Last week, we began an article on the Central Bank Death Dance, and made it part 1, [here]. The main premise we want to address is why the broadly known demand factors for gold and silver are not being reflected in higher values.

People are not asking the right question[s] in determining that answer. What few are considering, or may not be aware of, is the US government defense of its fiat currency. Part 1 attempted to put the fiat Federal Reserve Note into its true context, for its defense it what keeps gold and silver at purposefully suppressed levels.

The entire Western world has its fiat teat caught in a financial ringer from which it will never extract itself at the expense of non-banking businesses and the man and woman on the street, all of whom will suffer badly. To allow gold to rise in value exposes the fiat sham being perpetrated by all Western governments. They will not let that happen.

Right now, the federal government has become isolated by the fast-rising Eastern powers, most notably China and Russia, along with the other BRICS nations. They have had it with the US exporting inflation to the rest of the world, via the petro-dollar as a world reserve currency, and the endless issuing of Treasury Bonds, bonds which have become toxic and are being avoided by the BRICS countries, and soon even Europe, already under water with them but still in bed with Western central banks as the [mis]guiding forces.

The US is losing the war against Russia for supremacy in supplying energy to Europe. Gazprom is the largest energy producer in the world, yet few in America know of it. Russia seeks to be the energy supplier for Europe, and that would end the dominance of the US petro-dollar, aka world reserve currency status. Losing that status puts the US into the Third-World status it has already entered, starting well over a decade ago.

The US has no place to turn to sell its [unwanted]Treasury Bonds because the BRICS nations are now using non-dollar denominated contracts, cutting the US out of the picture. Enter China, and the rise of the petro-yuan. China will become the world's largest oil importer some time next year, and it has already become Saudi Arabia's largest customer. China is converting its huge oil imports into the Yuan, not the dollar.

More and more countries are setting up currency swaps with China, including the UK! Even the US' closest ally is forming important financial links with China as it becomes more and more financially isolated. More on the UK?US relations in a moment.

In the entire world, which government is the only government beating the drums for war? The regime led by a Nobel Peace Prize winner, Barack Obama. Why has he been so desperate to bomb Syria? Because of a few hundred deaths from chemicals, versus the hundreds of thousands of deaths caused by the US in it use of chemical warfare? That is a "chemical" smoke screen to hide the more [poorly]calculated reasons.

Syria is the last link for Iran's natural gas pipeline that leads to Mediterranean ports. Qatar and Iran have a joint deal involving natural gas. Russia has been building massive amounts of pipelines to serve Europe, China, and all the former USSR countries. The US is being cut out, entirely, and once Syria goes with Russia, the US dollar is done, as is the US, increasingly becoming financially crippled.

Because Russia now supplies energy to Europe AND the UK, one need not wonder too much why the UK decided not to back the US in bombing Syria. While the Peace Prize regime has been doing everything possible to start a war with Syria, it has been totally out-maneuvered by the Russian president, making Obama look like a rank amateur in the game of political chess. Where Japan was a country of the Rising Sun, the US has become a country of the Setting Sun.

Always, always follow the money. It is always about money, for money is the lifeblood of the failing central banking system.

China, Russia, BRICS nations are setting up their own trade policies which do not include the increasingly isolated US, fast becoming a financial pariah, and these Eastern-led countries are going to use a gold-backed contract, in all likelihood. This is the kind of nformation one does not read about in the bought-and-paid-for-main-stream-media, but for many of the reasons cited above, the fight for survival of the fiat dollar is why central bankers are keeping their foot on the gold/silver suppression pedal.

This is the good news and bad news. The good is recognizing the forces of financial evil are doing everything possible to suppress PM prices, which means when those forces eventually fail, gold and silver will soar to new levels. The bad news is, no one knows for how long these forces will continue to exert control.

Some are counting in months. We continue to lean more in the year[s] camp, for these forces maintain enormous financial control over everything, and that control will not be easily given up, for it would mean the end for central bankers.

The Death Dance continues to unfold. It will get uglier and much worse before it ends. The fiat "dollar" is wearing no financial "clothes," but most of the watchers seem not to notice, or care. Those who care do not matter, while those that matter do not care. In the end, it is all about taking personal responsibility and acting responsibly.

When the end comes, it will be fast and furious. Those who failed to act and those who acted too prudently for timing will miss out. No one knows the when, but if it is months or years, what we know for certain is regardless of the when, we are prepared, even if it were tomorrow. Do you have your gold and silver safely in hand? Get more while the getting is good. You never know when when will strike.

The charts continue to tell a story, even if it is an artificial one. The story told is not very compelling, but it addresses the reasons why gold has not risen in value relative to the incredible demand. The information outlined above is the flip side to the incredible unseen forces at work on the "supply" side, and ones that still have the upper hand.

