Gold is not doing much today, but silver has already invalidated its breakout.

The US Dollar Index is poised for a rally. Perhaps VanEck Junior Gold Miners ETF (NYSE:GDXJ) will do the same shortly.

Gold’s strength, silver’s breakout, and a clearly unconfirmed breakout in the GDXJ may seem perplexing when taken separately, but together, they paint the same picture: the precious metals market remains vulnerable to a sell-off, which is likely to be triggered by a rallying USD Index.

Silver price is likely to soar in the following years (and there’s a way to profit on silver more than it rallies), but in the near term, it’s likely to respond to the USD Index’s rally with a decline.

To clarify, it’s not just “any rally” in the USDX that’s likely to result in a sell-off in the precious metals market, but a substantial one.

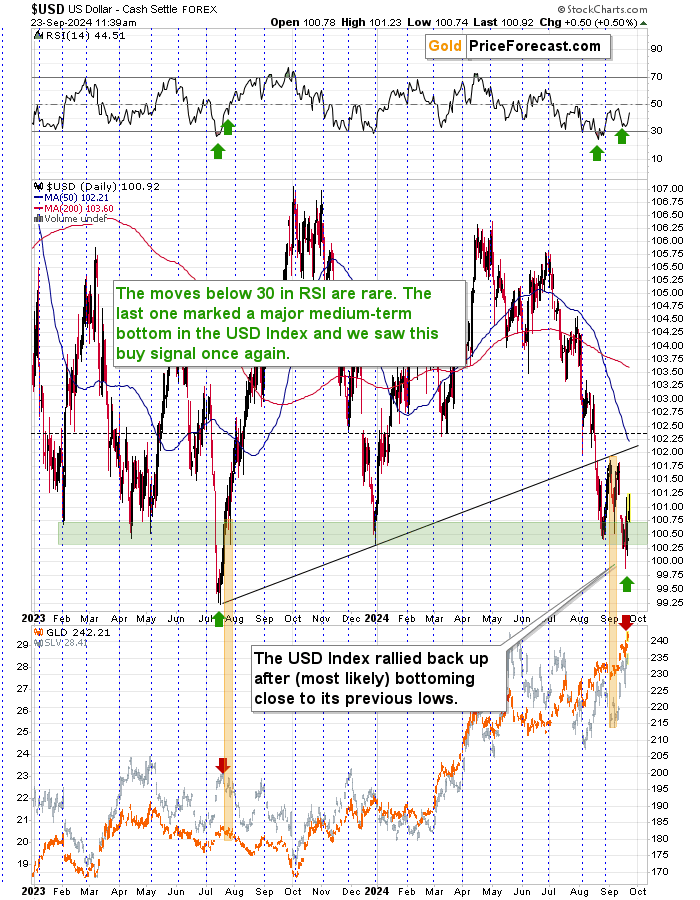

What we see in the USD Index so far is still a broad bottom.

What do we have right now?

A four-day-long bottom, and today is the fifth day.

How did the USD Index bottom in 2023 during its previous move below 100 and when the RSI was previously extremely oversold?

In the same way, it moved higher on the fifth day, but not sharply so. The rally picked up in the following days.

It might be the same right now.

USD/YEN Breaks Resistance

The USD/JPY is breaking above the declining resistance line after bottoming in a clear way at a very powerful combination of support levels.

Today, we see a pause but not an invalidation of the breakout.

This implies that the USD Index’s medium-term rally is likely about to start – very likely, not just likely.

Yes, gold rallied last week, but so what?

The Fed just cut rates more than expected (the expectation was between 0.25% and 0.5%), and the markets are still reacting to it – that’s pretty normal. The USDX is still likely to soar, and the big rallies in it are bound to trigger sizable declines in gold and junior miners. And even if they are not big, then there are still likely to be some declines in the metals and miners and it would THEN be a good chance to exit the short positions (whether profitably or not) – IF we saw that gold and miners are holding up very well despite USD Index’s rally. Not now.

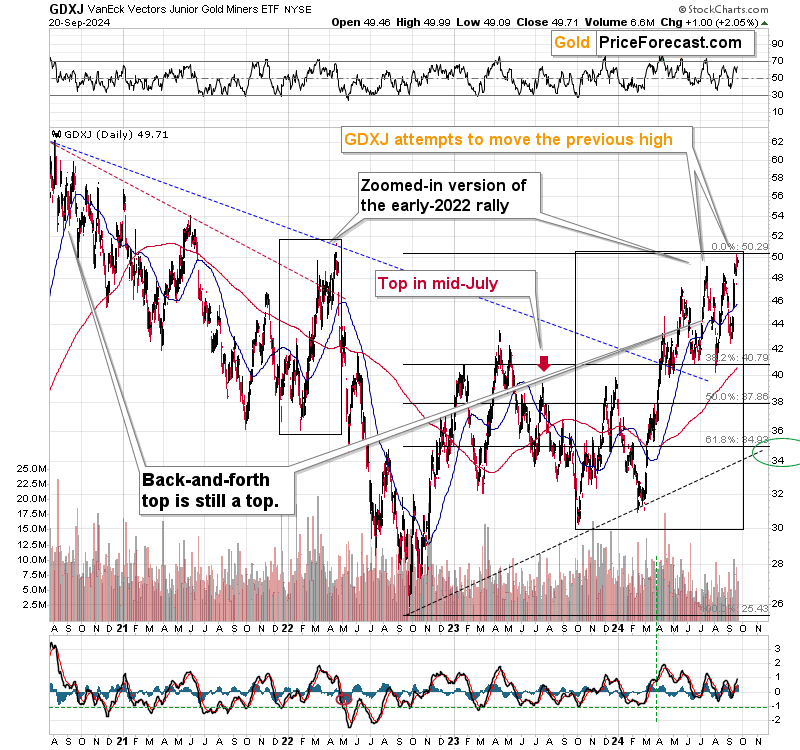

The rally in the stock market can be invalidated any day now in the buy-the-rumor-sell-the-fact manner, the USDX is most likely bottoming, and the GDXJ looks just like it did in 2022. In fact, the last year of GDXJ’s performance looks just like a zoomed-in version of what we saw in late 2021 and early 2022.

Even if GDXJ was to rally higher from here, it has a very strong resistance just ahead – the 2022 top. The upside here is really limited, and the downside remains enormous.

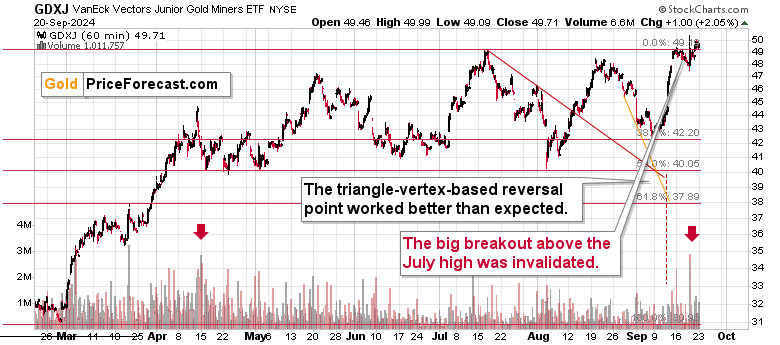

The above hourly GDXJ chart shows just how small the breakout above the previous highs is. The previous move above the July high was invalidated quickly and on huge volume. When we saw something like this in April, it meant that the short-term rally was over. Back then, this meant the start of a prolonged topping (most likely) process, but this time, it might mean that another slide is upon us.

The difference comes from the position of the USD Index. In mid-April, the USD Index was topping, and now it appears to be bottoming.