Investing.com’s stocks of the week

Gold fell in the U.S. on Friday hitting a 7 week low and fitting in with my overall view of the low from November 5th, 2014 being taken out. This also means I see the mining stocks hitting lower lows.

The data that comes out this week will be what might move gold from a micro level, but the dollar still seems to be the key to gold’s direction. The dollar bounced on Friday and that sent gold down. Because I am still dollar bullish, I still, after a few years now, say that gold will experience some rocky roads until it bottoms out. But I also think we get a point in time where gold and the dollar rise together. This may be hard for some to understand, but I have my reasoning and will explain it once my new book, “Illusions of Wealth” is released.

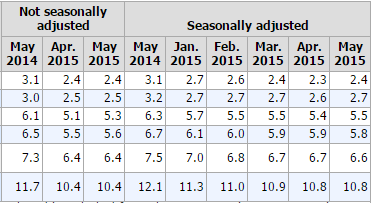

Interest rates have also shot up a bit and while some may say this is bad for gold, I actually think the Fed is somewhat worried about the spike up when the data doesn’t back this move higher, except for of course the unemployment reports coming in with good numbers. While the “official” rate that CNBC touts and the Fed speaks of has fallen to 5.5%, the U-6 rate is still double digits at 10.8%.

This is the number that I follow but it is ignored by the financial media. Why is it ignored? Because they want you to invest in stocks as it keeps paying their bills. Why would they tell you negative news and have you pull out of stocks?

When we see this number move higher, that could very well be the end of the stock market run. While we may get a pullback for the short term, I do think the stock market has one more higher high ahead and this could coincide with the final smack down in gold I have been writing about.

Here is a link to the upcoming data for the week from Investing.com. Because we have so many foreign readers I have decided to add more data than U.S. only data. It also is market moving and investors should be aware of it.