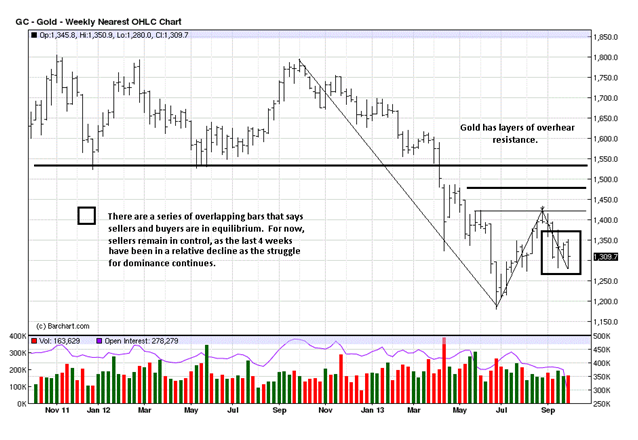

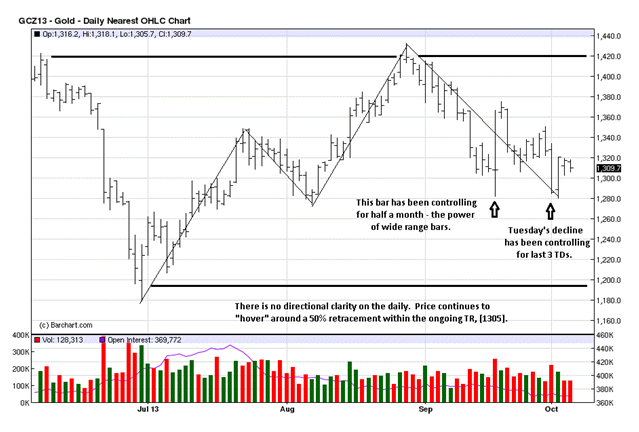

The trend remains down, and there is no evidence of concern that Bears are in trouble. The down trend has weakened, a little, but it has not ended. As long as gold remains in this condition, expectations for sharply higher prices will not be realized.

Mention has been made several times how wide range bars tend to be controlling for several bars of the same time frame moving forward. The mid-September bar has been controlling up to the past week, maybe more into next week. Both wide range bars show poor closes, and the last three TDs show a lack of demand.

Now into four months of a sideways TR, we need to see buyers show demand with wide range bars to the upside on increased volume. Until that happens, sellers retain the edge.

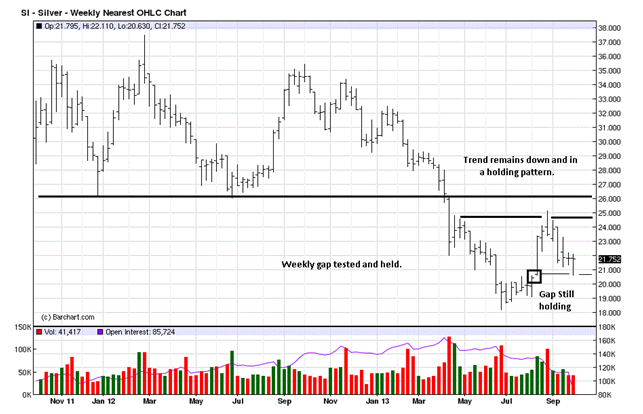

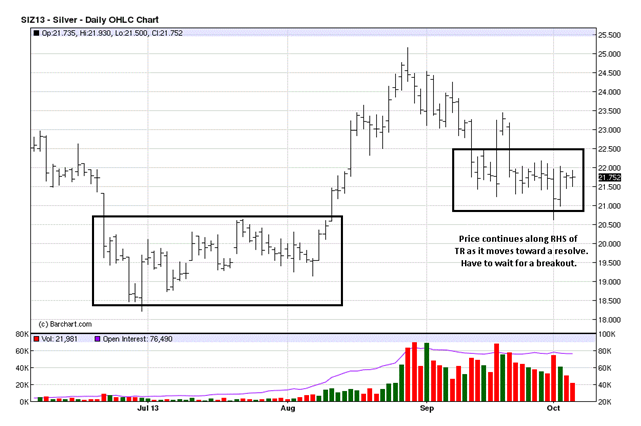

The dominating feature on the weekly chart remains the gap from 10 August, and we drew attention to it immediately for its potential importance, [See Fundamentals Never Say "When." Charts Do, 4th chart]. The high-end close, after a retest of gap support makes a positive statement. There is a clustering of closes, and silver may be near a turning point if buyers can step it up. Sellers are not showing a strong presence, so it is opportune for a rally if buyers can take advantage.

The farther price moves along the Right Hand Side, [RHS], of a Trading Range, [TR], the closer price is to making a directional resolve. The fact that the current TR is on top of the TR from June through August is a positive development. Buyers need to create wide range bars to the upside, on strong volume, otherwise, expect more of the same or even lower should buyers be unable to defend this TR.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold And Silver: Central Bank Death Dance, Part II: Good News/Bad News

Published 10/06/2013, 05:53 AM

Updated 07/09/2023, 06:31 AM

Gold And Silver: Central Bank Death Dance, Part II: Good News/Bad News

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.