Headlines continue to drive Gold and Silver higher despite very stretched RSIs.

Gold

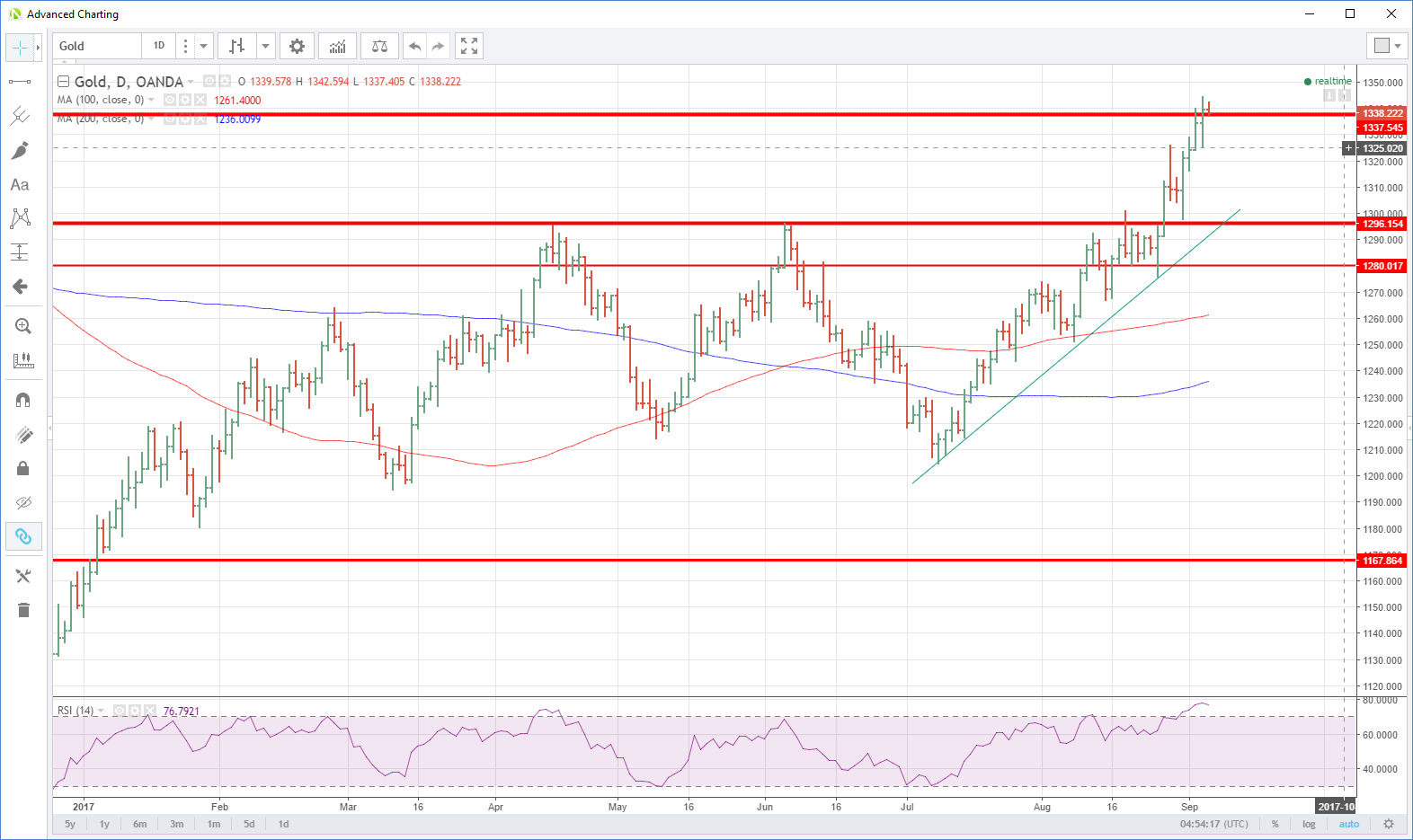

Gold pushed higher again overnight despite the very overbought technical picture. The rally was driven by escalating Korean peninsula tensions and dovish comments from Fed Governors Brainard and Kashkari that weakened the dollar in general.

In a welcome corrective pullback, gold fell to 1326.00 overnight, before flying higher by 19 dollars at one stage to touch 1345.00. Traders yet again are reassessing the future pace of Federal Reserve rate hikes ahead of this month’s FOMC meeting.

Gold’s safe haven status and its high inverse delta to the U.S. dollar index (DXY) is clear to see, subsuming the very overbought RSI in the process. We expect gold to remain headline-driven for the remainder of the week but would caution its possible vulnerability in the short term should the dollar unexpectedly strengthen.

Gold has closed above daily resistance at 1337.50, trading at 1339.00 in early Asia. This notionally implies gold should continue its progress to its next target at 1375.00 with interim resistance at the overnight high. Support lies at 1325.00 and then 1296.00.

Silver

Silver pushed higher along with gold, but despite touching 18.0100, it fell back to close unchanged on the day yesterday, at 17.8900. This perhaps belies some cracks in silver’s price action. Although we have now had two successive closes above the 17.7100 resistance level (now intra-day support), Silver has traced out a double top at the overnight high around the 18.0100 area.

More concerning technically, the RSI is now in extremely overbought territory where it has been for the last couple of days. This could make silver more vulnerable to a corrective pullback, especially given the unimpressive unchanged closing price.

Geopolitical headlines could see silver spike higher on a short term basis, but traders may well be wary adding to longs up here until we see the RSI correct lower.