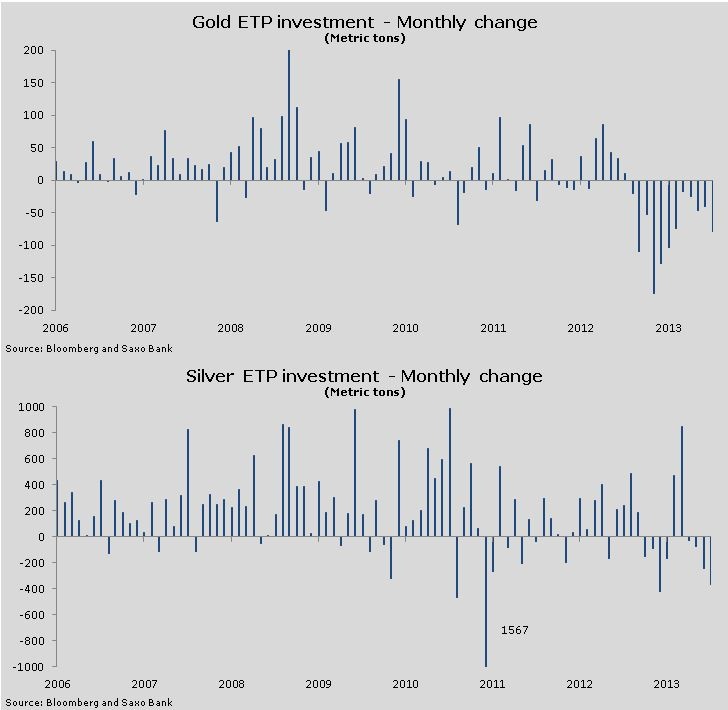

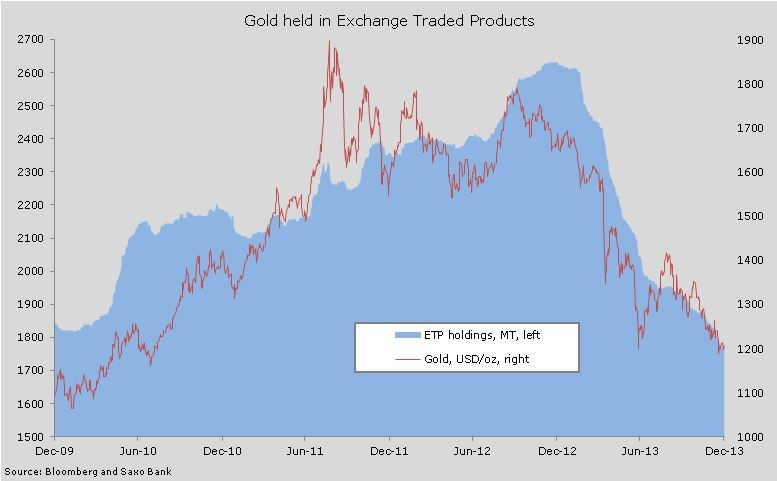

Holdings in exchange traded products backed by gold completed a 12-month sequence of reductions in December as total holdings fell by the most since June (Bloomberg). The reduction during the second half of 2013 was 283 tons compared with 586 tons during the first. The price of gold, however, managed to finish unchanged for the second half of 2013 with physical demand somewhat offsetting this continued reduction in investment demand. Silver holdings also dropped by the most since June despite being mostly rangebound during the month of December.

An almost non-stop period of selling in 2013 accelerated into December despite the relative calm price action seen during this time. The worst annual sell-off since 1981 following a 12-year rally yielded some additional position squaring before the year came to a close. Only six out of 52 weeks saw net buying during 2013 so the behaviour of investors will be watched very close as 2014 begins for any signs of whether the relatively calm price action may attract some fresh investment into yellow metal, either through futures or exchange traded products.

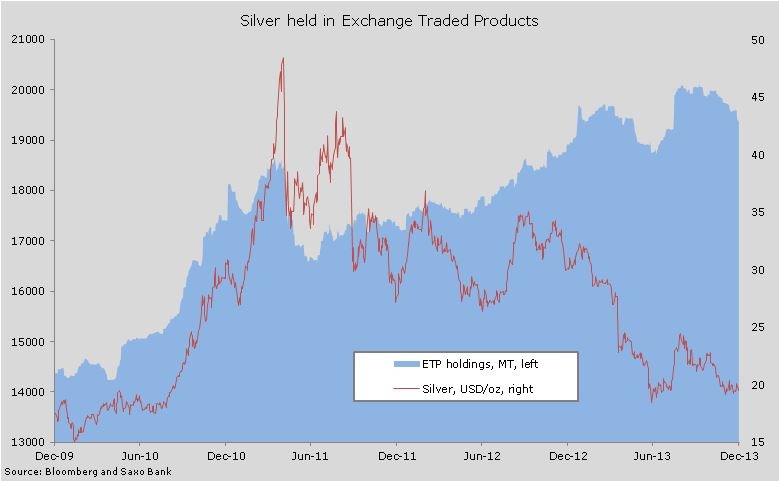

Investment holdings of silver dropped by the most since June during December. The second half reduction totalled 283 tons against a price rally of 5.3 percent compared with 587 tons during the first where the price dropped by 39 pecent. Just like gold the reduction was in response to the changing investment outlook with stocks continuing to offer better opportunities. The improved growth outlook which has yielded a strong rally in copper during December and may, if carried over into 2014, offer some support for silver and its crowd of loyal investors who have generally maintained their exposure despite it being one of the worst commodity investments in 2013.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold And Silver Reductions Accelerated In December

Published 01/02/2014, 05:10 AM

Updated 03/19/2019, 04:00 AM

Gold And Silver Reductions Accelerated In December

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.