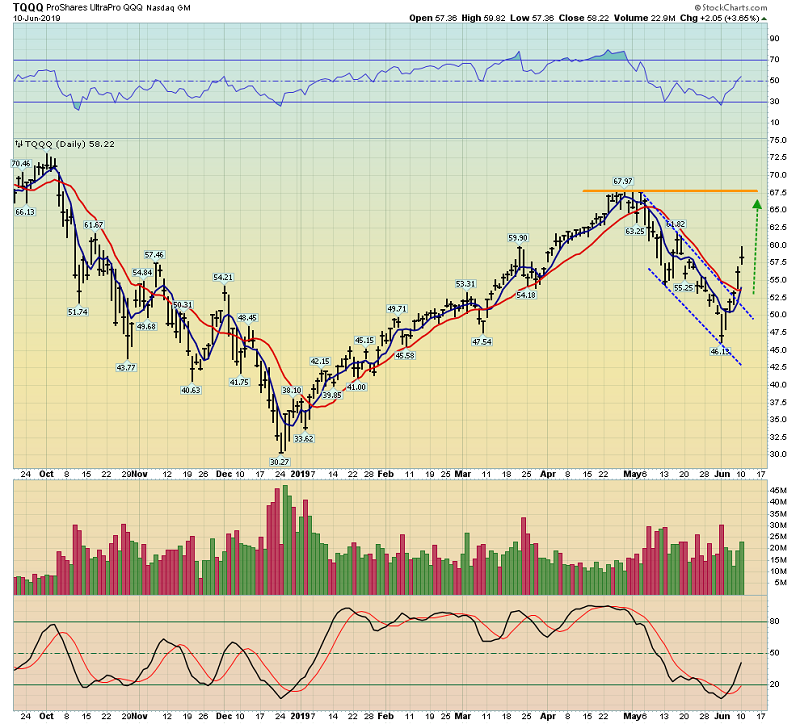

This is the ProShares UltraPro QQQ (NASDAQ:TQQQ) triple-leveraged Nasdaq ETF chart.

Almost 80% of mainstream stock market analysts predict the Fed will cut in July. If they are correct, the stock market will likely soar to new highs. If they are wrong, the market likely begins crashing at the start of August.

A lot of stocks in the Dow Jones Industrial Average index are already at new highs, and that’s usually a sign that the indexes will make new highs too, regardless of whether a crash follows soon after that. I think new highs for the indexes occurs ahead of the July Fed meeting. That meeting also likely marks the final bull market peak for the US stock market.

At my guswinger.com swing trade service, we are long the stock market via TQQQ. My system is mechanical; I am always either long or short the Nasdaq via TQQQ/SQQQ. I’m also always long or short gold stocks via Direxion Daily Gold Miners Index Bull 3X Shares (NYSE:NUGT)/Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST).

Even if the Fed doesn’t cut rates at the July 31 meeting, the market has about six weeks to keep rallying before getting disappointed by the Fed’s decision.

Also, I would not rule out a rate cut, because the Fed has tended to support the stock market whenever it gets into trouble. The Fed has also tended to support the US government with lower rates when the government wants to borrow a lot of money.

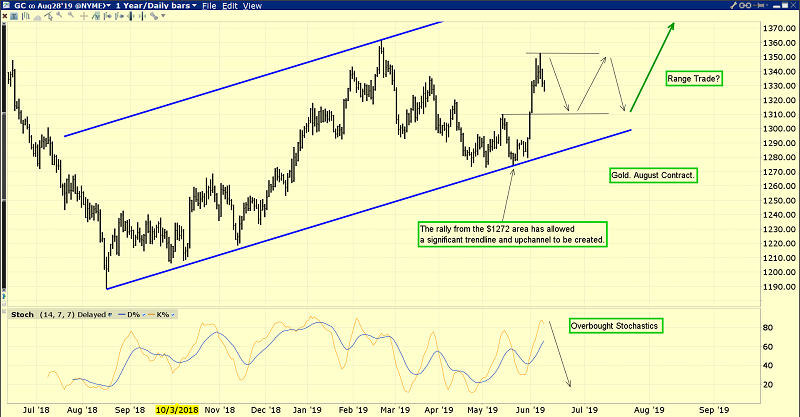

What about gold? Well, I suggested that investors should brace themselves for a pullback from $1350. That’s clearly in play this week as the stock market rallies. Also, Indian dealers have reduced their buying after the big gold price surge.

