Investing.com’s stocks of the week

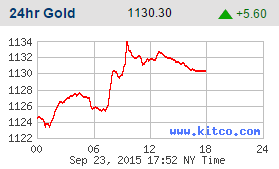

Gold started the day down and then moved higher today and settled lower. The dollar was the key in gold’s movement and received some bad data on the economy today that gave the yellow metal a boost in the morning, but that was it. From there, gold meandered the rest of the day, as without any negative news it simply has a tendency to fall.

It was the same story for silver, which back to where it started and was close to flat for the day.

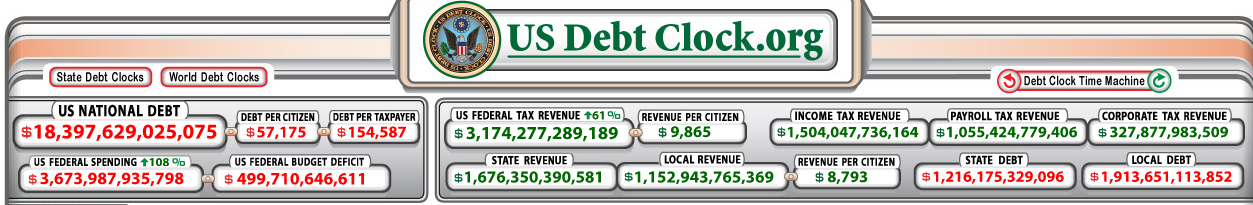

I want to bring something up that makes me simply laugh. If government spending contributes to GDP, and the spending doesn’t generate more growth than the debt it creates, how is it that this can be considered good for the economy? Why do the Keynesians always cry for more government spending? It’s simply because they see the benefits, but not the cost.

Printing money to pay for things isn’t “growth” it’s debt, and the U.S. leads the world in that category.

We’re not a nation of sheep as some may say about us when we elect Republicans or Democrats to office that we put in charge of how to spend the money we send them. But when that is not enough money, they put US, not THEM further into debt. The government is a mess and every election the candidates talk about how he or she is going to do this or that to satisfy the voters, but they never talk about the elephant in the room, the national debt.

As much as some may dislike him, I have to give Donald Trump some credit for talking about the elephant in the room wherever he goes as he did last night with Stephen Colbert. What could Donald Trump do to reverse this debt? Not much. No other candidate can do anything either. What can we do about it as citizens? Not much. I’m afraid the only way you can prepare for the coming disaster this ponzi scheme of a monetary system we have is to buy gold and silver as insurance against it.

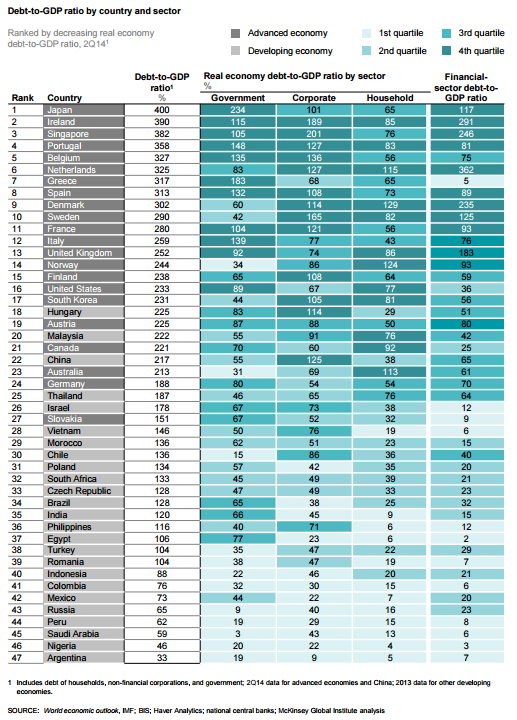

But debt isn’t just a U.S. issue. It’s everywhere and the eventual implosion will be felt everywhere too.

Question: Doug, how can you be negative on gold and silver and call for lower prices when faced with all this evidence?

Answer: Because you reading this blog and my thoughts know what’s going on but the other 99% of the citizenry does not. They believe in the dollar, the Fed, Congress and the future of America. Why else would they buy U.S. Treasuries? Why else is the dollar going higher since the last crisis?

Question: When will I get bullish on gold and silver?

Answer: When my indicators tell me to get bullish. My ideal price I am looking for is $900 gold and $12 silver. Yes, the prices can still go below these amounts, but I want you all in once we get to these levels.