Now that stocks closed at new all-time highs, the correction is officially over. What little rest stock bulls could claim last week, arrived on Friday. Yet, the bull was strong enough to defend the 3,900 zone, and charged higher the same day.

Who could be surprised, given the modern monetary theory ruling the economic landscape? The Fed amply accommodative, one $1.9-trillion stimulus bill just in, and a $2-trillion infrastructure one in the making. That's after the Trump stimulus. And who would have forgotten how it all started in April 2020? The old congressional saying 'a billion here, a billion there, and pretty soon you're talking real money" needs updating.

Stocks are readying another upswing as the volatility index is approaching 20 again, and the put/call ratio shows complacent readings. The sectoral examination supports higher highs as tech has reversed intraday losses, closing half of the opening bearish gap. Value stocks naturally powered to new highs, with industrials, energy and financial performing best. Real estate keeps showing remarkable momentum, and has been among the best performers off the correction's lows.

These all have happened while long-term Treasury yields have broken to new highs. Are they stopping to be the boogeyman?

As I'll show you, inflation expectations are rising – and the bond market is reflecting that. The market's discounting mechanism is at work, mirroring the future virtually ascertained CPI rise, if you look carefully into the PPI entrails. This inflation won't be as temporary as the Fed proclaims it will, but it still hasn't arrived in full force. We're merely at the stage of financial assets rising, because that's where the newly minted money is chiefly going.

As regards gold, let's remember the relentless rise in my favorite metric of forward-looking inflation – Treasury inflation protected securities to long-dated Treasuries (TIP:TLT). They have been relentlessly rising off the corona crash lows, and their accent in 2021 has accelerated just as steeply as the nominal rates reflect. As I said last Thursday:

(…) At the moment, evaluating the strength and internals of precious metals rebound, is the way to go as we might very well have seen the gold bottom, with the timid $1,670 zone test being all the bears could muster. Time and my dutiful reporting will tell.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

Gold Upswing Anatomy

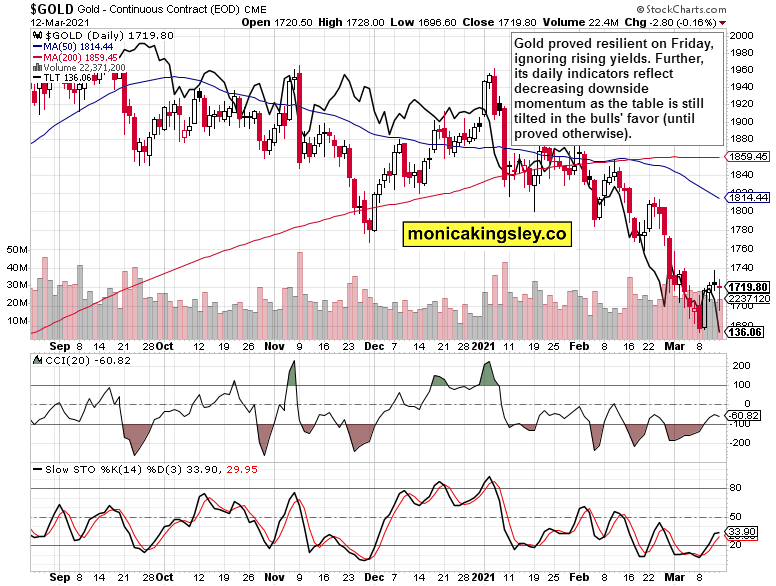

Gold refused the premarket losses, and has rebounded to close almost unchanged on the day. Is that sign of strength or weakness?

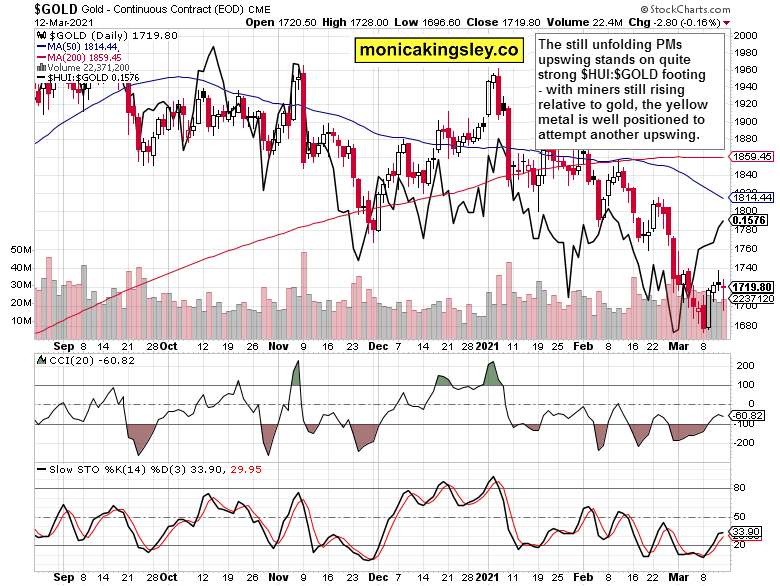

The miners-to-gold ratio provides a clear answer, and it's a bullish one to open the week. Finally, the gold market is showing signs of life on a prolonged basis, which I started talking about last Tuesday. Regardless of Friday‘s weakness in the yellow metal, it's so far so good as the miners keep leading the charge.

Silver's weakness in the course of the upswing isn't too worrying a sign. Silver miners are outperforming as well, which is a more important signal. It smacks of broadening leadership in the unfolding precious metals upswing.

Summary

Gold turned an important corner last Friday, and so have the miners – be they gold or silver ones. The precious metals upswing is unfolding, and decreased sensitivity to rising yields is a pleasant sight for the bulls.