Gold spot we wrote: outlook negative and holding first resistance at 1715/17 re-targets 1707/05 then 1700/1698. A good chance of further losses eventually to very important strong support at 1685/75.

What a call! gold collapsed straight to very important strong support at 1685/75 and bottomed exactly here.

This was perfect! The break below hit 1705 and even the bounce topped exactly at 1715/17. Outlook now negative.

Silver spot we wrote: breaks support at the 200 day moving average at 2485/75 which turns the outlook more negative & risks a retest of last week’s spike low at 2445/40. A break below here can target 2415/10, perhaps as far as 2370/60.

Another great call as we hit 2380 this morning.

Today’s Analysis

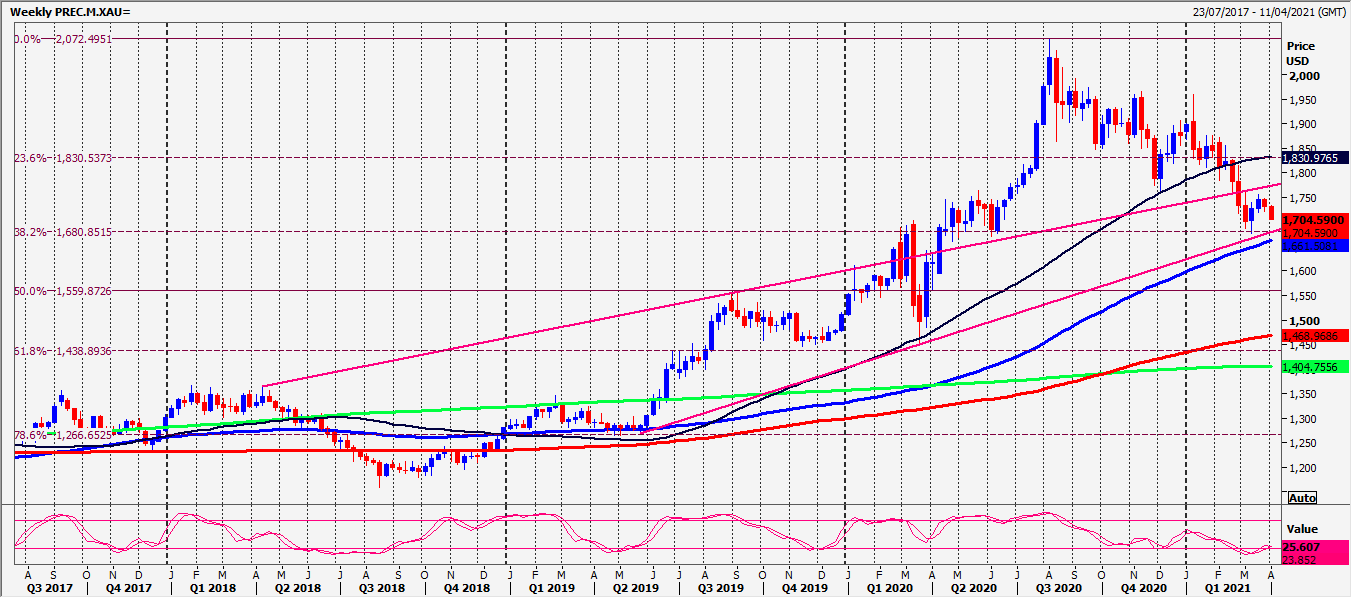

Gold tests and holds very important strong support at 1685/75. A bounce from here leaves a bullish double bottom pattern which is likely to trigger gains to 1690/95, perhaps as far as 1700/05 today. These are only minor resistance levels. If we continue higher, perhaps later in the week look for 1710/12, perhaps as far as are 1717/19.

A break below 1672 however is likely to trigger further losses to the 200 day moving average at 1660/57. This is the last line of defence for bulls. A break below 1653 could trigger significant losses in to next week.

Silver breaks support at the 200 day moving average at 2485/75 to hit targets 2415/10 as far as 2370/60. A break below 2350 risks a slide to 2300/2290.

Gains are likely to be limited with first resistance at 2335/45. 2nd resistance at 2470/80.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.