By Brien Lundin

“Don’t look a gift horse in the mouth.”

That was my first thought on seeing Gold up about $45...and Silver jumping 4%...this morning while other markets weren’t confirming the moves.

The Dollar Index was down, but not much. Treasury yields were actually higher. And the stock market was flat (and has since turned lower).

Long story short, I looked straight at that gift horse’s mouth and set about trying to figure out why the metals were soaring.

Yes, there was the collapse of Bashar Al-Assad’s dictatorship in Syria over the weekend and concerns over more uncertainty in the Middle East. But you know I discount geopolitical flashpoints as drivers for gold, and this change in leadership will likely be a good thing on balance.

Then there was China’s much-heralded return to gold buying, with its announcement of five tonnes purchased in November. But this was mostly public relations, as we know from the recent great research by our friend Jan Nieuwenhuijs that China has likely bought more than 60 tonnes of the metal over the last few months.

The fact that the People’s Bank of China famously stopped reporting gold purchases in early summer doesn’t mean they actually stopped buying, and Jan’s work shows they’ve bought much more than that 60 tonnes in November.

So, none of this is behind gold’s big surge today, in my opinion.

More likely are two factors:

1) China’s Politburo just announced that it will ease monetary policy and boost fiscal spending to jump-start the economy.

2) It’s simply time for gold to turn around.

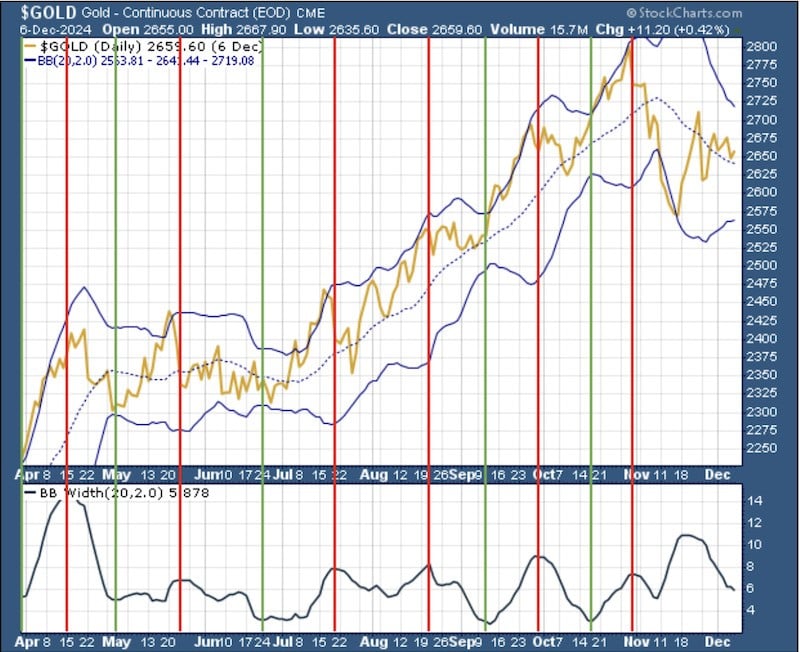

As you’ll remember, tracking the width of gold’s Bollinger bands was an extremely accurate tool for us throughout the summer and into the fall, as the bottoms in width (“pinching” bands) repeatedly foretold imminent rallies while the peaks in width pinpointed upcoming corrections.

That indicator failed us spectacularly in gold’s post-election correction as the bands, which measure volatility, greatly expanded as the gold price plummeted.

The one aspect of this indicator that did survive, though, was the timing.

You see, gold has exhibited fairly regular cycles during this bull market, as indicated in our chart...which I have updated below:

As you see, the red lines show when the band width peaked, showing an upcoming price decline. And the green lines indicated when the width bottomed, indicating an upcoming rally.

Things got messed up with that early November correction, as I said, but the timing of the cycles would indicate that a new rally is due.

But also, we see that the band width has fallen, and the bands are pinching once again. This chart, with data as of Friday’s close, seems to indicate that a new move — up or down — was about to occur.

Well, with gold’s big surge today, I’m guessing the predicted move is upward...and we’re back in rally mode.

Seasonality Also In Play

Even better news is that we’re in that time of year that often corresponds to a bottom in the metals and miners. Historically, we’ve often seen the beginnings of a rebound in the mid- to late-December timeframe.

In my experience, those who get in near the bottom can often add 20% or greater gains on top of the common early-year rally in junior mining stocks.

In short, a buy signal is flashing right now.

While gold and silver have given up some of today’s early gains, they’re still up strongly, as I write. The signal and the buying opportunity are still firmly intact.

I’m going to try to take advantage of it, and I urge you to consider doing so as well.

Published on Money Metals Exchange.