This is the daily gold chart. The most impressive event in the rally from the $1272 area is the creation of a new up channel!

A range trade for gold is likely now. I think it will be in the $1310-$1350 area, although a wider range of $1292-$1350 is also possible. I’m happily short gold stocks at my swing trade service via DUST/Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) after a big NUGT/Direxion Daily Junior Gold Miners Index Bull 3X Shares (NYSE:JNUG) win, but I do expect some gold stocks to keep rallying even as gold consolidates in the trading range.

This is the Kirkland Lake Gold (TSX:KL) chart. My swing trade subscribers and I hold call options on this great company. The stock is trading above its February high while most gold stocks are not. This kind of outperformance is what I look for when considering a call options position.

As VanEck Vectors Gold Miners ETF (NYSE:GDX) tumbled yesterday, Kirkland rallied higher!

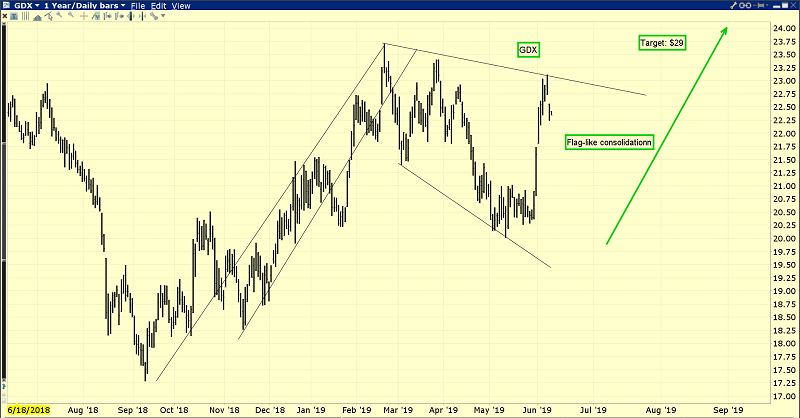

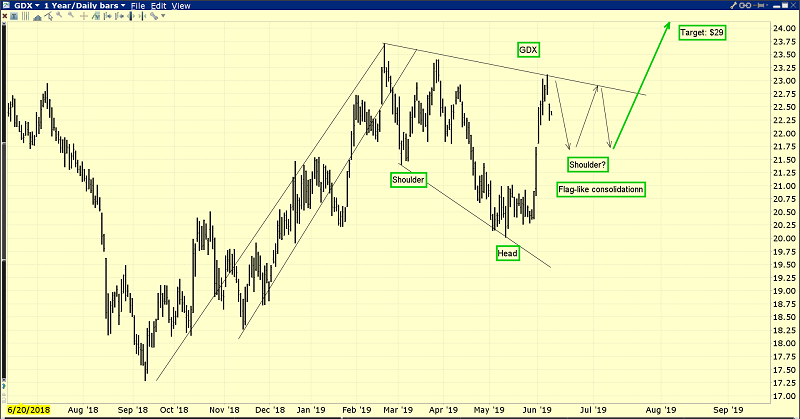

The entire pullback from February is starting to look like a giant flag pattern. The price target of the pattern is about $29.

That’s a second look at the GDX chart. Any consolidation that occurs now will build a H&S bull continuation pattern as well as more flag-like price action.

The July Fed meeting (which occurs as the gold love trade strong demand season begins) could create a stock market inferno and a gold stocks “Rally to the stars”. The bottom line: Investors who pare their stock market exposure as the US business cycle matures and increase their exposure to gold stocks are clearly acting with professionalism and prudence!Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?