Summary

Gold and silver failed to hold technically significant gains on Friday.

Set up an uneventful week that could kill the current rally.

Watch Jackson Hole speeches for hints of dollar strength.

Friday was a brilliant opportunity for a breakout in gold (GLD (NYSE:GLD)) and silver (iShares Silver (NYSE:SLV)). That breakout attempt failed. The metals had been rising on perceived geopolitical risks associated with North Korea.

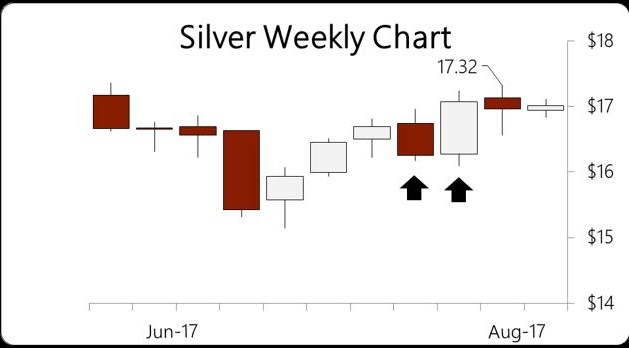

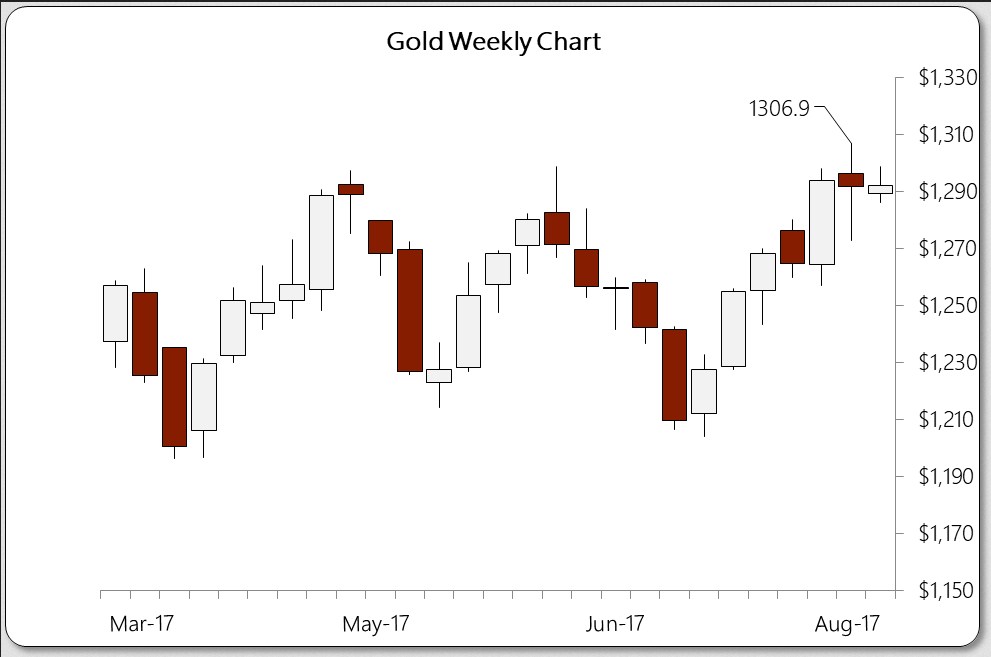

On Friday, at the European open at 3 a.m., the metals rallied hard with gold hitting a high of $1,306 and silver pushing above $17.30. But those rallies, technically significant, were unsustainable. Relentless selling from the New York open to the stock market close erased those gains and more leaving both metals in no man’s land for this week.

Looking for a reason for the spike and the sell-off, ECB President Mario Draghi’s spokespeople were out trying to talk down the euro (Guggenheim CurrencyShares Euro (NYSE:FXE)) without spooking markets. Hinting, as Zerohedge reported, that all policy changes were likely to be put off until October.

The takeaway being the ECB would hold off announcing tapering QE at the convocation of central bankers at Jackson Hole this week.

Since then the euro has failed to move above the high established in late July at $1.193, trading with a downward bias as the USDX (PowerShares DB US Dollar Bullish (NYSE:UUP)) looks to have bottomed as well.

Was that enough for traders to put the kibosh on the precious metals rally coming into stock options expiration on Friday? Apparently so.

The Technical Picture

Friday’s close for both metals resulted in effective "coin-flips" as to this week’s direction.

The price action on Friday pushed silver through the previous week’s high extending the rally another week. But, so far this week, we have not seen a break of either that high or last week’s low.

Looking at the probabilities, silver entered the week with a 43%/53% probability of an upside/downside break this week. Those numbers shifted to a 49%/47% split at $17.00 silver.

Gold gave us a similar picture with a 44%/51% split between upside and downside break probabilities to start the week.

Now, those numbers have shifted slightly, 51%/44% at $1292 gold.

All of these statistics are based on the last 252 weeks of trading for gold and silver, respectively.

For both metals to avoid further downside risk, they both need to violate last week’s high this week. Closing above those highs would be very bullish. But another failed rally in gold to breach and hold $1,300 and silver to do the same at $17 would be very bearish for September.

Also, the longer we go this week without an upside breakout the higher the likelihood of this week tracing an inside bar (where neither the previous high nor the low are broken). Those are usually preludes to reversals in the metals, given their volatility and history in this bear market.

The Takeaway

While the charts for this week are completely neutral, the failed breakouts from last week did provide upside breaks on the monthly charts. And this tells me that sentiment in the metals is beginning to turn in a larger sense.

Gold’s breach of $1,306, no matter how short-lived, was enough to push it above the June high of $1305.50 and that is significant. A close in August above that level would constitute a weak two-bar monthly reversal signal. Getting there between now and month-end is, however, still a coin flip.

And there is little in the way of catalysts that would allow for that to happen between now and then. The central bankers are not likely to unveil new policies at Jackson Hole that would extend the current situation, given how far and how fast the dollar has fallen and its opposites have rallied.

The Fed is more likely to be hawkish than dovish, pushing forward with its balance sheet normalization to support higher rates on the long-end of the yield curve. That’s not going to be bullish for gold.

Silver, on the other hand, will retain its bid as long as the broader commodity complex continues to hold up. Copper is threatening $3.00/lb. Brent Crude looks like it may have a temporary bottom in place.

But, if the dollar reverses and begins strengthening, we’ll find out if these higher commodity prices are purely a currency effect or traders betting on stronger global growth. I think it’s the former, but the charts will ultimately tell us.

All of that said, however, it will take much higher gold and silver prices which break their post-Brexit vote highs to get excited that the new bull market has begun.

Long-term holders of gold equities should use pull-backs to accumulate their favorite gold-related stocks. For me that means companies like Pretium Resources Inc. (TO:PVG), the GAMCO Global Gold Natural Resources & Income Trust Pref (NYSE:GGN_pb) and Franco-Nevada Corporation (TO:FNV).

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own some gold and silver, a basket of cryptos, a few guitars and too many goats.