The key things that I described in last week’s flagship analysis remain up-to-date, but there are a few specific comments that I would like to make today about Friday’s session.

Gold prices moved higher on Friday, and they were somewhat down on Monday, which means that overall the monthly consolidation was continuing.

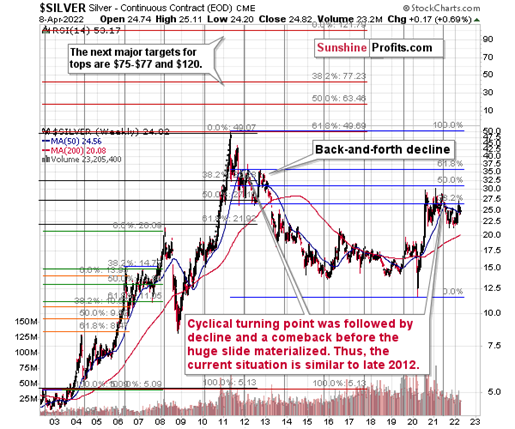

Silver prices moved higher, but it was nothing to write home about, and overall, silver was continuing to decline in a back-and-forth manner.

Moreover, since the white metal had just moved to its declining resistance line, the odds were that we’ll see another short-term downswing shortly.

The above-mentioned moves in gold and silver are in perfect tune with what we saw in 2012 in both precious metals right after the final pre-slide top.

In both cases, the decline first took the form of a back-and-forth move lower, which was generally what we were seeing on the charts lately. Therefore, lower, not higher, values of precious metals were to be expected in the medium term, even though it’s not 100% clear when the short-term consolidation will end.

Silver’s move to its declining resistance line suggested that another short-term decline was just around the corner, but then again, silver has been known for fake breakouts right before declining, so it wouldn’t be surprising to see some short-term strength before a much bigger decline resumes.

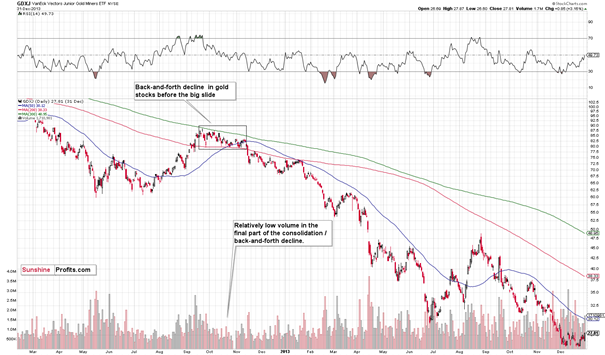

Junior miners moved slightly above their triangle pattern, but this breakout was far from being confirmed. The VanEck Junior Gold Miners ETF (NYSE:GDXJ) closed the day just slightly above the upper border of the triangle, and the move took place on relatively low volume. This indicated that market participants were not convinced that the next move will really be to the upside.

Also, since I already wrote about the similarity to 2012 in gold and silver, let’s see how GDXJ performed at that time.

In short, it performed similarly.

At first, in late-September 2012 and early-October 2012, junior miners consolidated, and then they declined, thus entering the back-and-forth decline mode. It happened on relatively low volume.

What happened next?

Well, at the late-2012 top, the GDXJ closed at $87.83. Months later, it closed at $29.59, or roughly one third of its initial price. In other words, junior miners erased about two-thirds of their initial price. Yes, it was a great time for inversely trading instruments. The Direxion Daily Junior Gold Miners Index Bear 2X Shares (NYSE:JDST) wasn’t trading at that time yet, but Direxion Daily Gold Miners Index Bear 2X Shares (NYSE:DUST), which trades opposite to VanEck Gold Miners ETF (NYSE:GDX), moved up by over 600%.

Even though the short-term outlook is somewhat unclear, the medium-term outlook for the precious metals sector remains very bearish, and the upside potential for the short positions in junior mining stocks remains enormous, in my opinion. In my view, patience is likely to be very well rewarded.